As a researcher with experience in analyzing cryptocurrency markets, I find the recent decline in Bitcoin traders’ sentiment, as indicated by the Fear & Greed Index, to be of great interest. The index’s value of 44 suggests that fear is currently prevalent in the market, which is a change from the neutral sentiment we saw just a few days ago.

The latest data indicates that the sentiment among Bitcoin traders has shifted towards fear following the significant price drop experienced by the cryptocurrency in the last 24 hours.

Bitcoin Fear & Greed Index Is Now Suggesting A Fearful Market

The “Fear & Greed Index,” a tool developed by Alternative, offers insights into the prevailing emotions among Bitcoin and cryptocurrency traders, providing a gauge of their collective sentiment.

The index employs a zero-to-100 scale for expressing sentiment, with the score derived from the assessment of five key aspects: volatility, trading activity, social media opinion, market influence, and Google search popularity.

Investor sentiment is represented by the indicator, with values exceeding 53 indicating greed and values under 47 suggesting market fear. The zone in between signifies a neutral attitude.

Now, here is what the Bitcoin Fear & Greed Index looks like currently:

From my perspective as a researcher, the Bitcoin Fear & Greed Index currently stands at 44. This signifies that the market sentiment is teetering on the edge of fear territory. A shift from the previous days’ sentiments.

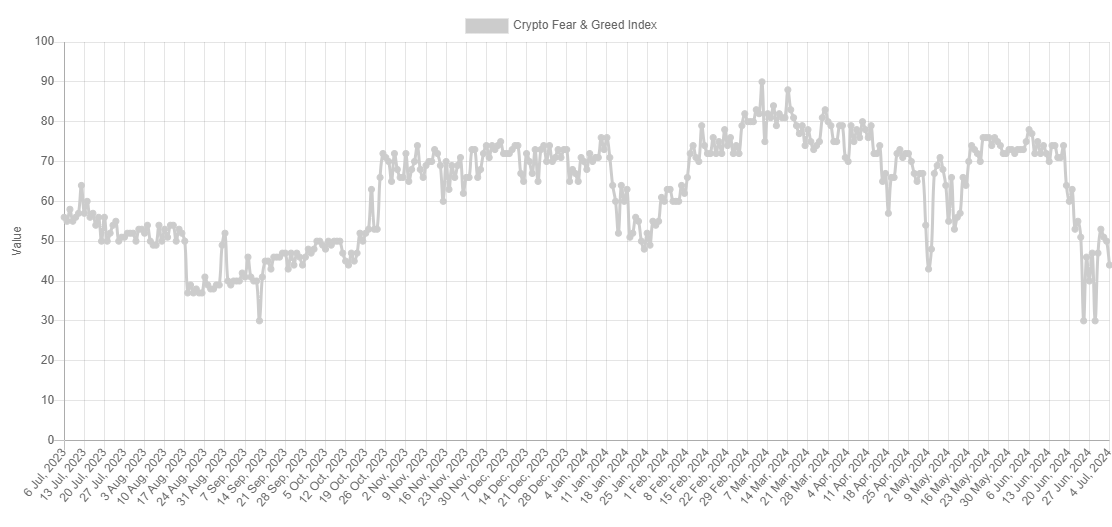

The chart below shows how the indicator’s value fluctuated over the past year.

As a crypto investor, I’ve been closely monitoring the Bitcoin Fear & Greed Index throughout the month. For the initial three days, the index hovered around the neutral zone. However, on the fourth day of this month, my observation reveals a significant shift in sentiment. The Bitcoin Fear & Greed Index has taken a nosedive, indicating heightened fear among investors.

The deteriorating attitude can be attributed to the significant drop in cryptocurrency’s value over the past day, causing its price to fall below the $58,000 mark.

As a crypto investor, I’ve noticed an intriguing pattern in the chart. The neutral sentiment during the first three days of July saw a significant uptick compared to how June had concluded. The metric had dipped as low as 30 on two occasions in June, signaling bearish momentum at its peak for Bitcoin.

If I’m a crypto investor and the bearish sentiment is returning to the market, I might lose some optimism about the asset’s recovery. But it’s essential to remember that market downturns can create opportunities for buying at lower prices. So, while the short-term outlook may seem grim, long-term investors could potentially benefit from this trend.

As a seasoned crypto investor, I’ve observed that Bitcoin’s price behavior often defies popular belief. The greater the consensus among investors about a particular trend, the higher the likelihood of an opposing move. This tendency is more pronounced when the Fear & Greed Index indicates strong emotions in the market – be it extreme fear or greed.

In simpler terms, significant peaks and troughs in an asset’s price trend usually happen when it lies beyond the zones of excessive optimism (above 75) and excessive pessimism (below 25), respectively, on the fear and greed index.

If the indicator’s value keeps dropping, it might signal an “extreme fear” level that could be worth monitoring closely. Such a downturn could potentially mark the bottom for Bitcoin prices in this instance.

BTC Price

Currently, Bitcoin is priced approximately at $57,900 during my composition of this text, representing a nearly 6% decrease over the previous week.

Read More

- Move Over Sydney Sweeney: Ozzy Osbourne’s DNA Is in Limited-Edition Iced Tea Cans

- Steven Spielberg UFO Movie Gets Exciting Update as Filming Wraps

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

- Anna Camp Defends Her & GF Jade Whipkey’s 18-Year-Old Age Difference

- Aaron Taylor-Johnson Debuts New Look at 28 Years Later London Photocall

- Best Items to Spend Sovereign Sigils on in Elden Ring Nightreign

- The Entire Cast Of Pretty Little Liars Hopes For A Reunion Movie

- Brody Jenner Denies Getting Money From Kardashian Family

- How Taylor Swift’s Bodyguard Reacted to Travis Kelce’s Sweet Gesture

2024-07-05 06:04