As a seasoned researcher with over a decade of experience in the crypto market, I have witnessed the rollercoaster ride that Bitcoin has been on since its inception. Over the years, I have learned to read between the lines of complex on-chain data and make informed predictions about price movements.

In the case of the latest on-chain signals regarding Bitcoin, I find myself cautiously optimistic. The spike in the taker buy/sell ratio on OKX exchange, as observed by analyst Ali Martinez, suggests a surge in buying activity that could potentially push the price back toward $100,000. This is a promising development, especially considering the current position of Bitcoin at just beneath the $95,000 mark.

However, I always remind myself to approach such predictions with a grain of salt, as the crypto market can be unpredictable and volatile. As the saying goes in this field, “never invest what you cannot afford to lose.”

To add a touch of humor to lighten the mood, let me share a joke: Why did Bitcoin cross the road? To get to the other blockchain!

Over the last seven days, Bitcoin’s cost has experienced a mild holding pattern, finding it challenging to surpass $100,000 on Christmas day. Yet, there remains optimism among investors that the BTC price might offer one more significant surge before 2024 comes to a close, as recent off-chain indicators hint towards this possibility.

Can Increased Buying Pressure Push Bitcoin Price Back Toward $100,000?

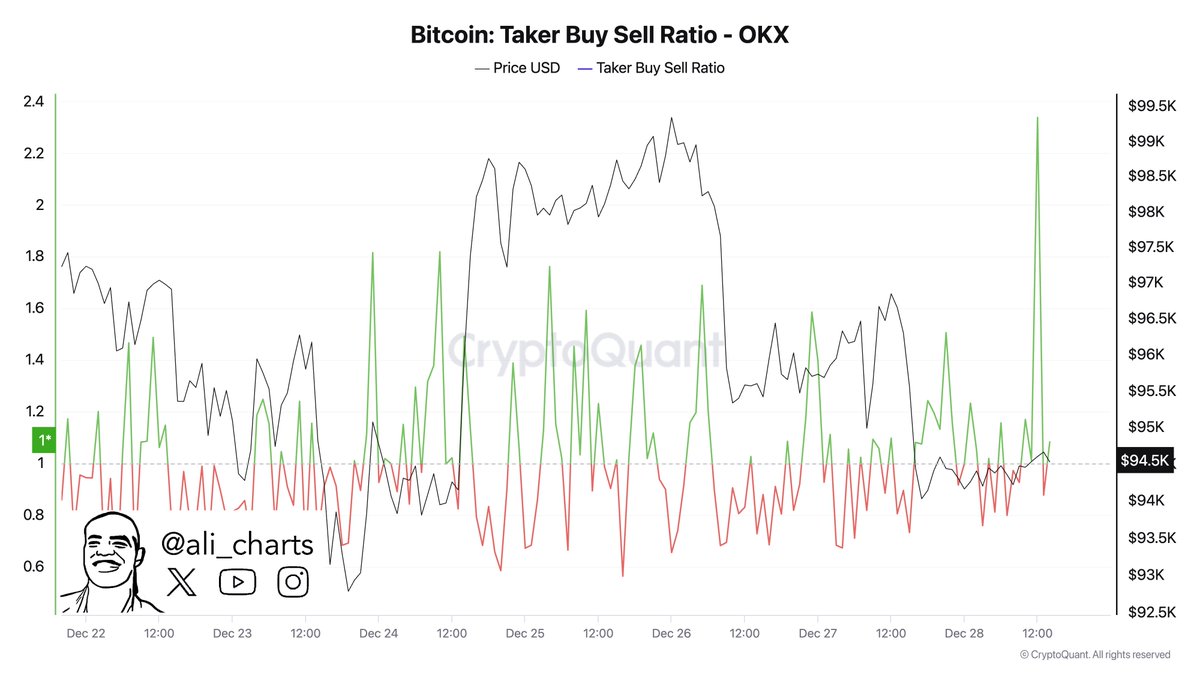

On December 28th, renowned crypto analyst Ali Martinez posted an intriguing observation about Bitcoin’s price movement before 2024 on the X platform, based on a key on-chain metric: the balance between taker buy and taker sell orders for a specific cryptocurrency, which is called the “taker buy/sell ratio.

If the taker buy/sell ratio surpasses one, it’s indicating that more buyers (takers) are looking to purchase Bitcoin than sellers (takers) are offering to sell. This situation is often seen as a bullish indicator, hinting at investors’ readiness to pay a premium for the asset (Bitcoin in this case).

Conversely, if the value of the ratio is smaller than 1, it implies that there are more sellers ready to offload their assets at a lower cost. In such a situation, the demand from buyers may be outweighed by the supply in a specific cryptocurrency market, indicating a bearish trend and pessimism among investors as they are less eager to buy.

On December 28th, Martinez posted that the ratio of Bitcoin buyers to sellers on the OKX exchange significantly increased, reaching up to 2.3. This indicates an increase in purchasing actions taking place on this centralized trading platform.

In summary, the rising demand suggested by this on-chain indicator might lead to a bullish outlook for Bitcoin. This boost in purchasing power could potentially spark an uptrend in Bitcoin’s price. Currently, Bitcoin’s value hovers around $95,000, marking a 0.6% rise over the past day.

BTC Continues To Flow Out Of Exchanges

On the CryptoQuant platform, an anonymous expert has disclosed that a significant volume of Bitcoin (BTC) has been moving into exchanges, marking a multi-year trend. This observation aligns with the low Netflow-to-Reserve ratio, which monitors the discrepancy between exchange outflows minus reserves.

A low Netflow-to-Reserve ratio suggests that Bitcoin holders are opting to retain their investments instead of cashing out, indicating a bullish trend for the leading cryptocurrency. This on-chain indicator may signal potential substantial price increases ahead.

Read More

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-12-29 16:34