As a seasoned crypto investor with a decade of experience navigating the volatile waters of this digital frontier, I find myself intrigued by the predictions put forth by analyst Timothy Peterson and others regarding Bitcoin’s potential surge to $100,000 within the next 90 days.

In simpler terms, the price trend of Bitcoin might reach a staggering $100,000 over the next three months, irrespective of who wins the upcoming U.S. Presidential election.

Bitcoin At $100,000 By February 2025?

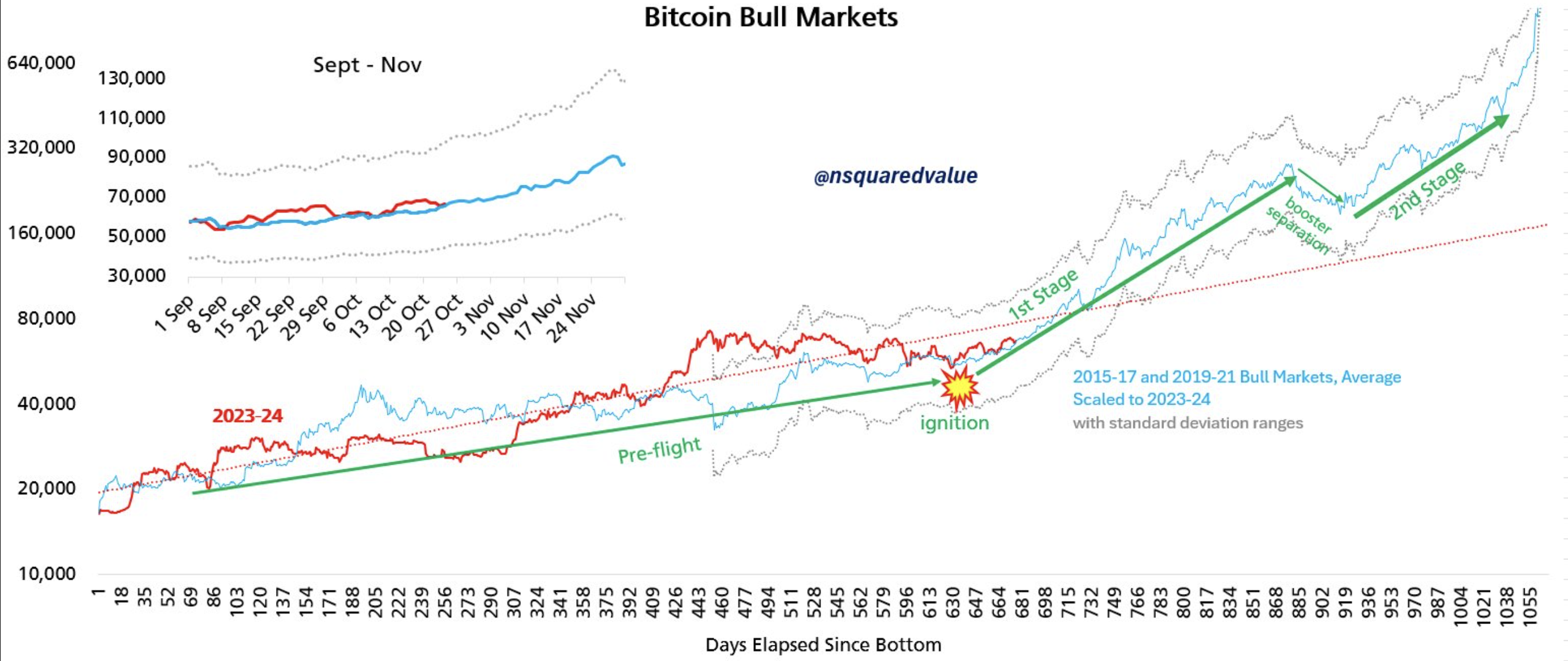

As an analyst, I’m expressing my perspective that the recent price fluctuations in Bitcoin (BTC) aren’t significantly divergent from past patterns, which prompts me to ponder the validity of the “diminishing marginal returns” hypothesis.

For an investor, the concept of diminishing marginal returns in relation to Bitcoin suggests that with each halving event, the subsequent price increases become progressively smaller. This is due to the fact that as the digital currency’s total market cap matures, its supply shocks have less effect on boosting demand.

It seems that this implies BTC’s growth might persist, but the exceptional gains witnessed during its initial phases could potentially lessen as time goes on. Yet, Peterson’s perspective seems to contradict this notion.

