Experts in Bitcoin are abuzz following President-elect Donald Trump’s criticism of current Federal Reserve policies, labeling interest rates as excessively high even amid ongoing inflationary pressures. At a gathering at Mar-a-Lago, Trump stated that the situation he is inheriting from the previous administration is challenging and suggested that officials appear to be attempting everything they can to complicate matters for his incoming team.

Remarks made recently, just over a fortnight before Trump’s inauguration, have fueled expectations of potential changes in the U.S. monetary policy. This has also sparked discussions about the possible increase in value for Bitcoin and other high-risk investments as we move into the new year.

The 2017 Trump Playbook: Dollar “Too Strong”, Bitcoin Up?

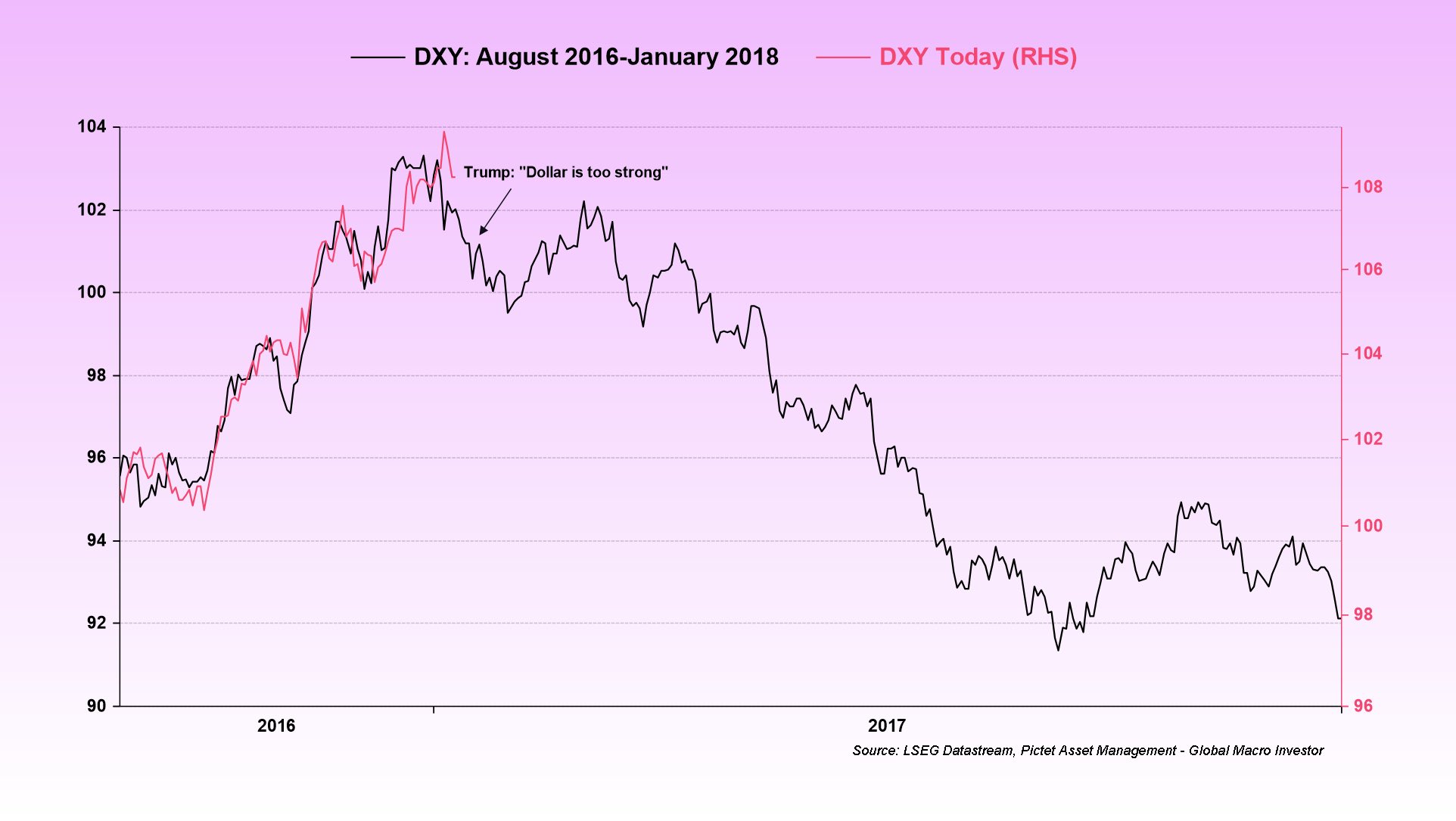

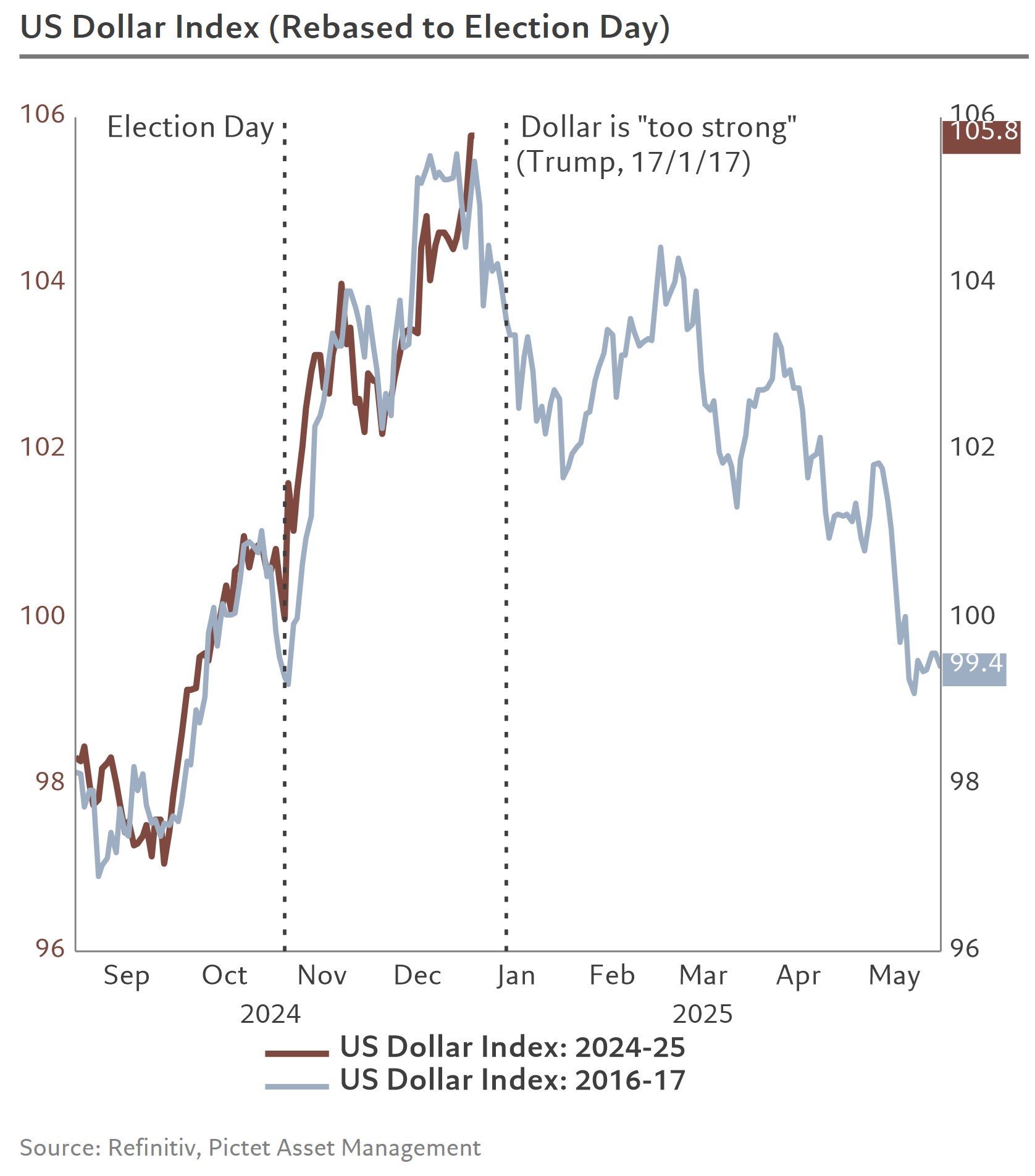

Despite significant shifts in the global economy and geopolitics since Trump’s initial term, certain financial analysts are drawing comparisons to his 2017 statements. Back then, he criticized the US dollar as being “too strong,” which came before a substantial drop in its value. The U.S. Dollar Index (DXY), peaked close to 104 in early January 2017, but it started falling and continued until early 2018, reaching a low of approximately 98.

The significant increase in the value of the dollar occurred concurrently with a general rise in risk-taking attitude, sparking surges in stock markets as well as those for Bitcoin and cryptocurrencies. Notably, Julien Bittel, Chief Macro Strategist at Global Macro Investor (GMI), made an explicit link to aspect X.

Previously, when Trump commented that something was too high, it was the U.S. dollar – this remark was made in January 2017, only a few days before his inauguration. Here’s what he stated: “Our businesses struggle to compete because our currency is too strong. And it’s hurting us.

Significantly, during the previous year, Trump also referred to recent strength as a “heavy burden for U.S. businesses.” Bittel also pointed out that Trump recognizes the effects of a strong dollar, and this reasoning can be applied to high-interest rates as well. They tend to diminish exports, weaken corporate profits, and decelerate economic development.

