As a seasoned researcher with years of experience in analyzing cryptocurrency markets, I find myself intrigued by the recent surge in Bitcoin whale transactions. The spike in the Whale Transaction Count, as high as it has been since early August, suggests a heightened level of activity among these large players.

The surge in large-scale Bitcoin transactions on the blockchain suggests that some investors might be cashing out after the recent price increase, potentially indicating the start of profit-taking.

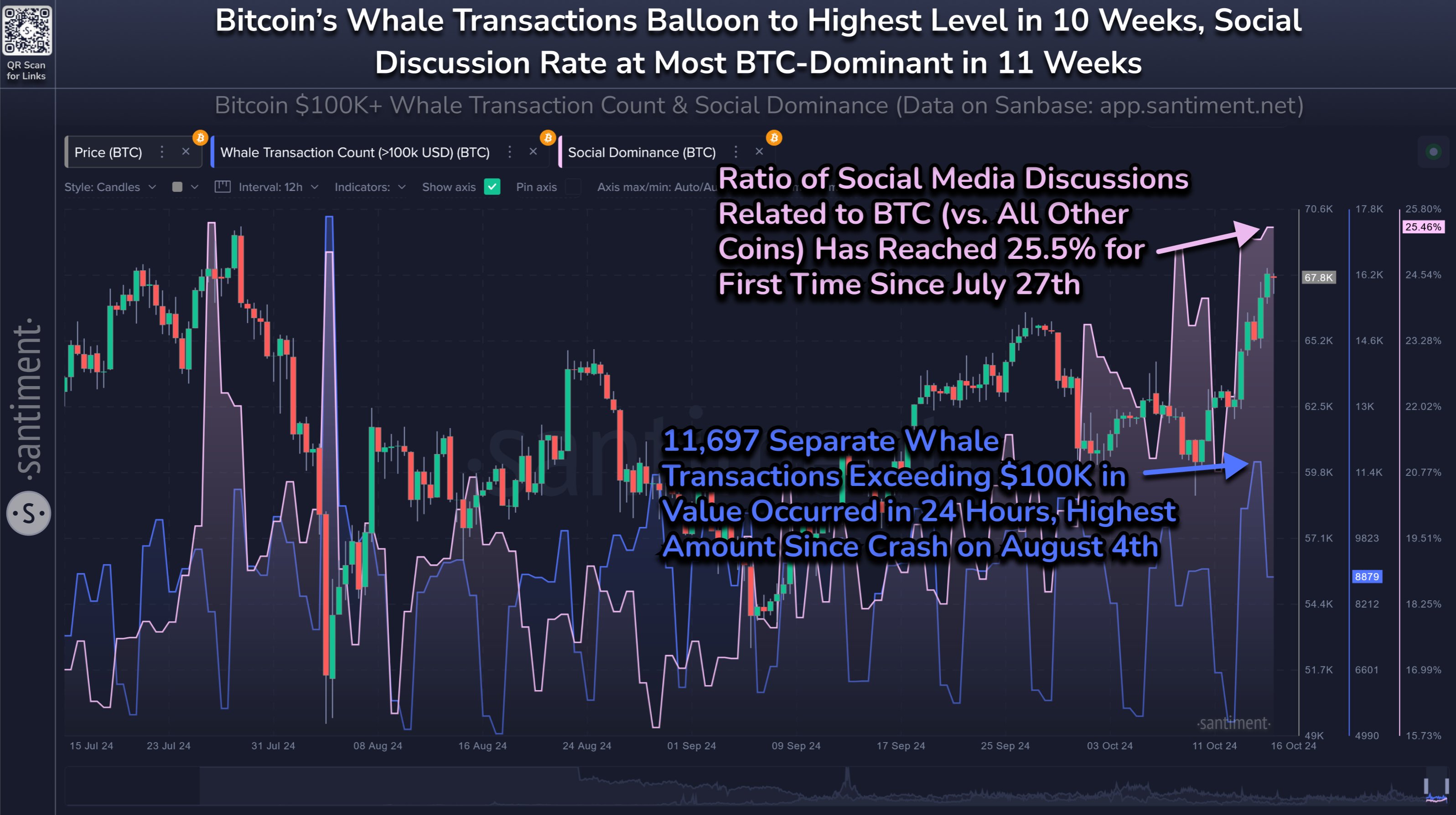

Bitcoin Whale Transaction Count Now Highest In Over 10 Weeks

Based on information from Santiment, a company specializing in on-chain analysis, Bitcoin’s large investors or whales have been more active as of late. The key metric to focus on here is the “Whale Transaction Count,” which tallies up all the transactions occurring on the Bitcoin blockchain that involve amounts worth at least $100,000.

When this metric has a significant value, it signifies that whales are currently engaging in numerous transactions within the network. This pattern suggests that these massive investors are actively involved in buying or selling the cryptocurrency.

Conversely, a low level of this indicator implies that whales might not be actively engaged with the cryptocurrency right now, since there are few transaction activities taking place.

As an analyst, I’d like to draw your attention to this graph illustrating the recent development in the number of significant Bitcoin transactions, or ‘Whale Transactions’, over the past few months.

The graph shows a significant increase in Bitcoin Whale Transactions lately, implying that the whales have been actively moving large amounts of Bitcoins. Specifically, these massive entities conducted a total of 11,697 transactions within a 24-hour period at the height of this surge.

Typically, the number of whale transactions (buying or selling) doesn’t give a clear indication because they appear similar in the transaction count. However, the accompanying price movement can offer clues.

Currently, the most recent high point in our measurement surpasses any level reached since early August. In August’s beginning, a surge in this data corresponded with a fall in the asset’s value, suggesting that many ‘whales’ might have been selling at that time.

It appears that the number of Whale Transactions is on the rise, coinciding with Bitcoin’s rally. This could suggest that whales are potentially cashing in their profits once again. Notably, since the surge, Bitcoin has dipped below $67,000, which might provide support for this theory.

Alongside the same graph, Santiment provides additional data on a different Bitcoin metric – Social Dominance. Essentially, this measure reflects the proportion of discussions related to Bitcoin across all top 100 assets within the sector.

It’s clear from the graph that the percentage of Social Dominance for cryptocurrencies has reached a peak of 25.5%, which is its highest point since late July. This suggests that Bitcoin’s influence or popularity is currently stronger than that of other cryptocurrencies at present.

Typically, this behavior shows a ‘Fear of Missing Out’ (FOMO) in traders, which historically hasn’t been a good indicator for Bitcoin (BTC). Excessive excitement has often been followed by price peaks.

According to the analysis, both indicators suggest that the rally might temporarily pause because significant investors are cashing out and there’s a lot of fear among the public about missing out on profits (FOMO).

BTC Price

At the time of writing, Bitcoin is trading at around $66,900, up more than 9% over the last week.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-10-18 02:10