As a seasoned researcher with over two decades of experience in financial markets, I have seen my fair share of market cycles and trends. The current state of Bitcoin’s UTXO metric has certainly piqued my interest.

This week, Bitcoin‘s price has stayed below $68,000, but it’s held above the $66,000 support. Despite not experiencing a strong upward surge, the fact that it hasn’t plunged further indicates that Bitcoin is still poised to finish October on an optimistic trend.

To back up this perspective, a cryptocurrency analyst has pointed out a developing pattern in Bitcoin’s Unspent Transaction Output (UTXO) indicator, implying a potential surge in the digital currency’s value.

UTXO In Loss Reaches Highest Point Ever

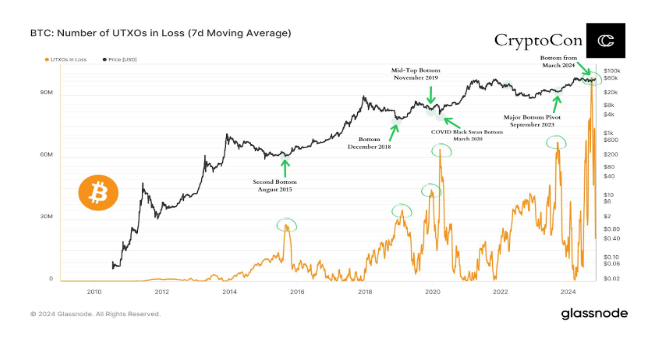

As an analyst, I’ve noticed an interesting trend: The number of Bitcoin UTXOs (Unspent Transaction Outputs) experiencing losses has hit a new high on September 11, 2024. This figure surpasses levels last seen during the market downturn caused by the COVID-19 pandemic in 2020 and even exceeds the low point we saw during the market bottom in September 2023.

The term “Unspent Transaction Output” (UTXO) refers to the amount of Bitcoin left unutilized within a Bitcoin wallet following a transaction. When UTXO is calculated as a loss, it signifies the quantity of Bitcoin holdings that are currently worth less than the last transaction price recorded in the wallet.

Based on Glassnode’s data analysis, the count of Unspent Transaction Outputs (UTXO) in a negative position saw a substantial increase in September, exceeding past records. This suggests that many active Bitcoin wallets are currently holding bitcoins at a loss. Initially, this trend might seem to indicate pessimistic market sentiment. However, looking back at history, such a scenario doesn’t necessarily point towards bearish trends.

According to crypto analyst CryptoCon, significant increases in UTXO loss typically occur after, rather than before, poor market performance, and they usually mark the end of it. Given this pattern, it’s possible that the recent peak in September served as a turning point in Bitcoin’s price trend for the remainder of the year.

What Does This Mean For Bitcoin Price?

Historical trends suggest a recurring pattern: when Unspent Transaction Output (UTXO) is significantly in the red, Bitcoin’s price tends to be close to a price reversal. For example, during the COVID-19 market downturn in March 2020, UTXO in loss experienced a substantial increase, which was followed by a robust recovery that propelled Bitcoin to new record highs over the subsequent months.

The significant increase in the UTXO (Unspent Transaction Output) related to losses occurred in September 2023, which marked the beginning of the recent bull market phase that started in October 2023. This trend peaked in March 2024 with a new record high for Bitcoin, indicating that increases in UTXO loss could be a sign of a positive market trend.

Should history follow a similar pattern, the surge in UTXO losses during September might indicate a market low point, thus potentially paving the way for an uptrend for the remainder of the year.

It’s worth noting that Bitcoin’s price trend has been remarkably upward since the peak in UTXO at a loss. At that point, Bitcoin was valued around $57,000. Since then, it has witnessed a significant surge, moving towards the $70,000 price mark.

At the time of writing, Bitcoin is trading at $66,720.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Overwatch 2 Season 17 start date and time

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-10-27 08:46