As a seasoned crypto investor who has weathered numerous market cycles, I can confidently say that this latest surge in Bitcoin price is reminiscent of the thrilling rollercoaster rides we’ve all come to know and love in this space. The sudden spike in price, coupled with massive liquidations, is a testament to the inherent volatility of Bitcoin, but also its resilience and potential for significant returns.

Bitcoin (BTC) has regained the $64,570 level, causing a stir in the cryptocurrency derivatives market. In the last 24 hours, over $100 million worth of short positions have been liquidated due to Bitcoin’s price surge, which took many traders by surprise. The volatility for the past 24 hours stands at 2.7%, while the total market capitalization amounts to approximately $1.28 trillion, and the volume in the last 24 hours reached $26.91 billion.

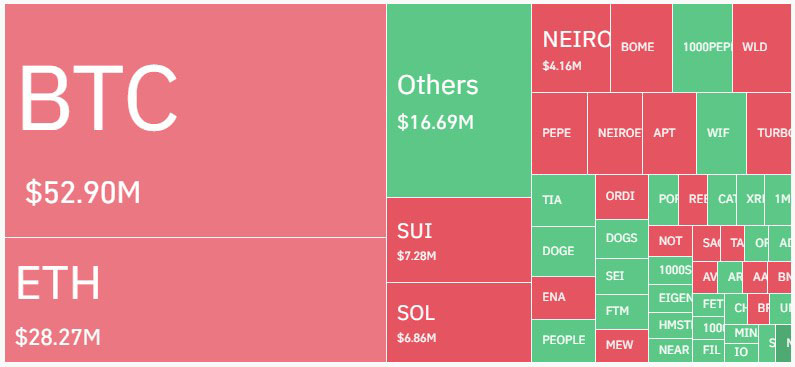

Based on information from CoinGlass, a sudden shift in Bitcoin’s price led to over $101.57 million worth of short positions being closed across the cryptocurrency market. In all, approximately 54,422 traders experienced liquidations totaling over $167.18 million. Short positions on Bitcoin accounted for around $52.90 million of these liquidations, with Ether shorts accounting for about $28.27 million on that day.

Source: Coinglass

Short-sellers of Bitcoin took a significant blow due to the swift surge in value, leaving minimal space for margin calls and compulsory sell-offs. Notably, Bitcoin’s market dominance has climbed significantly, surpassing 58%, which is close to its highest level since April 2021, as per TradingView data.

On the 14th of October, the value of Bitcoin increased by 1.90%, peaking at approximately $64,040. In the past day alone, trading activity surged by an impressive 52%. This peak price of $64,173 marks a new high for October and represents the highest Bitcoin has been since late September.

Source: CoinMarketCap

Mt. Gox Delays $9B Asset Return

On Monday, Bitcoin started climbing higher, continuing its strong recovery from the weekend. It was reported that Mt. Gox, an inactive crypto exchange, plans to wait another year before returning assets to creditors. This news helped ease concerns about a potential large-scale sell-off, which could have intensified market volatility further. Despite this positive development, Bitcoin and other digital currencies generally maintained their current positions.

Approximately a week ago, those responsible for Mt. Gox announced their intention to distribute the remaining assets by October 31, 2025. This plan includes approximately $9 billion in tokens that were stolen, primarily Bitcoin from the 2014 hack, and has left investors questioning how this could potentially impact the supply of Bitcoin due to the $2.8 billion worth of tokens they still hold.

Previously this year, the prospect of these holdings coming back into circulation resulted in a steep decrease in Bitcoin’s value. The apprehension about an abrupt surge in Bitcoin’s supply led to substantial market losses. However, Mt. Gox postponing the return has given Bitcoin an opportunity to rebound and achieve new record highs.

Uptober Surge Continues Nine of Eleven Years

There’s a lot of talk among experts about an upcoming period they’re calling “Uptober”. Interestingly, over the last eleven years, October has been a profitable month for Bitcoin, with gains in nearly nine out of those years. This trend has fueled anticipation that Bitcoin might keep rising throughout October.

On October 14, financial expert Kyle Chassé, with a following of 219,000 on X (previously known as Twitter), expressed optimism to his audience. He suggested that the market is moving towards an exhilarating phase, stating, “Things are changing for the better,” and expressing high confidence in this transition.

“The next big rally isn’t just a possibility — it’s a reality waiting to unfold.”

In simpler terms, on-chain expert James Check offered his opinion, suggesting traders to “Hope for a downturn,” pointing out potential difficulties that bearish traders could encounter in this present bullish market phase. This sentiment mirrors overall market optimism mixed with apprehension among those betting against the rising trend.

Currently, Ethereum is demonstrating resilience, surpassing the $2,440 mark which suggests a potential continuation of its bullish momentum in both short-term and intradaily trading. According to technical analysis, Ethereum seems to have formed a double bottom pattern, with a key confirmation level at $2,515.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-10-14 11:41