As a seasoned crypto investor with a knack for deciphering market trends, I find myself intrigued by the recent developments in the Bitcoin market. The taker buy/sell ratio soaring to over 28 on Binance, as highlighted by analyst Ali Martinez, is indeed an encouraging sign of growing buying pressure. This surge in demand could potentially propel BTC towards its coveted $100,000 milestone.

The cost of Bitcoin has temporarily decreased, failing to hit the sought-after $100,000 threshold following a strong bullish trend throughout the week. Yet, investors seem unfazed by Bitcoin’s subdued performance over the last couple of days.

Bitcoin Taker Buy/Sell Ratio Is Rising — Impact On Price

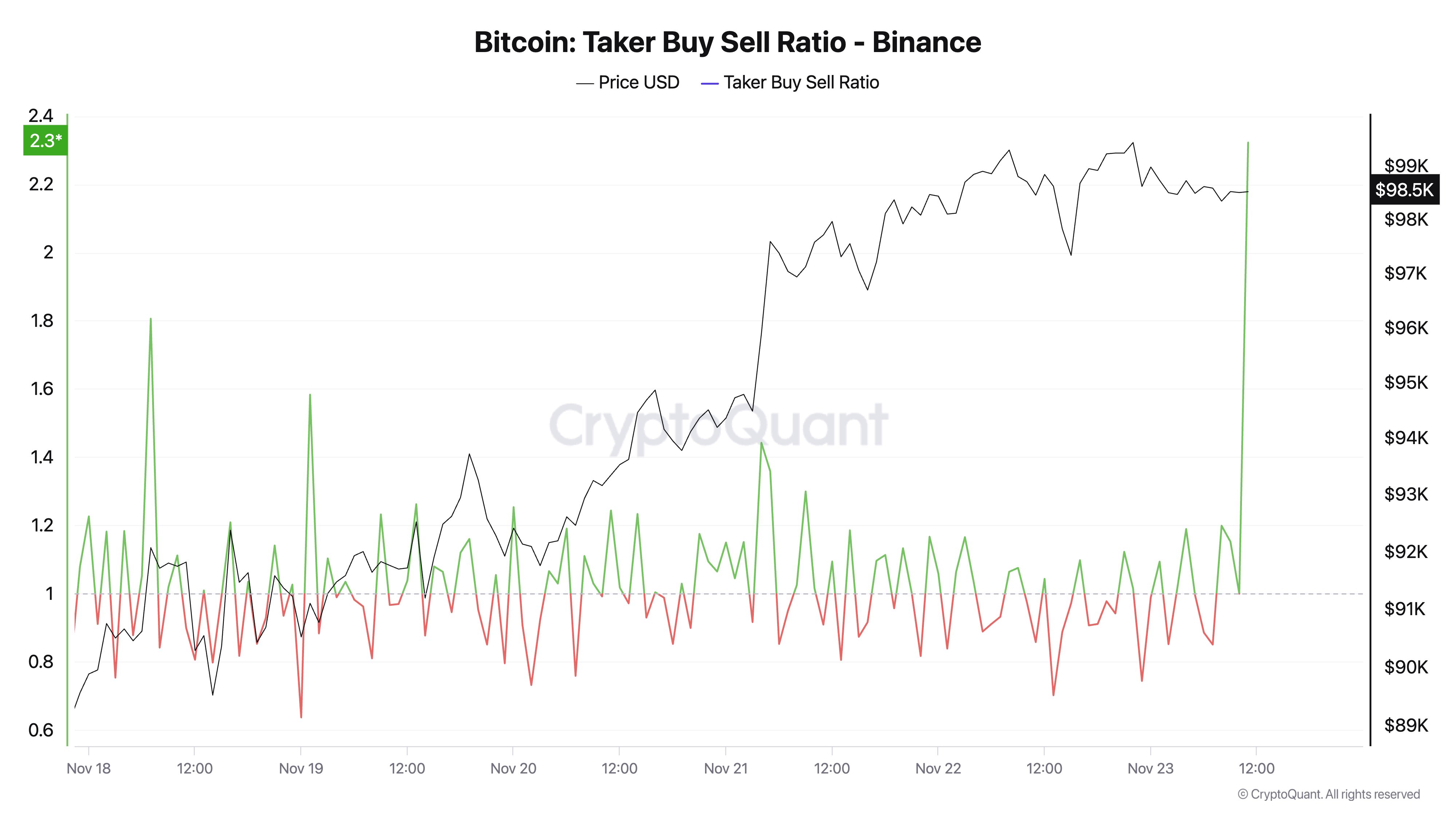

On November 23, well-known crypto expert Ali Martinez posted on the X platform that traders have been accumulating Bitcoin over the past few days, as indicated by an analysis of the “taker buy/sell ratio.” This data is derived from monitoring the taker buy and taker sell volumes for a specific cryptocurrency.

A taker buy/sell ratio greater than 1 indicates that more buyers are eager to purchase Bitcoin than sellers are willing to offload it. This is often viewed as a bullish sign, implying that investors are ready to pay higher prices for the cryptocurrency.

Conversely, if the metric’s value falls below 1, it signifies that there are more sellers eager to offload their assets at a reduced price. Usually, this situation suggests a pessimistic outlook among investors because the selling force surpasses the buying force in the particular market, indicating increased pressure to sell rather than buy.

In his recent post on X, Martinez pointed out that the ratio of Bitcoin buyers to sellers, measured across prominent trading platforms like Binance, OKX, HTX, and Bybit, has seen a substantial increase within the last 24 hours. As you can see in the graph below, this indicator peaked at more than 28 on Binance, which is currently the world’s largest exchange.

In a similar fashion, the Bitcoin ‘buy vs sell’ ratio soared significantly above 1, indicating growing demand to buy Bitcoins in the market. This high level of buying activity suggests that Bitcoin could maintain its upward trend and potentially reach the $100,000 mark.

Currently, Bitcoin’s price hovers approximately at $97,800, showing a minor decrease of 1.1% over the last day. Yet, its weekly performance remains noteworthy, with Bitcoin gaining almost 8%, as per CoinGecko statistics.

Who Is Buying?

It was recently disclosed on the X platform by Martinez that a significant group of big-time investors (often referred to as “whales”) have been trading Bitcoin in the last few days. These particular whales possess between 100 and 1,000 coins.

Based on information from Santiment, large Bitcoin investors, or “whales,” have recently purchased over 40,000 BTC, amounting to approximately $3.96 billion in the past four days. Given their impact on market trends, this significant buying spree by these whale investors could potentially boost the price of Bitcoin.

Read More

- Shruti Haasan is off from Instagram for THIS reason; drops a comeback message on Twitter

- Connections Help, Hints & Clues for Today, March 1

- Shiba Inu Sees Bullish Reversal In On-Chain Metrics, Can SHIB Price Recover?

- The games you need to play to prepare for Elden Ring: Nightreign

- The Babadook Theatrical Rerelease Date Set in New Trailer

- When To Expect Blue Lock Chapter 287 Spoilers & Manga Leaks

- Sitara Ghattamaneni: The 12-Year-Old Fashionista Taking the Spotlight by Storm!

- Chiranjeevi joins Prime Minister Narendra Modi for Pongal celebrations in Delhi; see PICS

- Cardi B Sparks Dating Rumors With Stefon Diggs After Valentine’s Outing

- BUZZ: Rajinikanth starrer Jailer 2 directed by Nelson Dilipkumar likely to go on floors from March 2025

2024-11-24 14:46