As a seasoned crypto investor with a decade of experience under my belt, I can confidently say that the recent Golden Cross in Bitcoin is a sight for sore eyes. Having witnessed the power of this technical indicator since the bear market bottom in 2022, I’ve learned to take it seriously and trust its predictive capabilities.

Currently, the price of Bitcoin exceeds $70,000 for each coin. The latest surge in value has brought Bitcoin close to its previous local peak, causing two crucial moving averages to create what’s known as a “Golden Cross.” This technical pattern has only occurred twice since the end of the bear market and has consistently led to substantial gains. Now that this signal has been confirmed, let’s delve into the data and examine the details.

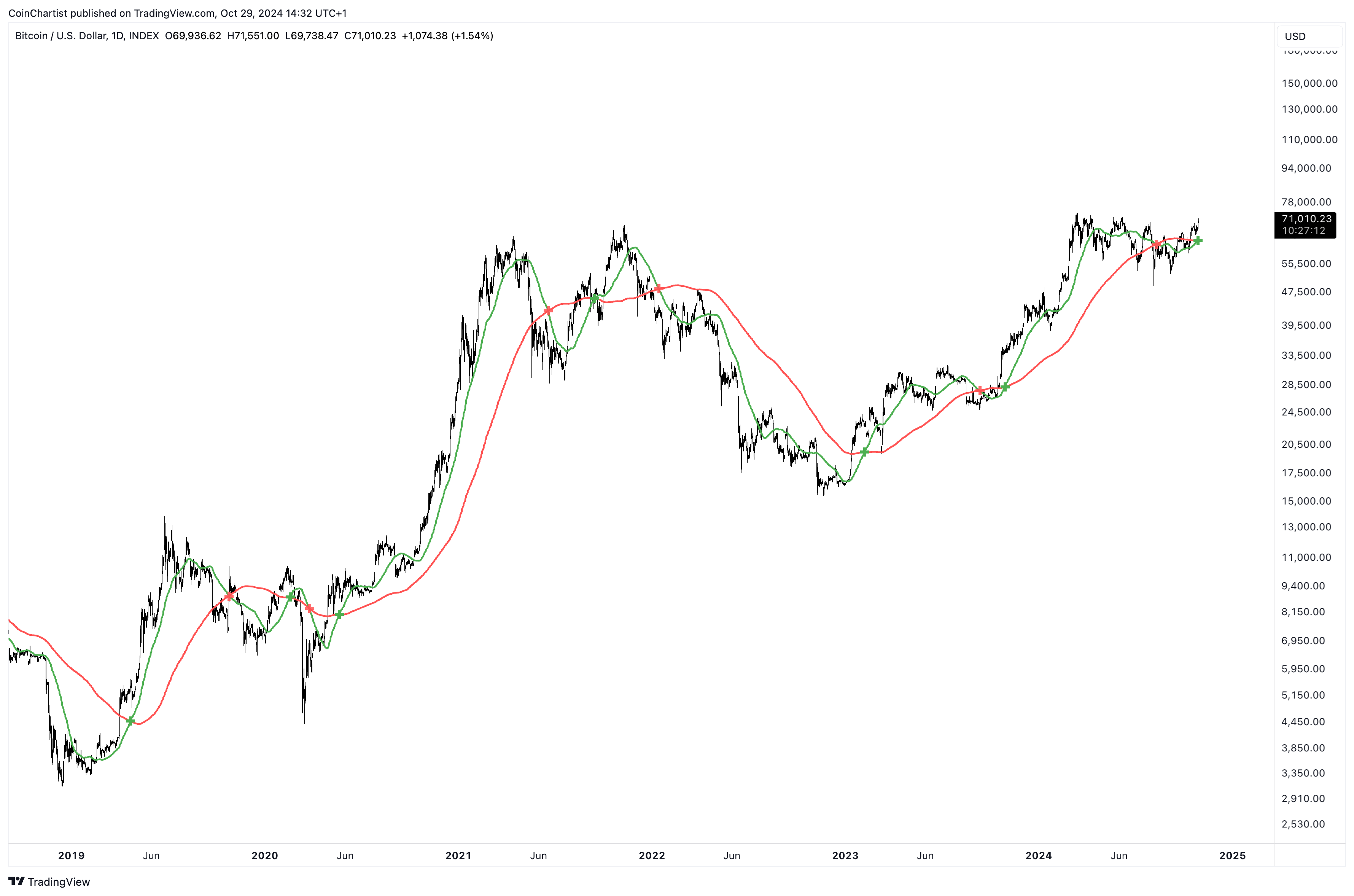

Bitcoin Daily Golden Cross: 50-Day And 200-Day Moving Averages

The image you see shows BTCUSD experiencing a daily “golden cross,” which means its 50-day moving average has crossed above the 200-day moving average. In terms of technical analysis, this event occurs when a short-term average line moves higher than a long-term average line. Generally speaking, such an occurrence indicates a market that is trending strongly and is anticipated to increase in value.

