As a seasoned crypto analyst with over a decade of experience in the financial markets, I have seen my fair share of market volatility and price fluctuations. The recent 27% crash in Bitcoin volume and subsequent price drop is not uncharted territory for me, but it certainly piques my interest.

The dramatic plunge in Bitcoin‘s trading activity, amounting to around 27%, followed its initial surge in price, sparking concern among investors. A drop this large has piqued the interest of market observers, as a cryptocurrency analyst deliberates on the underlying causes and implications of Bitcoin’s decline – whether it signals a Distribution or Accumulation period.

Bitcoin Price Falls As Volume Plummets 27%

According to information from CoinMarketCap, the day-to-day trading activity of Bitcoin has dropped by 26.46%, resulting in a total value of approximately $85.89 billion. This substantial decrease in Bitcoin’s trading volume aligns with a broader adjustment in the cryptocurrency’s market price.

Over the past day, Bitcoin’s price dipped to $87,848, from its previous level above $90,000, representing a 2.87% decrease. This significant drop in trading volume might suggest a waning market curiosity or excitement. Nevertheless, this trend might not apply to Bitcoin, given the increased market activity surrounding the recent US Presidential elections, which saw Donald Trump emerge victorious, potentially influencing Bitcoin’s market behavior.

A possible explanation for the reduced volume might be market consolidation, which could lead to Bitcoin’s price becoming more stable prior to a potential surge. Backing this up, a crypto analyst known as ‘Personal Trader’ suggested that the market is currently experiencing a downturn, and Bitcoin may be entering its final correction period before approaching the $100,000 mark.

BTC Price Decline May Indicate A Distribution Or Accumulation Phase

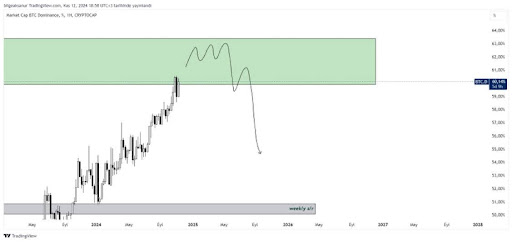

Based on the current drop in Bitcoin’s price and trading activity, an analyst known as ‘IonicXBT’ is utilizing a particular platform to analyze and explain the importance of this downturn by focusing on two key stages typically seen in a Bitcoin market cycle: the Accumulation and Distribution periods.

As an analyst, I find myself observing that the Accumulation phase is when shrewd investors and institutions begin purchasing Bitcoin. In this stage, prices often remain low or have stabilized following a downturn. Concurrently, Bitcoin’s trading volume surges as more buyers enter the market to drive prices upwards. Furthermore, each upward price movement typically reflects robust trading volume, signaling heightened buying pressure.

Instead, let me rephrase it for you: Contrastingly, the Distribution phase refers to when knowledgeable investors start offloading or distributing their Bitcoin. During this period, prices might have reached their maximum or appear overpriced. The number of BTC transactions increases as its price decreases, indicating strong selling activity. Furthermore, sharp price fluctuations with low trading volume imply weak demand for buying, a warning sign that experienced investors are leaving the market. This is a potential danger signal.

According to the Bitcoin stages analyzed by IonicXBT, it’s predicted that he will identify both the peak and trough of the Bitcoin market shortly. The analyst has demonstrated that we are not yet in the distribution phase for Bitcoin, indicating that it remains a “buyer’s market.” This implies there could be further price rises in the future.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Gold Rate Forecast

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- Delta Force Redeem Codes (January 2025)

- CNY RUB PREDICTION

- Criminal Justice Season 4 Episode 8 Release Date, Time, Where to Watch

2024-11-15 21:04