As an experienced analyst, I find Willy Woo’s analysis of Bitcoin’s VWAP oscillator intriguing and potentially bullish. The bullish divergence between the cryptocurrency’s price trend and the VWAP oscillator has historically been a strong indicator of upcoming price increases for Bitcoin. While it’s important to note that this trend does not guarantee a continuation of the uptrend, it is certainly worth keeping an eye on as a potential bullish sign.

An analyst has shared their perspective that Bitcoin appears primed for significant growth according to the pattern indicated by this trend.

Bitcoin VWAP Oscillator Has Been Showing A Bullish Divergence

According to analyst Willy Woo’s latest analysis on X, there are signs of a potential price rally for the cryptocurrency based on a developing bullish divergence in its Volume-Weighted Average Price (VWAP) oscillator.

As a researcher studying financial markets, I would explain the Volume-Weighted Average Price (VWAP) as follows: The VWAP is a valuable tool for determining an asset’s average price while considering both price and trading volume. In simpler terms, it represents the price at which a given asset has been traded on average during a specific time period. To calculate this indicator, we sum up the prices of all trades multiplied by their respective volumes, then divide the total by the cumulative volume.

This measurement gives greater importance to the price at which larger trading volumes occur. In contrast to exchange reports, the complete transaction history of a cryptocurrency like Bitcoin can be accessed publicly through blockchain data. Instead of using reported volume, Woo employs on-chain volume to determine the Volume-Weighted Average Price (VWAP) for Bitcoin.

The VWAP oscillator, the actual indicator of interest here, is a ratio between the asset’s spot price and VWAP. Here is the chart shared by the analyst that shows the trend in this metric over the past couple of years:

I’ve noticed that the Bitcoin VWAP oscillator has been trending negative on my chart for over a month now. However, more recently, there seems to be a shift as this indicator has started turning around.

Despite the metric’s upward trend, it remains well within the red zone’s boundaries. Simultaneously, the cryptocurrency’s price has been on a downtrend.

Based on Woo’s analysis, a bullish divergence is emerging for the asset, and this trend has the potential to extend significantly since historical peaks in the coin have typically occurred when the oscillator approaches a reversal point within the positive region, which still appears to be quite distant.

“The analyst remarks that the current conditions appear favorable for Bitcoin to break through and achieve significant growth. However, it remains to be proven if the bullish trend will ultimately result in profitable gains for the cryptocurrency.”

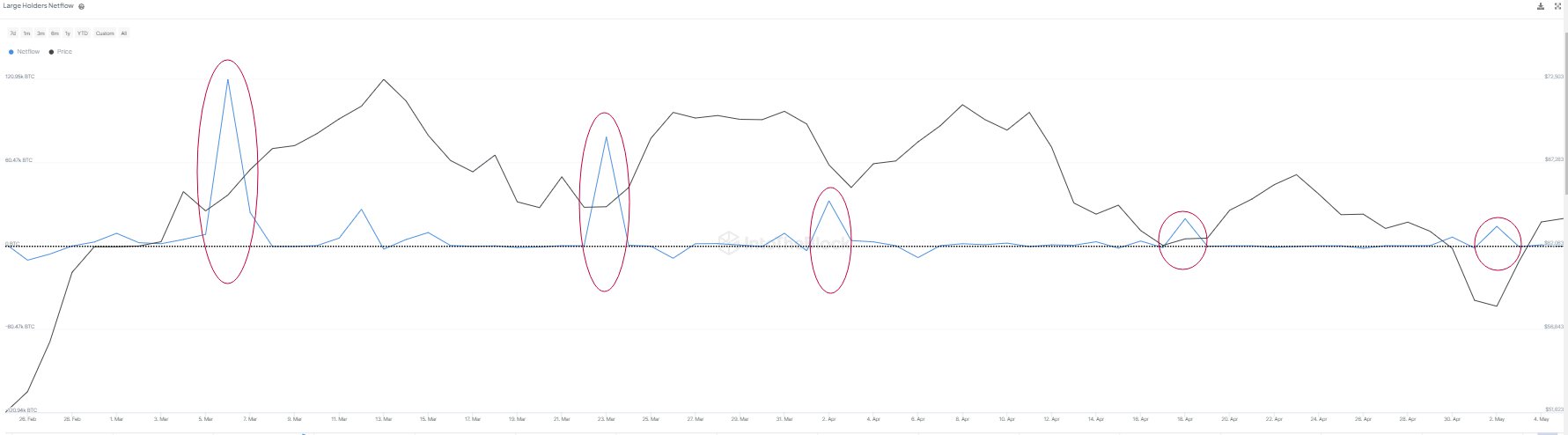

In other developments, large-scale Bitcoin investors, holding over 1,000 BTC each, have been active buyers around the recent price bottoms. However, data from market analysis firm IntoTheBlock indicates that these whales’ accumulation activities have shown a consistent decreasing trend.

Based on the graph, it’s clear that Bitcoin whales have been purchasing during the recent market dips over the past few months. However, the amount they’ve bought at each dip has progressively decreased.

The diminishing desire to purchase among these investors, though not entirely vanished, grows increasingly cautious with every market downturn.

BTC Price

When writing, Bitcoin is trading at around $63,500, up over 1% in the last seven days.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-05-07 05:10