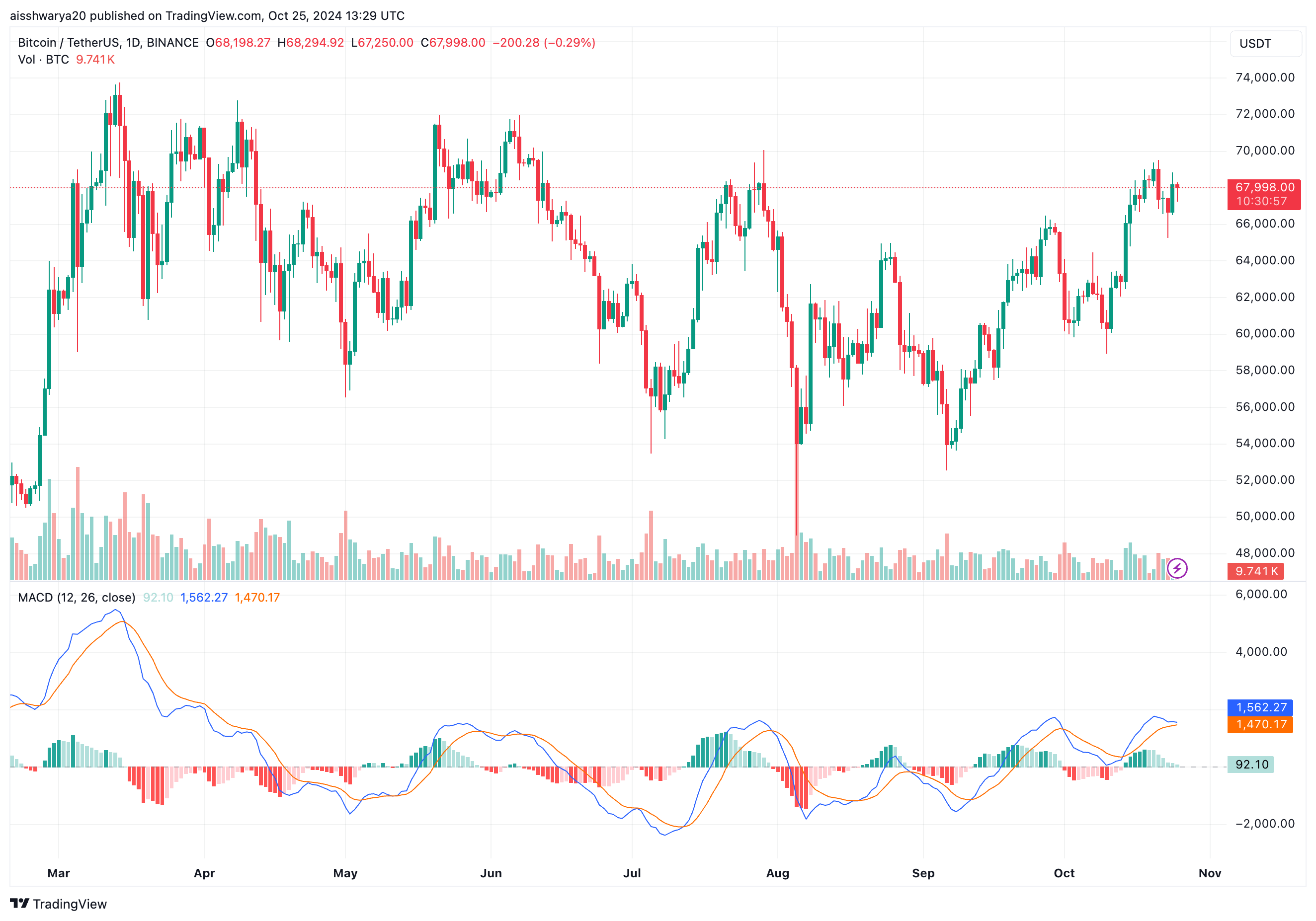

In March 2024, Bitcoin (BTC) hit an all-time high (ATH) of $73,737. Since then, over the past eight months, BTC has been in a holding pattern, fluctuating significantly within a broad price range that dipped down to $54,000. At this moment, Bitcoin is being traded at $67,998, which represents approximately a 10% decrease from its all-time high.

According to Peterson’s analysis, if Bitcoin surpasses its current red trendline in the next 90 days, it could potentially reach $100,000. He further stated that this prediction is entirely reasonable.

A conservative scenario puts bitcoin at $100k around February. I think this happens regardless of the US election outcome.

Additionally, the analyst believes, based on various metrics he tracks, that Bitcoin’s current market value does not indicate it is overpriced. He finds it progressively less likely that the price will dip below $60,000.

Focus On BTC Year-End Price Predictions

According to Peterson, Bitcoin could reach around $100,000 within the next three months; however, other experts and professionals in the field hold diverse opinions about its potential future value.

As a cryptocurrency investor, I’m eagerly anticipating that Bitcoin (BTC) could smash through its old All-Time High (ATH) before the end of November, regardless of who takes office as the next U.S. President.

In the latest report for one of their clients, Bitwise’s Chief Investment Officer, Matt Hougan, highlighted a number of potential reasons that could lead Bitcoin’s price to reach $80,000 by the end of 2024.

Among these elements are the possibility of Donald Trump winning as the Republican nominee, potential reductions in interest rates by the U.S. Federal Reserve (Fed), and an extended stretch with no significant negative events occurring within the cryptocurrency market.

Additionally, the enthusiasm for a fourth-quarter Bitcoin (BTC) surge is further supported by an increase in consumer interest and appetite for the leading digital currency.

According to a recent study by CryptoQuant, there’s been an increase in smaller Bitcoin transactions, suggesting a resurgence of retail interest as the market shifts towards riskier investments. Currently, Bitcoin is trading at approximately $67,998 on the daily chart and has risen by 1.1% over the past day.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- CNY RUB PREDICTION

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Overwatch 2 Season 17 start date and time

2024-10-26 10:16