As a seasoned analyst with over two decades of experience in financial markets, I find the analysis presented by Ali Martinez on Bitcoin‘s potential price top based on the Mayer Multiple to be intriguing. Given my background, I’ve seen numerous market cycles and have learned that historical patterns can provide valuable insights into future movements.

According to an expert’s analysis, Bitcoin might reach values even higher than $168,500 according to the historical pattern of this specific indicator.

Bitcoin Mayer Multiple Could Reveal Location Of Next Price Top

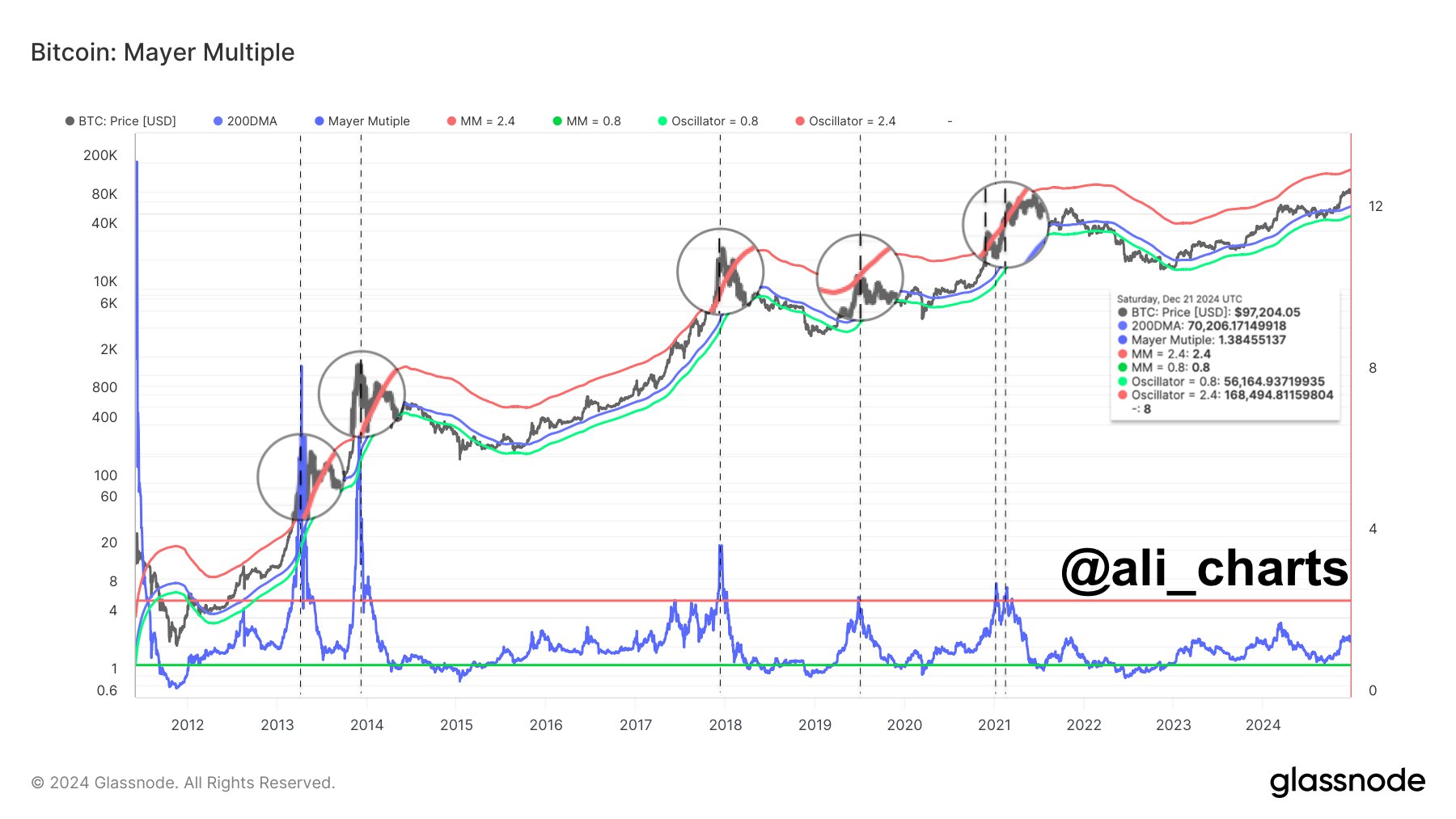

As a researcher delving into cryptocurrency analysis, I recently found myself exploring potential Bitcoin (BTC) price tops based on the Mayer Multiple. This analytical tool is designed to monitor the relationship between the BTC price and its 200-day moving average (MA). In a fresh post on X, analyst Ali Martinez shared his insights about where this ratio might point us.

Historically, the 200-day Moving Average (MA) has played a notable role in Bitcoin’s (BTC) price movements, acting as a dividing line between bearish and bullish phases. By monitoring how far the price deviates from this MA, as the Mayer Multiple does, can provide valuable insights.

If the Mayer Multiple indicates a higher value, it suggests that the asset’s price is substantially above its 200-day moving average, potentially indicating overbought conditions. Conversely, a lower value might hint at an upcoming bullish reversal for Bitcoin.

Currently, I’d like to present a graph provided by Martinez, which illustrates the pattern in the Bitcoin Mayer Multiple depicted as an oscillator throughout the history of this digital currency.

From the graph we can see, the Bitcoin Mayer Multiple is presently nearly at the point that historically indicates potential overvaluation of the coin’s price.

The level under discussion lies at 2.4 on the scale. When this value is reached by the metric, the asset’s price equals 2.4 times its 200-day moving average. On the same graph, a line indicating this specific level can also be seen.

It seems clear that significant peaks in Bitcoin’s history have occurred when it surpassed a specific line. As of now, during this current cycle, Bitcoin has not managed to return to that level again.

The Mayer Multiple might not reach that point quickly, as it will only become 2.4 when the cryptocurrency’s price approximately reaches $168,500.

During this recent cycle, BTC encountered a significant level of importance related to the Mayer Multiple, specifically the 0.8 mark. Just as the 2.4 level often signals potential market overheating, hitting the 0.8 line could indicate that the coin might be approaching a price bottom.

Bitcoin experienced a recovery at an important level earlier in the year, indicating that the shift to a bear market may not have occurred yet. It’s uncertain whether the value of the asset will attempt to reach its previous high or if it might first drop back down to these current lows.

BTC Price

On Friday, Bitcoin appeared to be nearing the $92,000 mark, but it appears that the asset has experienced a rebound since then, now standing at around $96,000 as we begin the fresh week.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Gold Rate Forecast

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- CNY RUB PREDICTION

- Criminal Justice Season 4 Episode 8 Release Date, Time, Where to Watch

- Delta Force Redeem Codes (January 2025)

2024-12-23 23:10