As an experienced options market analyst, I’ve seen my fair share of market corrections and the accompanying shifts in sentiment. The recent price correction in Bitcoin has certainly shaken up the options trading space.

As a crypto investor, I’ve noticed that the recent correction in Bitcoin‘s price has caused quite a stir in the options trading community. According to analyst reports, there’s been a substantial surge in the demand for downside bets. This trend is indicative of growing anxiety among traders regarding Bitcoin’s near-term price direction. The increasing open interest for put options and soaring implied volatility are clear signs of this heightened concern.

Options Data Indicates Bearish Sentiment

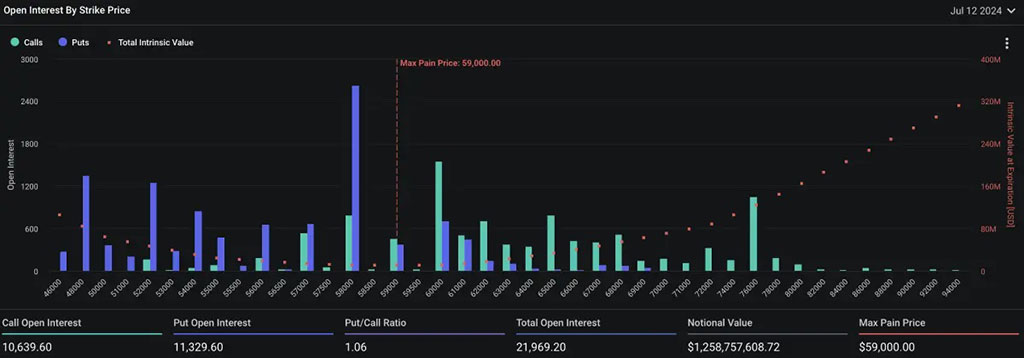

Leading cryptocurrency derivatives exchange Deribit reveals that the demand for Bitcoin options with a bearish bet has outpaced those with bullish bets. Specifically, the put-call ratio has exceeded one as we near this week’s expiry on Friday. This imbalance suggests a pessimistic market sentiment as investors are purchasing more put options (profiting from price decreases) than call options (profiting from price increases).

Photo: Deribit

As a researcher examining Deribit’s trading data, I’ve noticed an intriguing trend: traders seem particularly interested in put options with strike prices at $58,000, $52,000, and $48,000. This pattern implies that these traders might be either predicting potential price floors at these levels or taking proactive measures to protect against possible market downturns.

As a crypto investor, I closely follow the insights shared by industry leaders like ETC Group. In their latest report released on Monday, they highlighted an emerging trend that I find intriguing. According to their analysis, there’s been a notable increase in institutional adoption of digital assets. This is a positive sign for the long-term growth and legitimacy of the crypto market.

As an analyst, I’ve observed that the surge in Bitcoin options open interest is primarily attributed to a rise in put open interest. This trend aligns with Bitcoin’s recent price correction, suggesting that options traders are increasing their downside bets and hedges. Furthermore, a noticeable increase in put-call volume ratios and one-month 25-delta option skew indicates a substantial demand for downside protection among market participants.

Bitcoin’s Implied Volatility Surges

As a researcher, I’ve come across an intriguing finding in the ETC Group report: Bitcoin’s implied volatility has experienced a substantial surge. This metric is used to gauge market anticipation of future price fluctuations and currently hovers around 50.5% for one-month at-the-money options. Traders are willing to pay a premium for these options with heightened implied volatility, suggesting they’re eager to secure protection against potential price shifts.

The analysis in the report reveals an “abnormal volatility term structure,” which is characterized by greater implied volatilities for shorter-term options compared to longer-term ones. This observation from ETC Group specialists may indicate “excessive bearish sentiment” within the options market.

Currently, Bitcoin is priced at $56,129, representing a 1.20% decrease over the past day. In contrast, the digital currency has experienced a more significant drop of 8.70% within the last week. Surprisingly, Bitcoin’s trading volume has significantly increased to $33.96 billion within the last 24 hours, marking a substantial 69% uptick.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Delta Force Redeem Codes (January 2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Overwatch 2 Season 17 start date and time

- Gold Rate Forecast

2024-07-08 19:00