As a seasoned crypto investor with scars from past bear markets etched deep into my portfolio, I can’t help but feel a mix of excitement and caution as Bitcoin continues its relentless rally. The current price action is truly remarkable, with BTC setting new all-time highs almost every day – it’s like watching a freight train barreling down the track without any signs of slowing.

Yesterday, Bitcoin hit a new record high of $93,483, marking another milestone in its ongoing, unyielding rally. In the past nine days, this digital currency has soared with only minor drops, never dropping more than 5% during this bullish period. This persistent price increase has garnered a lot of attention as Bitcoin continues to confound expectations and withstand any substantial pullback.

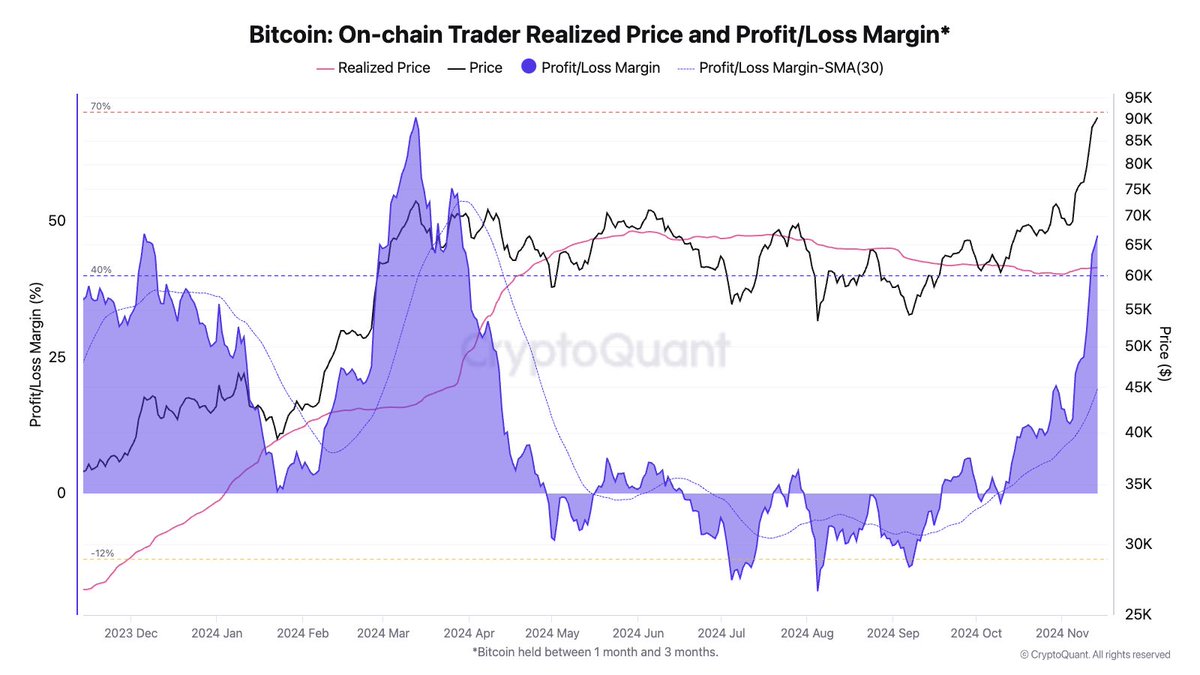

Information from CryptoQuant suggests that traders’ potential profits are increasing, which could mean the market is approaching a short-term high. High unrealized profits often suggest a possible correction may be imminent as investors look to lock in their earnings. Nevertheless, due to Bitcoin’s current robust price trends, it’s hard to predict exactly when and how significant a correction might be.

As Bitcoin’s price continues its robust upward trend, the upcoming days are vital in predicting whether the market can maintain these high levels or if a necessary correction is imminent. Investors are vigilantly scanning for potential opportunities to invest and crucial support thresholds. They understand that even small declines could ignite significant buying activity due to Bitcoin’s ongoing bullish trend.

Bitcoin Strong Move About To Pause?

The incredible rise of Bitcoin is undeniable, with its price increasing by 38% following the U.S. election. This digital currency has garnered extensive interest due to its persistent bullish run. Yet, recent trends suggest that this strong rally might be taking a short break, possibly leading to a correction as suggested by some data.

Recently, the chief researcher at CryptoQuant, Julio Moreno, posted an intriguing graph illustrating the unrealized profits of Bitcoin traders, currently standing at approximately 47%. Historically, such high levels have typically been followed by a decrease in price.

Large, undistributed profits among traders might suggest they’re holding onto substantial gains, increasing the possibility of profit-taking which could cause a market cool down or correction. According to Moreno’s analysis, this metric often aligns with an increased risk of a correction when it exceeds certain levels. For example, in March, the unrealized profits stood at 69%, and in December 2023, they reached 48%. These high profit levels preceded significant corrections shortly after.

Despite indicating a need for caution, the present 47% level hints at Bitcoin’s bullish phase potentially having more growth ahead. Previous cycles show that the market has been able to endure greater unrealized gains before reversing. In other words, while a dip might be imminent, Bitcoin may continue its upward trajectory for a while longer before any major cooling down occurs.

Over the next few days, investors will keenly observe any indications of either a consolidation period or possible reversal. If Bitcoin manages to hold its strong base levels, it’s possible this bullish trend might continue. But if selling pressure increases significantly, a correction could occur, offering a refreshing break before Bitcoin can regain strength for further growth.

BTC Breaking ATH Almost Every Day

Over the last eight days, Bitcoin has smashed its previous record price by seven instances, causing a lot of optimism in the market. At the moment, it’s being traded at around $90,620, having reached as high as $93,483. The robustness of Bitcoin’s price movements suggests that buying interest remains robust. However, a short period of correction might be needed to balance things out after such a prolonged upward trend.

In simple terms, with so many people wanting to buy Bitcoin, a temporary drop might occur to balance the market. This dip would let Bitcoin check its less active demand zones and develop stronger foundations for future growth. If selling pressure increases soon, Bitcoin could return to around $85,000 before settling down again.

Over the next few days, investors will keep an eye on the possible consolidation period as a sign of Bitcoin’s durability. If Bitcoin successfully bounces back from the $85,000 support level, it would bolster faith in the continued bull market and create a more robust platform for further growth. In essence, while the overall trend is optimistic, a measured correction could be beneficial to sustain the market’s momentum over the long haul.

Read More

- Shiba Inu Sees Bullish Reversal In On-Chain Metrics, Can SHIB Price Recover?

- Shruti Haasan is off from Instagram for THIS reason; drops a comeback message on Twitter

- Connections Help, Hints & Clues for Today, March 1

- The Babadook Theatrical Rerelease Date Set in New Trailer

- The games you need to play to prepare for Elden Ring: Nightreign

- Sitara Ghattamaneni: The 12-Year-Old Fashionista Taking the Spotlight by Storm!

- BUZZ: Rajinikanth starrer Jailer 2 directed by Nelson Dilipkumar likely to go on floors from March 2025

- Chiranjeevi joins Prime Minister Narendra Modi for Pongal celebrations in Delhi; see PICS

- When To Expect Blue Lock Chapter 287 Spoilers & Manga Leaks

- What Is Dunkin Donuts Halloween Munchkins Bucket?

2024-11-14 19:34