As a seasoned crypto investor with a decade of experience under my belt, I must admit that the recent events have left me both exhilarated and apprehensive. The Bitcoin surge to $100,000 was a momentous occasion, one that validated years of patience and strategic investing. However, the subsequent crash has served as a stark reminder of the volatile nature of this market.

Following reaching the $100,000 mark, Bitcoin unexpectedly plummeted in value on Friday, causing an estimated 7% decrease in price. This downward trend also affected the funding rates of Bitcoin derivatives, but traders still possess sufficient control to potentially drive significant price fluctuations in the near future.

Bitcoin Short-Term Outlook Uncertain Due To Heightened Leverage

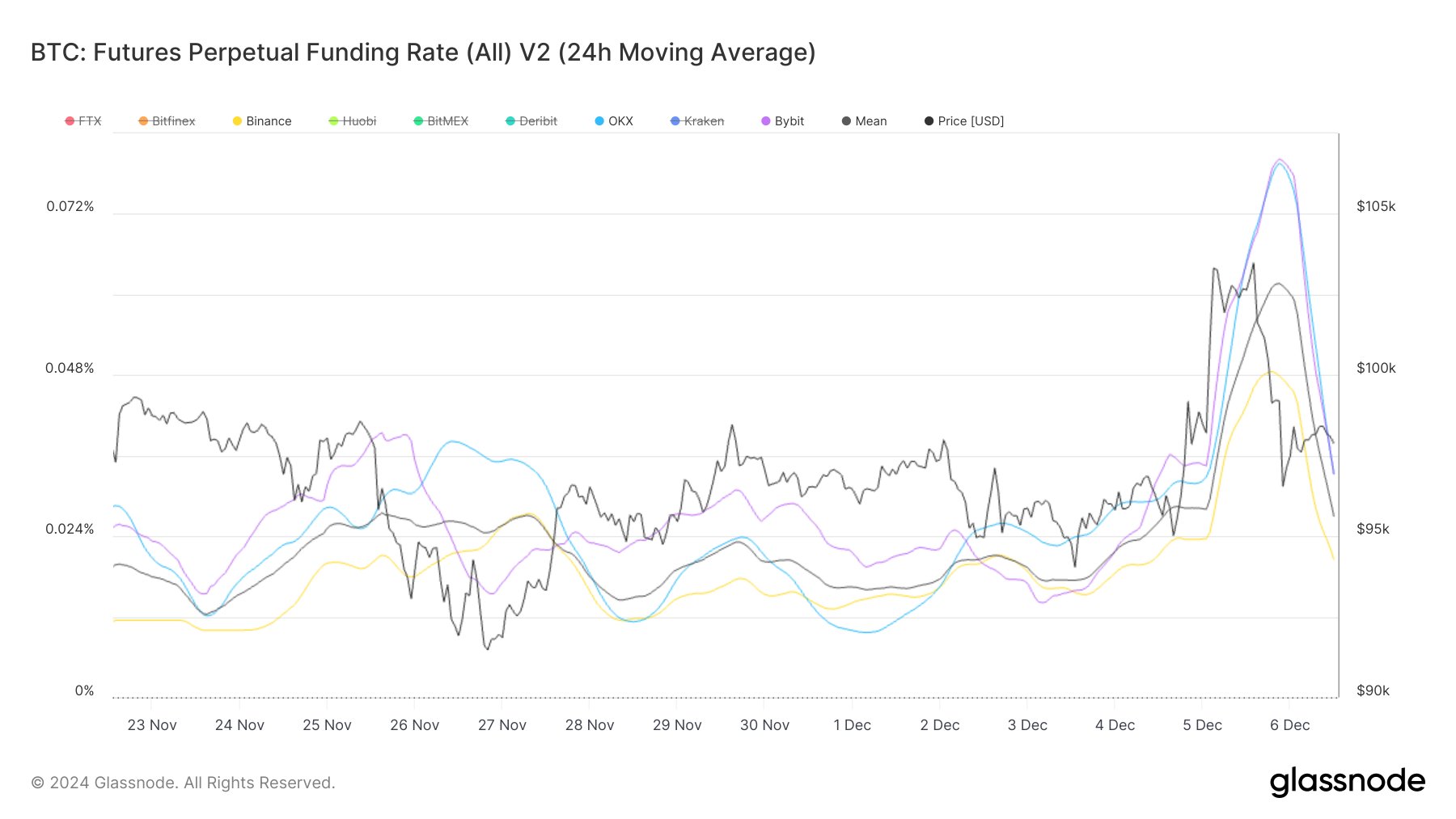

On December 6, according to a post by Glassnode, a blockchain analysis company, the ongoing funding rate of Bitcoin could potentially have substantial effects on the asset’s immediate price movement.

In simpler terms, in the continuous future trading market for Bitcoin, regular payments called funding rates are exchanged between traders to keep the contract price consistent with the current Bitcoin value (the spot price). When these rates are positive, it means long-term investors are compensating short-term ones, which is a sign of optimism about Bitcoin’s price increase. Conversely, negative funding rates imply that short-term traders are paying long-term ones, suggesting pessimism or bearishness about Bitcoin’s immediate future.

As reported by Glassnode, Bitcoin’s perpetual funding rates appeared to be becoming more stable in its weekly view due to speculative demand. Yet, the sudden jump in Bitcoin’s price to $100,000 on Thursday, fueled by increased market leverage, caused these funding rates to skyrocket approximately 3.6 times higher than their average for that week.

Significantly, the funding rate for Bitcoin reached a high of 0.062, which is its highest point since April. It’s worth noting that the analysts at Glassnode suggest this surge in the funding rate indicates a strong impact from the derivative market on Bitcoin surpassing $100,000.

