In a rather delightful turn of events, a certain CryptoQuant Quicktake has emerged from the ether, suggesting that our dear Bitcoin (BTC) might still be lurking in the shadows of undervaluation. The ever-astute analyst, BorisVest, has taken it upon himself to enlighten us with a plethora of on-chain metrics that, if one squints just right, might indicate a bullish sentiment still frolicking about for our leading cryptocurrency. 🧐

On-Chain Metrics Suggest Bitcoin Still Undervalued

Now, BorisVest, in his infinite wisdom, has pointed out two rather intriguing on-chain metrics that imply BTC’s current price could be playing a game of hide-and-seek with its fair value. First on the list is the rather alarming decline in Bitcoin’s exchange reserves. One might say it’s akin to watching a magician pull a rabbit out of a hat, only to find the hat is now empty! 🎩🐇

Recent data reveals that BTC exchange reserves – the amount of Bitcoin available for our trading pleasure – are currently lounging around 2.43 million BTC, a sharp drop from the 3.40 million BTC that graced exchanges during the 2021 bull run. BorisVest, ever the optimist, remarked:

“The Bitcoin exchange reserve data shows that Bitcoin is being withdrawn from exchanges after seven years. The fact that Bitcoin is not readily available for sale suggests it is being held for the long term. A decrease in Bitcoin supply supports a potential price increase.”

To elucidate further, a decline in BTC exchange reserves means fewer coins are available for sale on centralized exchanges. This suggests that investors are holding onto their precious coins rather than selling – a rather bullish signal, if I may say so, as supply tightens while demand may rise like a soufflé in a hot oven! 🍰

Moreover, BorisVest has also pointed to the Bitcoin Stablecoin Supply Ratio (SSR), which currently stands at a rather respectable 14.3. This suggests that even if BTC were to take a tumble, there’s enough purchasing power among potential investors to prevent a major price decline. Quite the safety net, wouldn’t you agree? 🛡️

He further explained that the SSR increases as the BTC price rises, indicating reduced purchasing power, which may signal that BTC is overvalued at current market prices. The following chart shows that the SSR has not yet reached its 2021 levels – around 34 – hinting that BTC may indeed be undervalued at its current price. A classic case of “the grass is always greener,” if you will! 🌱

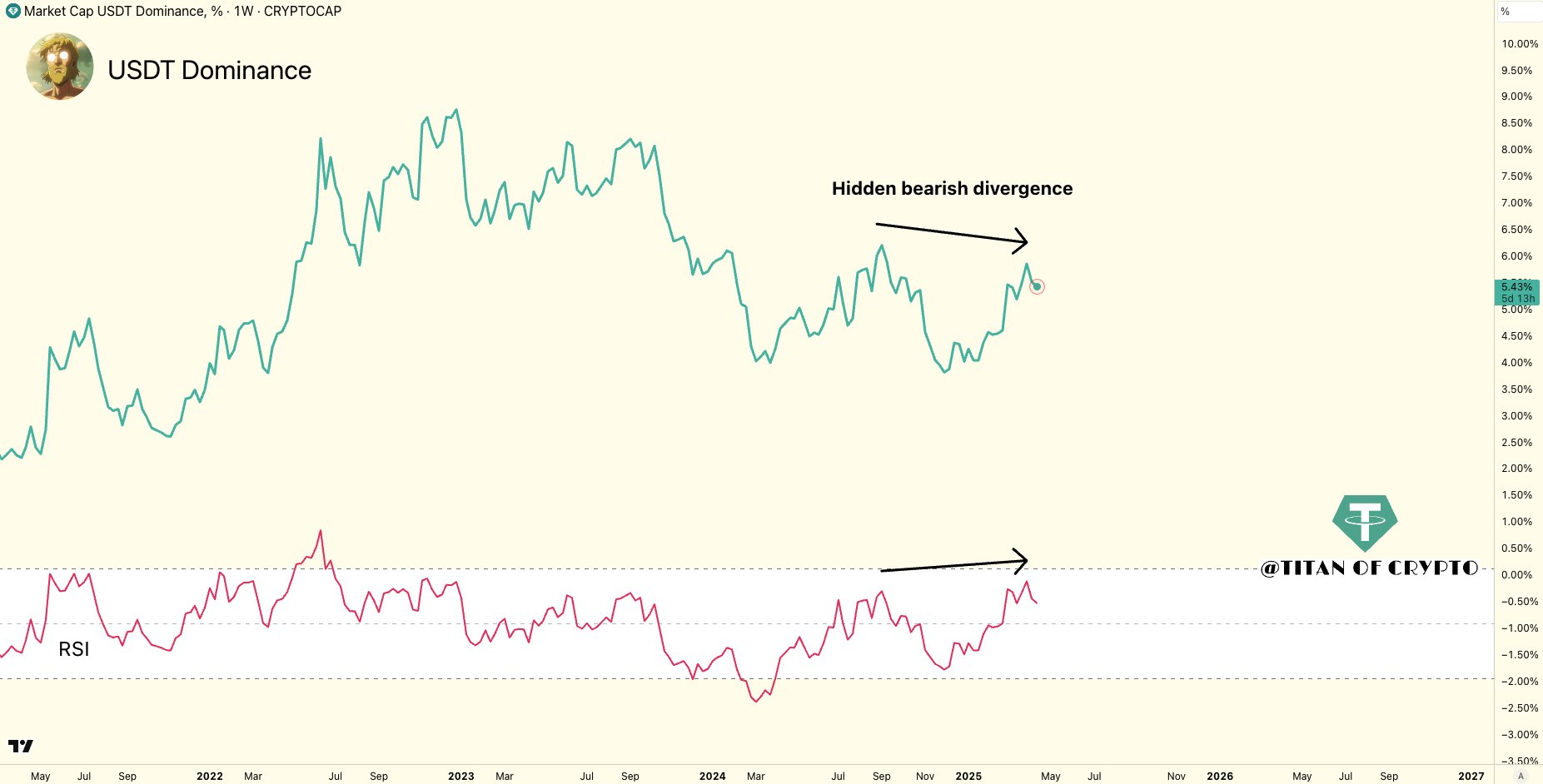

USDT Dominance Shows Bearish Divergence

Meanwhile, our dear friend Titan of Crypto has shared a rather fascinating observation regarding the declining USDT dominance on the weekly timeframe. It appears that a hidden bearish divergence may be forming, which could indicate an early signal of risk-on sentiment returning to the market. How thrilling! 🎢

A bearish divergence on the USDT dominance chart suggests that investors are becoming less defensive, possibly rotating out of stablecoins and back into risk-on assets like BTC and altcoins. It often signals improving market sentiment and a potential bullish phase for crypto. A veritable rollercoaster of emotions! 🎠

Meanwhile, the Bitcoin weekly Relative Strength Index (RSI) has recently broken its prolonged downtrend, igniting hopes for a potential price recovery, with some analysts daring to dream of prices beyond $100,000. Quite the ambitious target, wouldn’t you say? 🚀

Additionally, exchange net flow data suggests that a BTC rally may be closer than most investors anticipate. At press time, BTC is trading at $85,550, up 0.5% in the last 24 hours. A delightful little uptick, indeed! 📈

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Like RRR, Animal and more, is Prabhas’ The Raja Saab also getting 3-hour runtime?

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2025-04-16 07:41