As a seasoned crypto investor with a few battle scars from past market cycles etched onto my digital wallet, I can’t help but feel a mix of apprehension and anticipation upon seeing the latest data on long-term Bitcoin holders selling off their coins. The trend we’ve seen this year is reminiscent of 2017 and 2021, with the LTH Net Position Change dipping into negative territory, implying a net amount of supply leaving the cohort.

Data from the blockchain indicates that long-term Bitcoin owners are offloading their assets. The question now arises as to whether this current wave of selling could potentially reach a peak in pricing, or if it may continue further.

Bitcoin Long-Term Holders Have Been Selling Big Recently

In a recent update on platform X, analyst Ali Martinez has shared insights on the pattern seen over time in the ownership of Bitcoin by long-term investors compared to its peak. By “long-term holders” (LTHs), he’s referring to individuals who have kept their Bitcoin for longer than 155 days.

Long-term holders (LTHs) constitute one of the primary categories in the Bitcoin market, categorized by the length of time assets are held, while the short-term holders (STHs) make up the other group, as they typically sell or trade their Bitcoin more frequently.

Historically, it’s been observed that the latter group tends to consist of investors with less firm convictions in the market, often quick to sell during price fluctuations. Conversely, the former group is composed of long-term holders, who generally remain unfazed by market rallies and crashes.

Tracking the actions of long-term holders (LTHs) can be helpful since significant sales from them are relatively uncommon. One method for monitoring LTH behavior is by focusing on their Net Position Change.

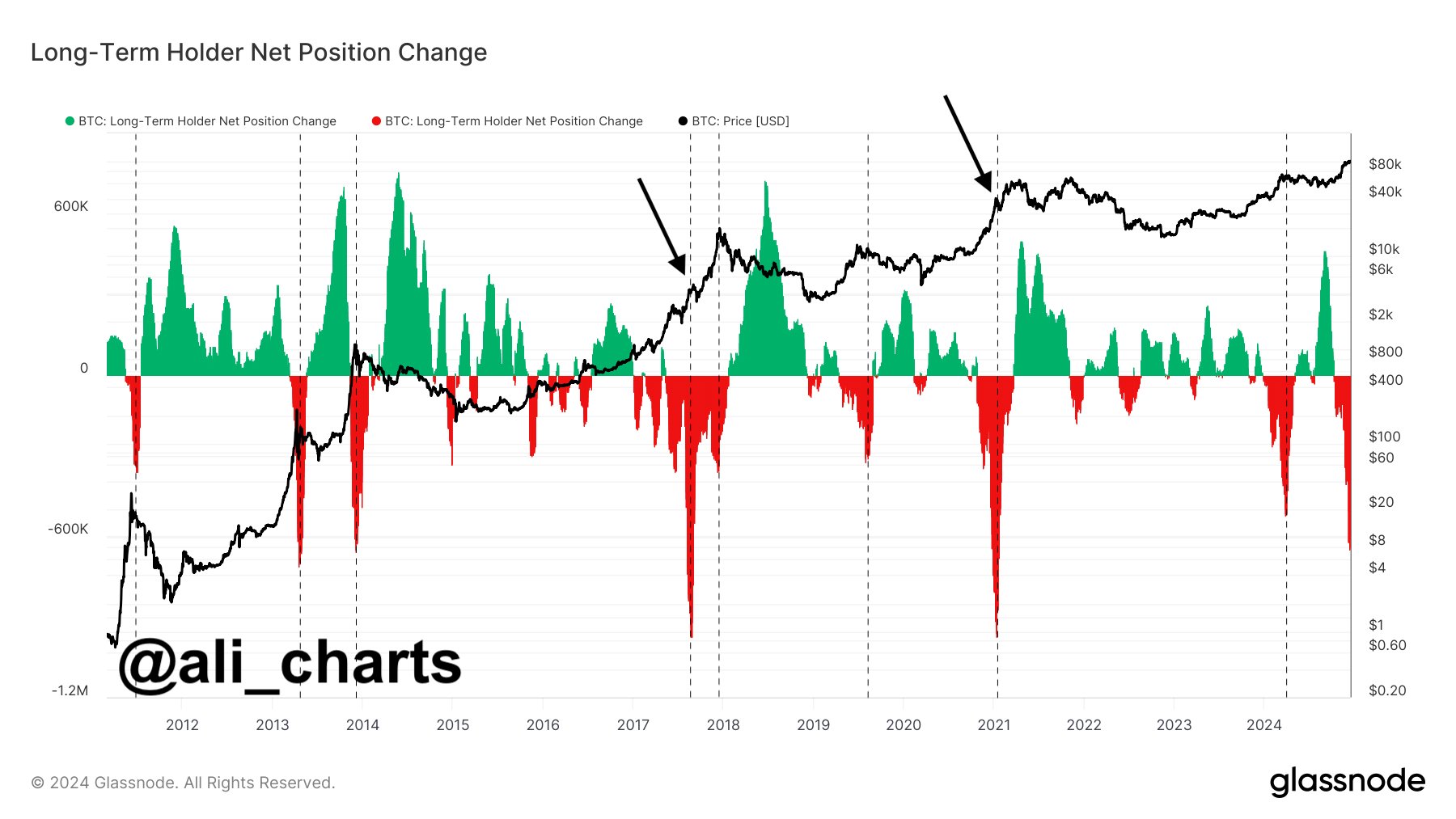

The Net Position Change is an on-chain metric that measures the total amount of Bitcoin entering into or exiting out of the LTH cohort. Below is the chart for the indicator shared by the analyst that shows the trend in its value over the history of the cryptocurrency.

According to the graph, the Bitcoin Long-Term Holder Net Position Change has seen a significant drop into negative figures over the past few weeks. This suggests that more Bitcoins are being moved out from this group rather than being accumulated.

As an analyst, I’ve noticed before in this year that the indicator has displayed a similar pattern, specifically during the first quarter. In fact, I’ve pointed out these instances on the chart, including the one you’re currently observing.

It’s interesting to note that the largest sales by Long-Term Holders (LTHs) often align with a peak or top in the cryptocurrency market. For instance, as observed in 2017 and 2021, their most significant sell-offs took place just before the subsequent price surge.

If the ongoing bull market for Bitcoin resembles past ones, then the recent selling by long-term holders might just be the beginning of a strong upward trend that could eventually reach the peak of this cycle.

As an analyst, I’m observing that the current state of the indicator is less negative compared to the significant red spikes during the 2017 and 2021 bull markets. This suggests there might be more room for growth before we reach the peak again. However, it’s crucial to note that history may not necessarily repeat itself this time; only time will tell if the same pattern unfolds or if we’re in for a different scenario.

BTC Price

Bitcoin has recently reached a new peak, surpassing the $107,000 mark, indicating that it’s once again breaking its all-time high (ATH) records.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-12-17 13:16