As a seasoned crypto investor with a decade of experience under my belt, the current surge in whale activity and holder count is a sight that brings back memories of the 2017 bull run. The parallels between then and now are uncanny, and I can’t help but feel a sense of deja vu. However, unlike the naive greenhorn of yesteryears, I’m not blinded by the allure of quick profits; I’ve learned to tread cautiously amidst the euphoria.

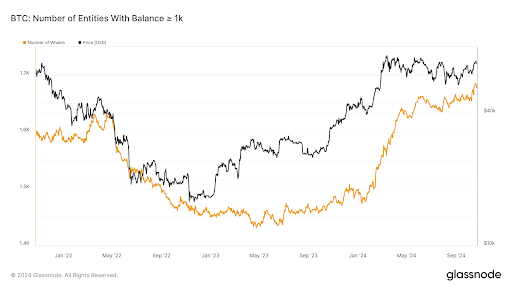

In the past few days, a significant achievement has been reached by large-scale Bitcoin holders, or “whales,” as they are often called. Specifically, the number of wallets containing 1,000 Bitcoins or more has reached its peak since the Bitcoin bull market in January 2021.

Given that Bitcoin is currently near its record price, this recent achievement by a major investor (whale) raises speculation about the likelihood of Bitcoin surpassing its previous high and potentially reaching a new all-time high in the near future.

Whale Activity And Holder Count Reaches New Highs

Bitcoin ‘whales’, significant players in the market, have consistently served as crucial barometers for trader and long-term holder sentiment. As per data from Glassnode analyzed by André Dragosch, European director and head of research at Bitwise, the count of these whale-class addresses has been steadily increasing since January 2024, initially numbering slightly less than 1,500 accounts.

In the past few months, a steady increase in the market conditions and investments from institutional investors have sustained this continuous upward trend. This growth has even surpassed several milestones. The latest data shows that there are now 1,678 Bitcoin addresses containing at least 1,000 BTC, which is the highest level of ‘whale’ activity since early January 2021, a time when we saw significant buying during the previous major bull market.

As an analyst, I’m observing that with the present value of Bitcoin, each of these addresses appears to be holding a minimum of 67 million dollars’ worth of it.

New All-Time High Incoming?

The significant build-up of whales (large Bitcoin holders) culminating in a level comparable to the January 2021 high played a crucial role in pushing the Bitcoin price beyond $69,000 in 2021.

Even though Bitcoin reached a record high of $73,737 in March 2024 by surpassing its previous peak, an identical accumulation trend seems to be emerging. This intriguing buildup of Bitcoin by major investors (Bitcoin whales) has provided the essential momentum to prevent more significant price drops following a misleading breakout from a descending triangle earlier in the week.

As an analyst, I’ve observed that despite the recent false breakout, there’s an overall optimistic vibe surrounding Bitcoin. Data from CryptoQuant indicates that it’s not solely the whales dictating market movements. In fact, retail investors are actively participating as well. Over the past month, on-chain data reveals a 13% surge in retail demand, a significant increase reminiscent of the retail interest preceding Bitcoin’s peak in March 2024, right before it hit its latest all-time high.

Retail on-chain activity returns after 4 months

Over the past month, retail demand experienced an approximately 13% increase, mirroring a situation similar to March, which was just before reaching our previous all-time high.” – Paraphrased by me (Human)

Full post

— CryptoQuant.com (@cryptoquant_com) October 22, 2024

Currently, Bitcoin is being exchanged for approximately $67,000. Over the past 24 hours, its price has fluctuated between $65,161 at its lowest and $67,538 at its highest. Within the last week, the trading range has been even wider, from a low of $65,441 to a high of $69,227.

It’s worth noting that Bitcoin is just about 10% short of reaching its previous all-time high yet again. Given the rising demand and hoarding by large investors, Bitcoin appears poised for another significant price surge, potentially establishing a new record before 2024 comes to an end.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- CNY RUB PREDICTION

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Overwatch 2 Season 17 start date and time

2024-10-25 01:34