As a seasoned crypto investor with a decade-long journey through the digital asset landscape, I can confidently say that this recent Bitcoin whale activity is reminiscent of the old adage, “Buy low, sell high.” The $1.5 billion accumulation by whales earlier this week, following a temporary dip to the $91,000 level, seems like a strategic move that could potentially propel BTC past its current all-time high and breach the psychological barrier of $100,000.

I, as a crypto investor, noticed that during this week’s dip to around $91,000 per Bitcoin, some big players, or ‘whales,’ seemed to be doing some strategic buying, accumulating approximately $1.5 billion worth of Bitcoins according to a recent report by CryptoQuant. This could potentially indicate a bullish sentiment from the whales, suggesting that they believe the price might rebound in the future.

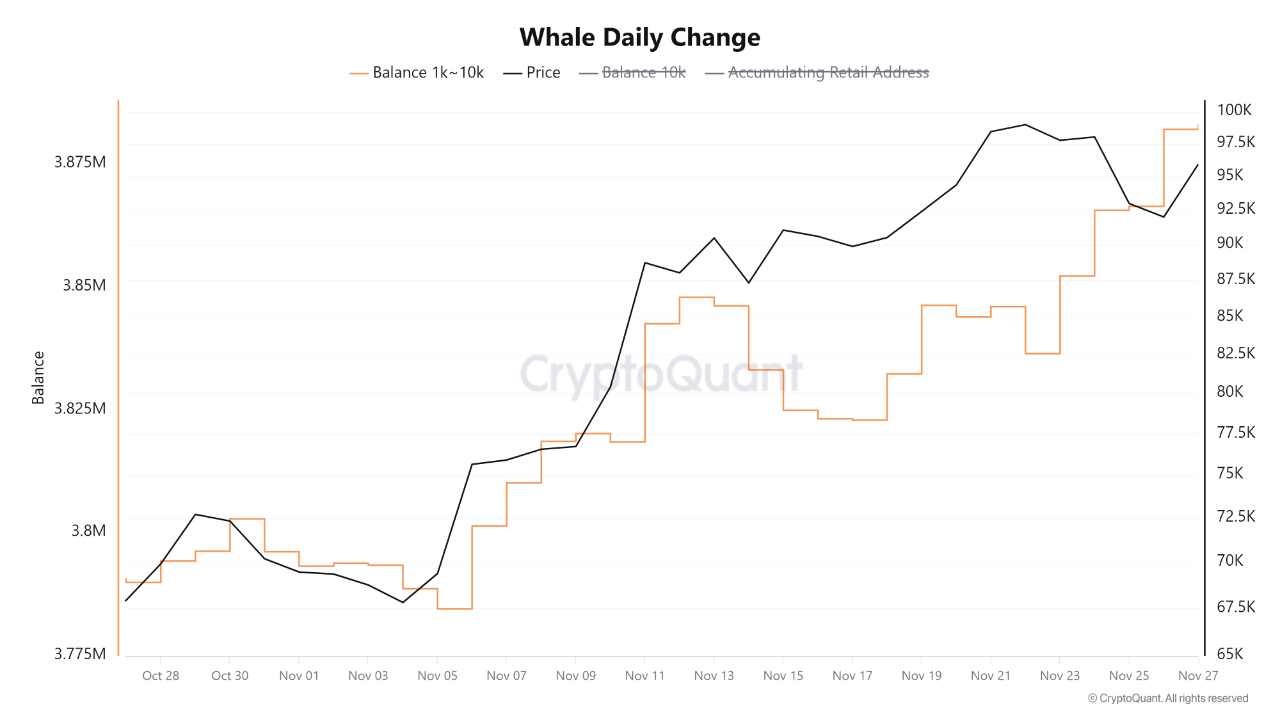

According to Caueconomy’s analysis at CryptoQuant, large Bitcoin (BTC) investors, or “whales,” took advantage of a drop in BTC price to $91,000 as short-term holders suffered losses amounting to approximately $1 billion due to panic selling. On November 26, Tuesday, an impressive 16,000 Bitcoins, valued at around $1.5 billion, were transferred into the whales’ reserves, indicating substantial accumulation on the blockchain network. It is important to note that this figure represents institutional addresses on the network, and a significant portion of these coins might still be held in exchange accounts by these investors.

The analyst additionally pointed out that although the number of Bitcoin being bought at a specific spot has significantly increased, this activity is primarily focused on institutional investors. Moreover, he mentioned that as of now, a widespread trend of ‘buying dips’ (purchasing when prices drop) has not yet materialized. For Bitcoin to reach another record high, it’s crucial to have a significant increase in buying activity from both retail and institutional investors alike.