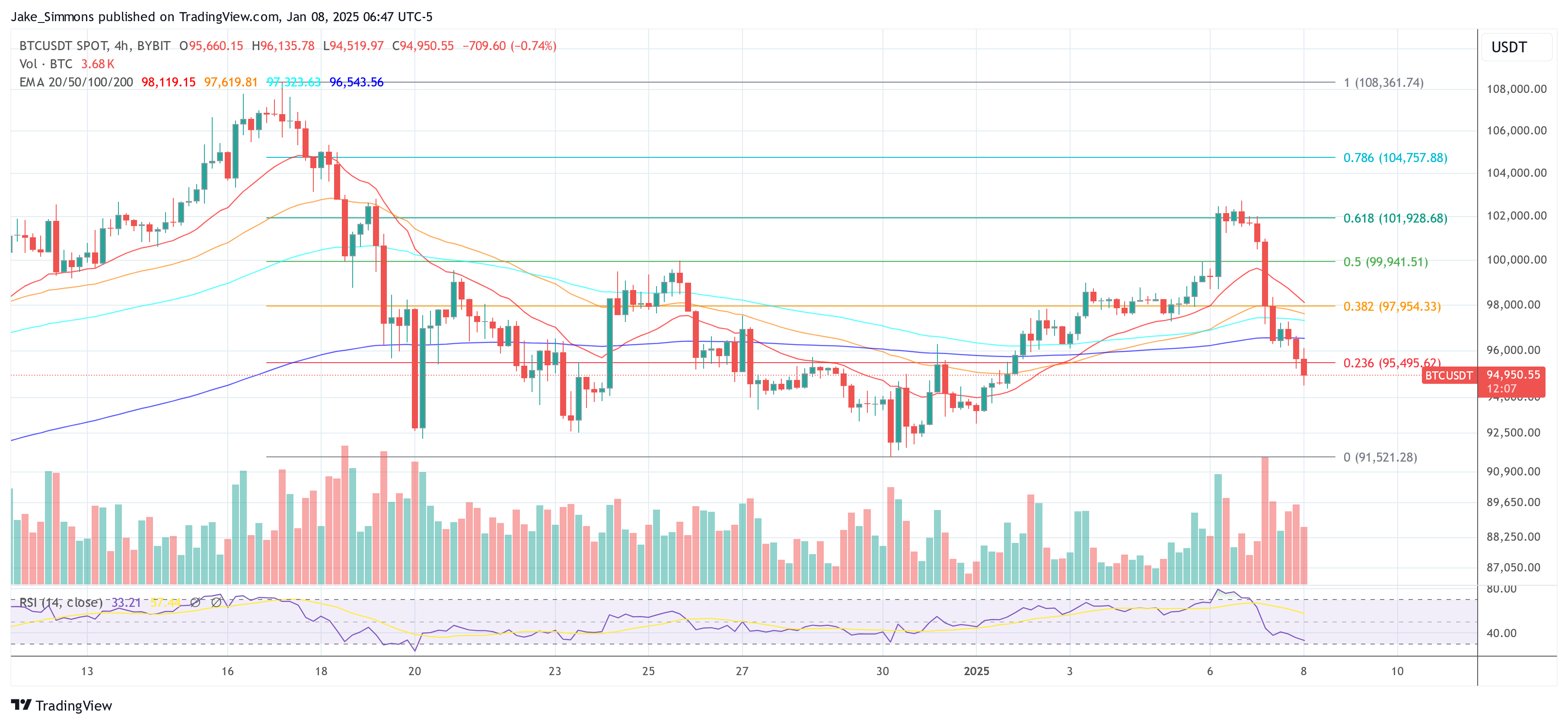

In relation to Bitcoin and the larger cryptocurrency market, Bittel observed: “Following this, the U.S. dollar started a substantial drop, which could lead to one of the key macro shifts in recent years – causing a surge in risky investments. Does this situation seem familiar? I believe it does. Let’s watch and see how things unfold.

Bittel isn’t alone in thinking that the DXY might have reached its highest point, resembling its peak pattern from 2017. Steve Donzé, Deputy Chief Investment Officer for Multi Asset at Pictet Asset Management Japan, posted a popular chart on platform X, commenting “On schedule. Ready for resistance,” while aligning recent DXY fluctuations with the currency’s path in early 2017. This diagram indicates a comparable trend that may signal potential dollar vulnerability in the upcoming weeks.

In another post, financial analyst Silver Surfer (@SilverSurfer_23) highlighted an intriguing coincidence: “The peak of the DXY occurred on January 3rd, 2017, which was just 18 days prior to Trump’s Inauguration. Remarkably, it seems that the DXY may have peaked again on January 2nd, 2025, a mere 19 days before Trump’s second Inauguration.” He described this pattern as “history repeating itself in an almost unbelievable way,” suggesting he perceives a connection between the trajectory of the DXY before both inaugurations.

Comparisons are sparking debate that another drop in the US dollar might create conditions beneficial for risky investments. If the dollar does indeed start to decline again, similar to what happened from 2017 to 2018, Bitcoin could benefit from a surge of fresh liquidity and renewed interest in speculative investing.

At press time, BTC traded at $94,950.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- How to Update PUBG Mobile on Android, iOS and PC

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

2025-01-09 01:34