As a seasoned researcher with years of experience in the cryptocurrency market, I find myself intrigued by the recent trends in Bitcoin‘s Average Coin Age. The fact that the 365-day MA has been on an uptrend since the end of the 2022 bear market suggests a growing resolve among holders. This could indeed be a bullish sign for the asset’s price, as statistically, longer holding periods tend to decrease the likelihood of selling.

A researcher has detailed that the typical Bitcoin token’s age has been steadily increasing during the current market surge, a factor that might indicate a positive trend for the asset’s value.

Bitcoin Average Coin Age Has Been Trending Up Recently

In a fresh article on X, writer Axel Adler Jr from CryptoQuant discusses the current development in the Average Duration of Bitcoin Coins being held idle. The “Average Duration” is a metric that tracks the length of time the average Bitcoin token remains inactive.

A coin is considered idle when it remains stationary within an address without participating in any form of transactional action. As time passes and the coin continues to remain in this state, it can be thought of as growing older or becoming more mature.

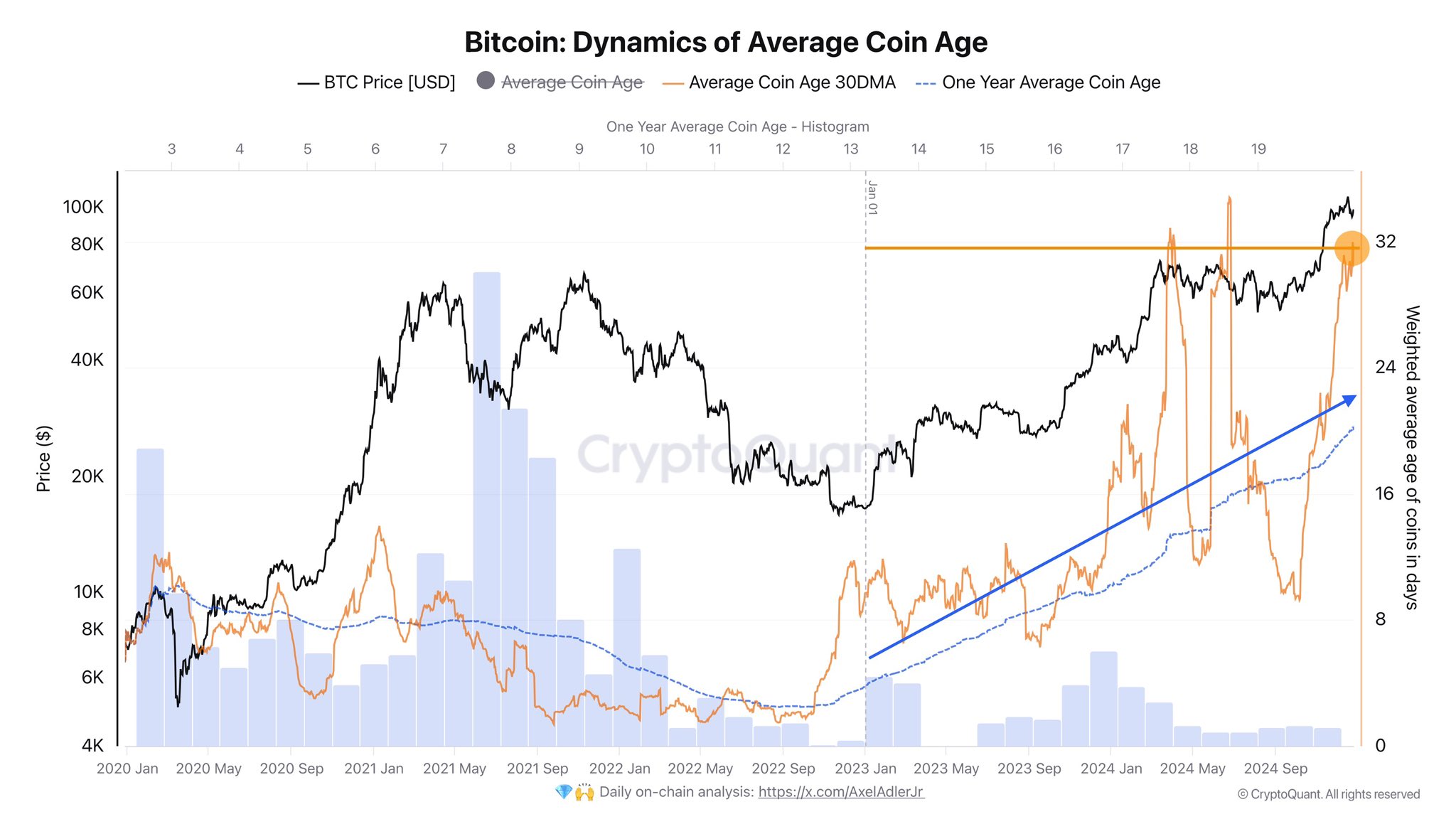

Let me share with you a graph provided by our analyst. It illustrates the pattern of the 30-day and yearly moving averages for the average age of Bitcoins over the past couple of years.

It’s apparent from the graph that the 30-day Moving Average for Bitcoin Average Coin Age has experienced notable peaks this year, along with significant drops. This indicates that investors have been both holding onto their Bitcoins during certain periods (HODLing), but also cashing out some of their gains.

