As a seasoned crypto investor with over two decades of experience in traditional finance, I find myself increasingly fascinated by the meteoric rise and potential of Bitcoin. The recent bullish sentiment surrounding this revolutionary digital asset has been further fueled by President Trump’s vocal support for crypto.

As a researcher, I find myself intrigued by the current bullish trend in Bitcoin‘s short-term price action, which seems to be bolstered by U.S. President Donald Trump’s vocal endorsement of cryptocurrencies. This leads me to contemplate an interesting question: What could be the potential trajectory of Bitcoin over the next five to ten years?

According to Mike Novogratz from Galaxy Digital, if we consider gold as a reference point, Bitcoin’s value could potentially reach $800,000 within the next five to ten years.

In a conversation on Bloomberg Television, Novogratz shares his optimistic view about the leading cryptocurrency with other analysts. He further predicts that Bitcoin’s price could reach as high as $800,000 within the next five to ten years, roughly equivalent to gold’s current market value of $16 trillion.

Bitcoin To Match Gold’s Market Cap: Analysts

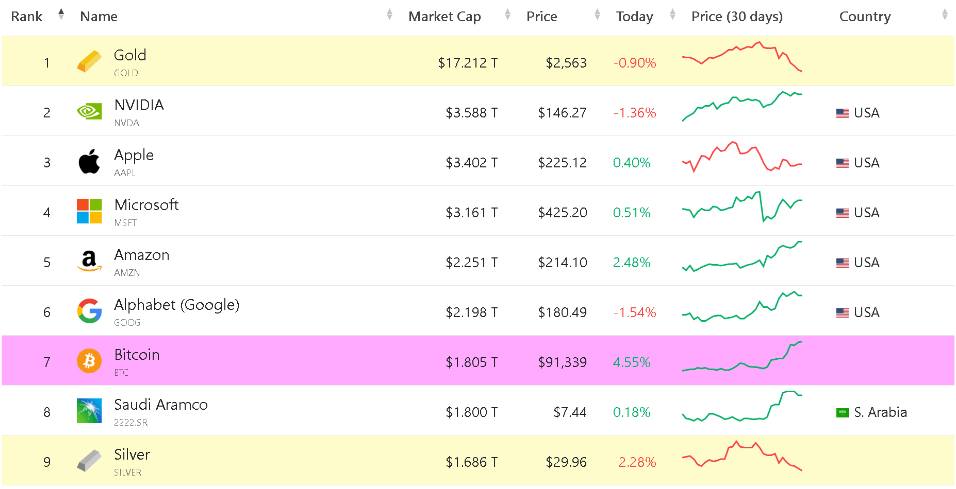

Trump’s victory may have contributed significantly to the recent fluctuations in Bitcoin’s value. Just a few days ago, Bitcoin surpassed silver in terms of market capitalization. Today, it outranks Saudi Aramco, with an estimated worth of $1.79 trillion. The escalating growth of digital assets has sparked debate about whether they can rival gold’s market cap.

As per Novogratz’s perspective, the change in market preferences among contemporary consumers and traders is bolstering Bitcoin. He emphasized that modern-day investors are drawn to Bitcoin, viewing it as a digital form of value storage.

From my perspective as an analyst, I find it intriguing to note that several market experts and influential figures, such as Novogratz, aren’t alone in viewing gold as a benchmark for Bitcoin. For instance, Howard Lutnick and Anthony Scaramucci have also drawn parallels between these two assets. Remarkably, they predict that Bitcoin will surpass gold’s market capitalization in the near future.

Bitcoin To Trade In $500k Level If It Becomes Part Of US Reserve

As a crypto investor, I too am captivated by Michael Novogratz’s vision that Bitcoin could soar to an astounding $500k if the US government decides to adopt it within their Treasury. His assertion is rooted in the existing bullish market trends and the possibility of favorable policies for cryptocurrency emerging.

Novogratz stated that should the U.S. choose to purchase approximately 1 million Bitcoins, it could spark other governments to follow suit, thereby increasing overall demand. Furthermore, President Trump’s endorsement of Bitcoin and cryptocurrencies is contributing significantly to their upward price trend.

Novogratz Not Confident On Government’s Decision To Add BTC As Reserve Asset

Mike Novogratz believes the U.S. Treasury is unlikely to acquire the asset he’s targeting at $500k due to potential challenges in getting it approved by the Senate, even though the House has given its support for it.

Tyler Novogratz continues to be optimistic about Bitcoin and encourages the U.S. government to invest more in it and strengthen its efforts to champion digital currencies. He also stated that there’s no need for the government to back the US dollar with other assets. In the same Bloomberg interview, he disclosed that he personally has significant investments in Bitcoin and would welcome the passage of the reserve bill.

Read More

- Brody Jenner Denies Getting Money From Kardashian Family

- Bitcoin Price Climbs Back to $100K: Is This Just the Beginning?

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- Superman’s James Gunn Confirms Batman’s Debut DCU Project

- All Elemental Progenitors in Warframe

- General Hospital: Lucky Actor Discloses Reasons for his Exit

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

- Move Over Sydney Sweeney: Ozzy Osbourne’s DNA Is in Limited-Edition Iced Tea Cans

- Anupama Parameswaran breaks silence on 4-year hiatus from Malayalam cinema: ‘People have trolled me saying that I can’t act’

- Anna Camp Defends Her & GF Jade Whipkey’s 18-Year-Old Age Difference

2024-11-16 19:20