As a seasoned researcher with over two decades of experience in finance and digital assets, I find Matthew Sigel’s prediction of Bitcoin reaching $180,000 in 2025 quite plausible, given his meticulous analysis of historical data and market patterns. However, it’s essential to remember that the crypto market is notorious for its volatility, so even if the pattern holds, we might see some overshooting or undershooting.

If certain crucial signs indicating the peak of Bitcoin’s cycle remain subdued, Bitcoin could potentially reach $180,000 by 2025, as suggested by Matthew Sigel, the Head of Digital Assets Research at VanEck. In a conversation with podcast host Natalie Brunell, Sigel highlighted a consistent four-year trend in Bitcoin’s price fluctuations that he believes has consistently held up across various market cycles.

Why $180,000 Per Bitcoin Seems Plausible

In simpler terms, Sigel pointed out that Bitcoin usually surpasses most other investment types during approximately three out of every four-year cycle following a process called “halving.” Afterward, there’s typically a significant drop in Bitcoin value, ranging from 60% to 80%, which usually occurs about two years after the Bitcoin halving event.

According to Sigel’s analysis, given that Bitcoin underwent its latest halving in April 2024, he anticipates both 2024 and 2025 as potentially robust years. He explained that “the traditionally weaker year typically follows the second one after the halving.” Therefore, he expects 2024 to be strong, while 2025 should also show strength. However, unless something significant changes, 2026 could possibly be a less favorable year for Bitcoin.