Overall, despite some challenges, these holders have demonstrated significant determination, with the 365-day moving average of the indicator maintaining an uninterrupted upward trajectory since the conclusion of the 2022 bear market.

Over time, it’s statistically more unlikely for investors to offload their cryptocurrencies once they’ve held onto them longer, suggesting that extended periods of inactivity could potentially indicate a positive outlook for the currency’s value.

It’s worth noting that despite an upward trend in the 30-day moving average of Average Coin Age during the 2021 bull market, the opposite was true for its 365-day moving average, which consistently declined throughout the year. This might suggest that investors have grown more astute in their investment strategies during this cycle.

For a while now, the 30-day Moving Average (MA) of the indicator is quickly rising. This suggests that the Bitcoin market is presently experiencing an active accumulation phase.

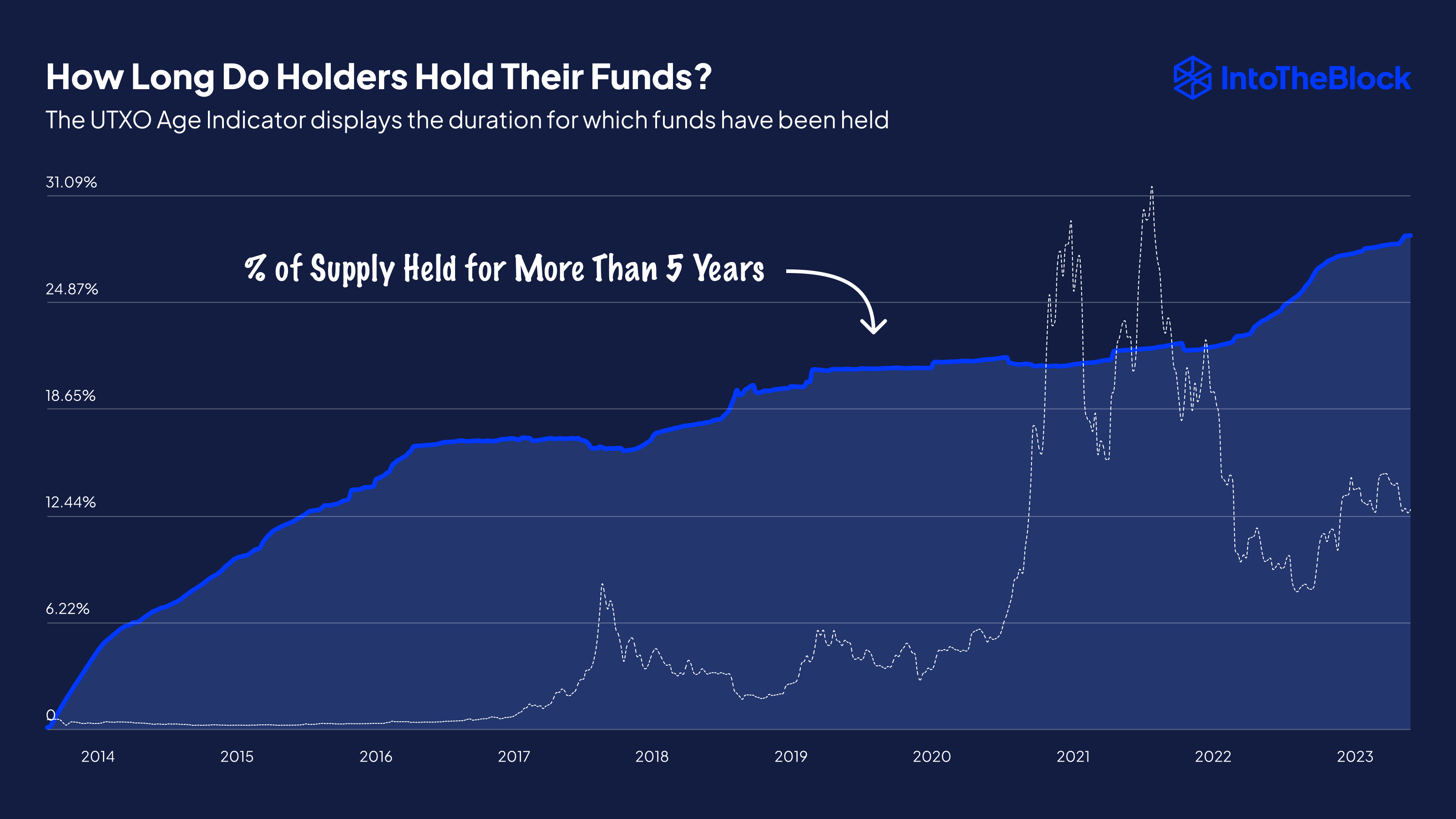

Meanwhile, let’s take a look at the latest insights from IntoTheBlock regarding the current state of Bitcoin supply that is over five years old.

As an analyst, I’ve noticed an interesting trend in the chart: the portion of Bitcoins in circulation that hasn’t been transacted recently has been increasing significantly. To be precise, after the latest surge, approximately one-third of these tokens have not been used for more than five years.

BTC Price

Bitcoin has seen a 3% drawdown during the last 24 hours that has taken its price to $95,900.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Gold Rate Forecast

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Overwatch 2 Season 17 start date and time

2024-12-27 04:16