Although Bitcoin’s sudden price surge led to a notable drop in its funding rates at approximately 0.024, Glassnode notes that these rates remain elevated compared to earlier in the week. This suggests that there are still substantial numbers of leveraged positions in the Bitcoin market.

This residual leverage in the market indicates a strong potential for increased price volatility. Therefore, Bitcoin’s price movement in the coming days appears unclear as a reversal on either side could trigger a significant level of liquidation, inducing a cascading effect.

STH Cost Basis Points To $112,000 Price Target

To provide an update, well-known analyst Ali Martinez has shared his Bitcoin price forecast using the average purchase price of recent investors over the past 155 days, which is referred to as their short-term holder (STH) cost basis. This prediction suggests a price point where these particular investors will no longer be making a profit or breaking even on their investment.

As per Martinez’s analysis, the Significant Trend High (STH) behavior suggests that Bitcoin might reach a temporary peak or hit a price of approximately $112,926. This prediction is based on a +1 standard deviation adjustment in the STH cost basis, taking into account Bitcoin’s price volatility and market trend patterns.

As I analyze the current market situation, I find that Bitcoin is currently trading at approximately $100,137. Following its recovery from the crash on Friday, it has faced a rejection at the price point of $102,000. Simultaneously, the trading volume for this asset has decreased by 42.46%, with a current value of approximately $89.12 billion.

Read More

- Connections Help, Hints & Clues for Today, March 1

- Shruti Haasan is off from Instagram for THIS reason; drops a comeback message on Twitter

- Shiba Inu Sees Bullish Reversal In On-Chain Metrics, Can SHIB Price Recover?

- The Babadook Theatrical Rerelease Date Set in New Trailer

- The games you need to play to prepare for Elden Ring: Nightreign

- What Is Dunkin Donuts Halloween Munchkins Bucket?

- Pepe Battles Price Decline, But Analysts Signal A Potential Rally Ahead

- Chiranjeevi joins Prime Minister Narendra Modi for Pongal celebrations in Delhi; see PICS

- Sitara Ghattamaneni: The 12-Year-Old Fashionista Taking the Spotlight by Storm!

- When To Expect Blue Lock Chapter 287 Spoilers & Manga Leaks

2024-12-07 18:40