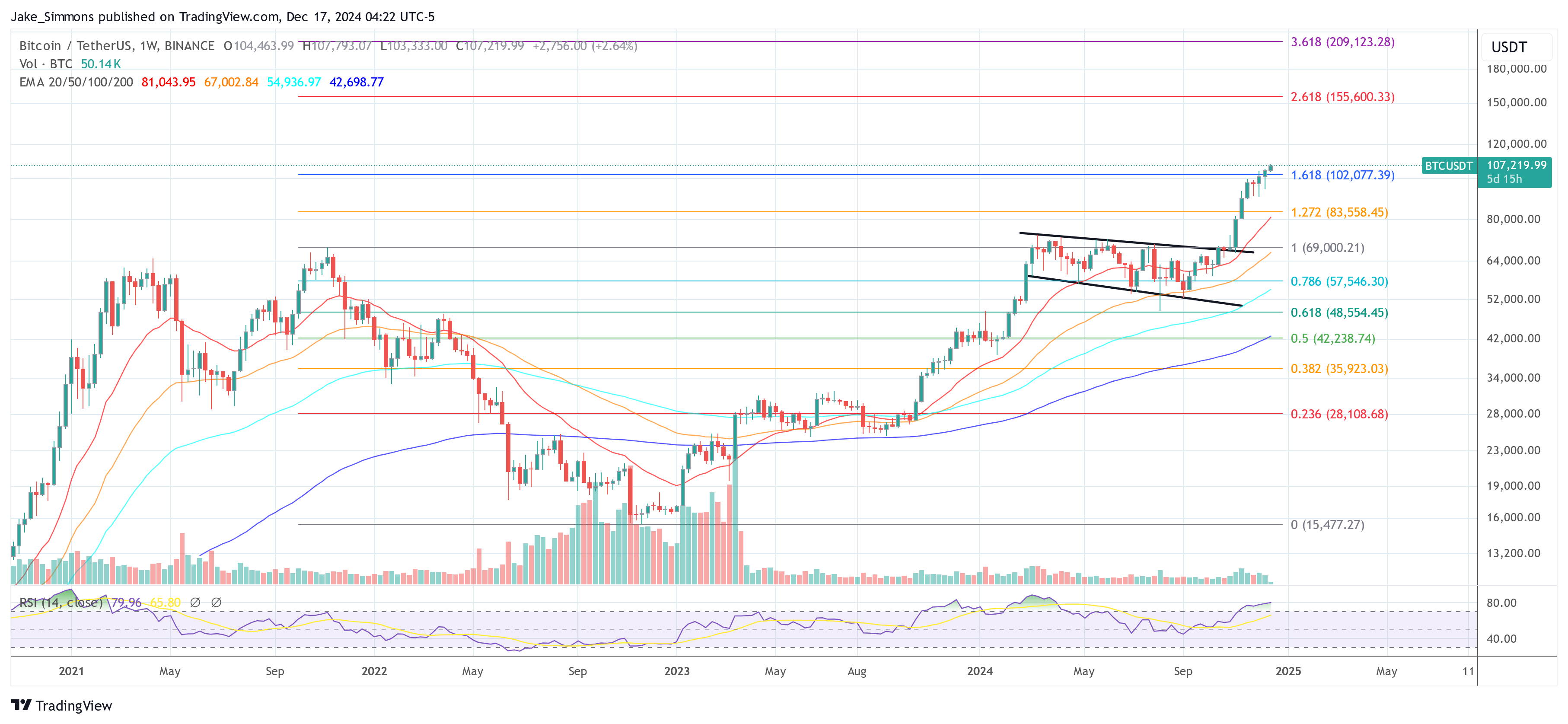

Referencing historical trends, Sigel noted the smallest increase from bottom to peak appreciation in Bitcoin’s past cycles, approximately 2000%. If this figure decreases to a 1000%, Bitcoin could potentially grow from its current trough of around $18,000 to a high of $180,000 in the present cycle. “I believe there is potential for it to reach $180,000 in this cycle, and I think this is quite probable within the next year,” Sigel concluded.

Additionally, he highlighted the fact that Bitcoin’s fluctuation could cause the price to exceed or fall short of the figure, but a valuation of $180,000 in 2024 is considered a feasible goal if the trend persists and no significant warning signs (or “red flags”) emerge.

Sigel outlines crucial warning signs for traders to focus on, with one significant indicator being derivative funding rates. If the yearly charge to maintain long Bitcoin positions in leveraged markets consistently surpasses 10% and remains so for more than a couple of months, Sigel views this as a potential concern or warning signal.

In simpler terms, Sigel cautioned that when the rate of return on Bitcoin investments surpasses 10% for over a couple of months, it’s often a warning sign. However, he pointed out that recent market activity has lowered these elevated rates, so they are no longer signaling danger at the moment.

The second point refers to the amount of potential profits that have not been realized on the blockchain, which can be examined through on-chain analysis. This analysis helps determine if market participants’ initial investment costs are so low that a large number of profit-takings could soon lead to increased selling pressure. Sigel pointed out that at this moment, we are not witnessing unusually high levels of unrealized profits.

Ultimately, he suggested that stories of widespread retail investment or gambling in the markets could serve as red flags. He clarified that if all these warning signs converged at a specific price level—for instance, if Bitcoin reached $150,000 and the data indicated a market peak—he would exercise caution. However, he added that if the price climbed to approximately $180,000 without those signals surfacing, there might still be potential for further growth.

If we manage to hit $180K without any warning signs (flashing lights), perhaps we can keep going. However, if all the warning signs are active and the price is only at $150K, Sigel believes it’s best not to delay.

Next BTC Cycle Predictions

Additionally, he examined Bitcoin’s future growth prospects over a longer period by drawing parallels with the market capitalization of gold. Since nearly half of all gold is utilized for industrial and ornamental purposes, it was suggested that the remaining half could be likened more directly to Bitcoin’s role as an investment and a means of storing value.

According to Sigel’s estimation, if Bitcoin’s market value ever matched just half of gold’s current market cap, its price might potentially increase towards around $450,000 per coin during the upcoming market cycle.

From a future-oriented viewpoint, he outlined VanEck’s strategic long-term plan suggesting that global central banks might someday incorporate Bitcoin into their reserve holdings, though possibly only at a 2% allocation. Given that gold makes up around 18% of the global central bank reserves, Sigel proposes that Bitcoin’s proportion would be significantly less in this scenario.

As a researcher, I too considered the possibility that Bitcoin could evolve into a global trade settlement currency, particularly within emerging economic blocs like BRICS (Brazil, Russia, India, China, and South Africa). If this happens, its value could skyrocket. In VanEck’s projections, this scenario might elevate the price of one Bitcoin to an astounding $3 million by 2050.

As a researcher exploring the potential future of Bitcoin, I posit that it may serve as a medium for international trade settlements, particularly among BRICS nations. If this trend continues, I project that the value of one Bitcoin could reach approximately three million dollars by the year 2050. This projection is based on an estimated compound annual growth rate of 16%.

At press time, BTC traded at $107,219.

Read More

- Connections Help, Hints & Clues for Today, March 1

- Shruti Haasan is off from Instagram for THIS reason; drops a comeback message on Twitter

- Shiba Inu Sees Bullish Reversal In On-Chain Metrics, Can SHIB Price Recover?

- The games you need to play to prepare for Elden Ring: Nightreign

- Sitara Ghattamaneni: The 12-Year-Old Fashionista Taking the Spotlight by Storm!

- The Babadook Theatrical Rerelease Date Set in New Trailer

- What Is Dunkin Donuts Halloween Munchkins Bucket?

- Pepe Battles Price Decline, But Analysts Signal A Potential Rally Ahead

- When To Expect Blue Lock Chapter 287 Spoilers & Manga Leaks

- BUZZ: Rajinikanth starrer Jailer 2 directed by Nelson Dilipkumar likely to go on floors from March 2025

2024-12-17 16:35