As a seasoned crypto investor with over a decade of experience navigating the tumultuous waters of the digital asset market, I can’t help but feel a familiar mix of excitement and trepidation as I watch Bitcoin dance around the $100,000 mark. The sudden pullback, while disappointing in the short term, is not entirely unexpected given the volatility we’ve come to associate with this revolutionary currency.

Due to the abrupt spike in Bitcoin’s ups and downs close to the $100,000 threshold, the cryptocurrency market is experiencing a heightened level of instability. Presently, Bitcoin (BTC) is trading at $99,404 and has seen a slight dip of 0.32% in the last 24 hours.

The intraday pullback of 1.74% in Bitcoin has significantly lowered the total crypto market, losing $62.89 billion in valuation. The total crypto market cap is currently at $3.55 trillion, down from the 24-hour high of $3.62 trillion.

Bitcoin to Pullback Near $87K?

As a crypto investor, I’ve noticed that the day-to-day movements of Bitcoin suggest a bearish shift at a significant resistance level. This downward trend indicates the commencement of a negative phase within the ascending wedge formation we’ve been observing.

The intraday pullback of 1.74% undermines the slow recovery over the weekend and starts the week on a bearish note. Despite the pullback, Bitcoin market cap is $1.96 trillion, with a surge of 2.57% over the past week.

In simpler terms, as the rising wedge pattern nears its narrowest point, it indicates a negative trend, suggesting a potential drop in price. This downturn could lead to a return to the key support level around $87,680.

Hence, the current price trend projects a pullback of nearly 12%.

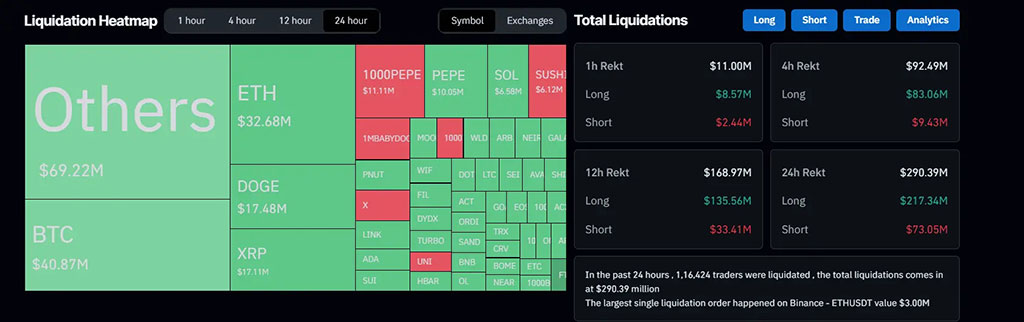

Crypto Liquidations Hit $288M

Over the last day, there were forced sales totaling approximately $290.39 million due to mounting supply pressure. Out of this amount, around $217.71 million were short sellers who had to exit their positions, signifying a general market pullback.

The current value of Bitcoin’s open interest is at approximately $61.5 billion, with major traders favoring a bullish mix of long and short positions on platforms like Binance and OKExchange. Yet, within the last 24 hours, a significant Bitcoin liquidation worth around $41 million was triggered, primarily due to a substantial loss of roughly $23.32 billion in long position liquidations.

Bitcoin ETFs to the Rescue

Regardless of the rising pessimism in the immediate future, the increasing backing from institutions plays a significant role in propelling the situation. With the influx of net investments into U.S. Bitcoin ETFs on the rise, predictions suggest that the value of Bitcoin will soar.

During the last seven days, the accumulated Bitcoin spot ETF saw its second-highest influx of funds, totaling approximately $2.73 billion. This significant increase in investment occurred just two weeks after a record-breaking $3.38 billion was poured in, fueled by the excitement surrounding President Trump.

Historic Performances Target $120K+

Based on historical data for Bitcoin’s monthly returns, it is common for a strong performance in November to carry over into December. Over the last ten years, Bitcoin has generally maintained the same positive trend during these months.

During the majority of November, as Bitcoin spiked by 20% or higher, its price experienced a substantial increase, mirroring a persistent upward trend. For instance, in November 2015, when Bitcoin climbed 19.27%, this trend persisted with a further rise of 13.83% in December.

During November 2017, an increase of approximately 53.48% led to almost a 39% escalation by the end of that year. In the year when Bitcoin underwent its halving event in 2020, there was a nearly 43% growth in November which was followed by a roughly 47% upswing in December.

According to this trend, the 37.29% jump in November indicates a higher probability that Bitcoin’s price could experience a strong upswing lasting till the end of 2024. A comparable surge in December may even push the Bitcoin price beyond the $120,000 mark.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Gold Rate Forecast

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Overwatch 2 Season 17 start date and time

2024-12-09 11:20