Courtesy: CryptoQuant

As an analyst in October last month, I observed a remarkable spike in Bitcoin whale holdings to an unprecedented 670,000 BTC. This significant increase was followed by Bitcoin’s ascent from approximately $60,000 to its current record high nearing $100,000. If history mirrors itself, the Bitcoin price might profit from continued whale accumulation, possibly propelling it over the psychological hurdle of $100,000.

BTC Price Recovery after Bitcoin Whale Activity

Initially rising after significant Bitcoin whale accumulation on Tuesday, the Bitcoin price has shown a robust rebound. Currently, the Bitcoin price stands approximately 1.89% higher at $96,575, and its market capitalization is around $1.911 billion as the news was published.

As a researcher, I’m sharing an insight from Ali Martinez: he anticipates that Bitcoin (BTC) might experience a surge around the Thanksgiving period. This potential rally could initiate a rebound, with Martinez projecting that the cryptocurrency may reach an astounding $99,000. His prediction is bolstered by robust technical indicators.

This evening, Bitcoin enthusiasts will likely share their insights about Bitcoin ($BTC) with their loved ones, potentially sparking an unforeseen surge in value, similar to a Thanksgiving rally. Consequently, I believe Bitcoin is poised for a recovery, reaching a peak of $99,000, and the technical indicators corroborate this forecast.

I could be wrong, which is why I’m leaving a tight stop-loss.

— Ali (@ali_charts) November 28, 2024

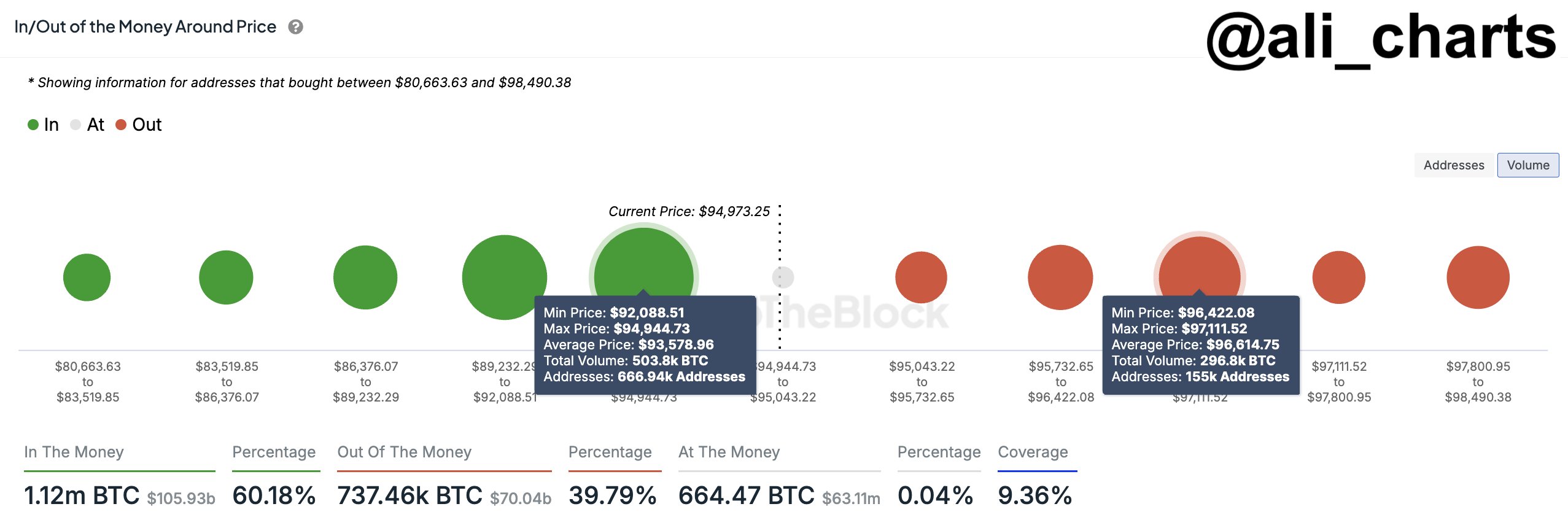

Crypto expert Ali Martinez underscores a vital price area for Bitcoin at around $93,580, where roughly 667,000 investors have accumulated about 504,000 Bitcoins. Martinez advises Bitcoin enthusiasts to protect this support level to discourage possible sell-offs from these investors.

Courtesy: Ali Martinez

After Donald Trump won in early November, the price of Bitcoin surged significantly, increasing from around $73,000 to approximately $100,000 within just under a month. This remarkable increase represented more than 35% growth for Bitcoin.

Since Election Day, Bitcoin has been surging with minimal setbacks; however, reaching the $100,000 milestone still presents a significant psychological hurdle. Breaking through this barrier now would be a strong positive indication for investors, but a temporary dip might occur first to build up momentum before another push towards that level. This is according to Mati Greenspan, founder and CEO of Quantum Economics, in an email to CNBC.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-11-29 15:27