As a crypto investor, I’ve noticed the ominous term “death cross” being mentioned in relation to my investments. In August 2024, the chart showed a death cross, but surprisingly, it didn’t trigger an extended period of decline as typically predicted. This leads me to ponder whether this recent golden cross could potentially fail to sustain a strong upward trend.

BTCUSD Golden Cross And Death Cross Recent History

Looking at a broader perspective since the signal’s lowest point in November 2022 offers a clearer view of its effectiveness. The Bitcoin to US Dollar (BTCUSD) market has seen significant growth, rising from approximately $16,000 during the bear market to around $23,000. This substantial increase caused the 50-day moving average to surpass the 200-day average, marking the first ‘golden cross’ of 2023.

The price of Bitcoin continued climbing until it hit approximately $32,000, but then dipped back down towards $25,000. This drop caused a temporary bearish trend, which led to what’s known as a ‘death cross.’ However, just like in the year 2024, Bitcoin didn’t fall into a prolonged decline. Instead, it moved horizontally and managed to avoid a steep descent. A small increase in price caused another ‘golden cross,’ which further boosted Bitcoin. Following this golden cross, Bitcoin’s value doubled within a 100% rise.

The graph demonstrates an interesting pattern: In October 2024, a golden cross followed the death cross, similar to what happened in late 2024. Could this signal another potential 100% increase from current prices? If true, Bitcoin’s price might surge as high as $140,000 before exhibiting signs of weakening.

Buy And Hold: Using Moving Average Crosses As A Trading System

Employing the 50-day and 200-day moving averages as a long-term investment strategy from 2018 produced substantial returns. The first ‘golden cross’ signal appeared in April 2019 at approximately $5,000 per BTC. A subsequent ‘death cross’ in October 2019 resulted in selling some coins. A brief crossover of these signals (a ‘golden cross’ and a ‘death cross’) in early 2020 caused a minor loss. However, the ‘golden cross’ that occurred in May 2020 more than compensated for it as Bitcoin was trading near $10,000 at that time.

During the most bullish Bitcoin surge of recent times in June 2021, which peaked at approximately $35,000 per BTC and marked a subsequent death cross, our trade remained active throughout. This extended period of activity netted us an additional profit of $25,000 on top of the initial $4,000 made from our early 2019 trade. However, a minor loss brings the total earnings to around $28,500.

In September 2021, the Bitcoin-to-US-Dollar (BTCUSD) pair experienced another golden cross near $45,000, but it soon followed by what’s known as a “death cross” at a price $3,000 lower. This death cross persisted until Bitcoin dropped an additional $30,000 in value. However, utilizing the two moving averages as a long-term trading strategy would have prompted you to sell during the death cross, thus shielding you from the most severe impacts of the bear market.

By early 2023, Bitcoin was poised to initiate a fresh upward surge, as evidenced by the golden cross occurring around the $23,000 mark. Conversely, a bearish pattern known as the death cross emerged at approximately $27,000, potentially securing additional profits of about $6,000. Subsequently, another golden cross was observed in October 2023 at roughly $35,000, leading Bitcoin to climb all the way up to $62,000 before a recent death cross concluded the trade.

Using a 50/200 Moving Average system in six trades, approximately $58,500 was earned as Bitcoin’s price increased from around $5,000 to $74,000. Four of these trades resulted in profits, while the losses incurred were minor compared to the overall gains made.

Read More

- Move Over Sydney Sweeney: Ozzy Osbourne’s DNA Is in Limited-Edition Iced Tea Cans

- Steven Spielberg UFO Movie Gets Exciting Update as Filming Wraps

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

- Anna Camp Defends Her & GF Jade Whipkey’s 18-Year-Old Age Difference

- Aaron Taylor-Johnson Debuts New Look at 28 Years Later London Photocall

- Best Items to Spend Sovereign Sigils on in Elden Ring Nightreign

- The Entire Cast Of Pretty Little Liars Hopes For A Reunion Movie

- Brody Jenner Denies Getting Money From Kardashian Family

- How Taylor Swift’s Bodyguard Reacted to Travis Kelce’s Sweet Gesture

2024-10-29 17:12