Bitcoin has hit a record high of $109,558 during early trading hours in Asia, coinciding with President Donald Trump’s inauguration day. Some market analysts suggest that there may be increased odds that Trump will establish a Strategic Bitcoin Reserve (SBR) via an executive order – one of approximately 100 orders he could issue immediately upon assuming office.

Is A Strategic Bitcoin Reserve Coming?

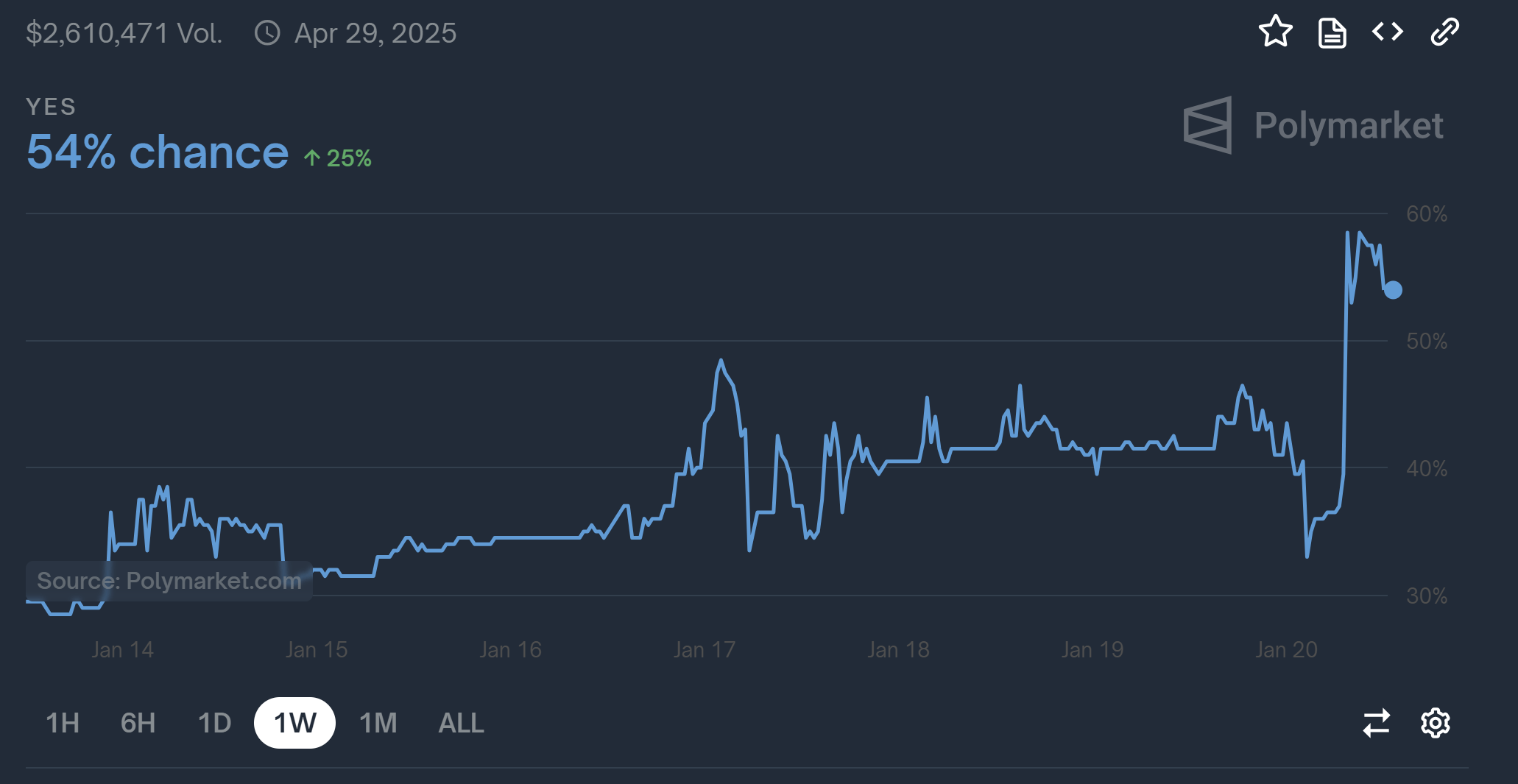

For a while now, there’s been discussion about the possibility of a U.S. Bitcoin reserve under President Trump. However, the chatter grew more vigorous when Polymarket, a prediction platform based on cryptocurrency, noticed a sharp increase in the likelihood of such a reserve being established within Trump’s first 100 days in office. Interestingly, as the odds rose to 59%, Bitcoin experienced a significant surge, reaching a new high.

As a researcher, I’ve delved into the past where Trump proposed an idea of confiscating Bitcoin seized by law enforcement and storing it in a government-controlled vault. Although no concrete confirmation has been given yet, whispers about a potential executive order being signed “as soon as Inauguration Day” have sparked a surge in Bitcoin’s price movement.

Significantly, a number of prominent Bitcoin supporters recently held discussions with the new administration over the weekend, sparking talk about its potential impact. On Sunday, Senator John Barrasso wrote on X (previously Twitter): “Senator Lummis and I enjoyed our conversation with President Donald Trump this morning. Wyoming is all set for Inauguration Day tomorrow!

As a passionate crypto investor, I’m sharing my excitement about Senator Cynthia Lummis’ recent post. She’s been vocal about her support for Bitcoin and is working tirelessly to establish the Strategic Bitcoin Reserve and comprehensive digital asset legislation. In her latest update on X, she mentioned collaborating with @jespow, @arjunsethi, and @DavidLRipley, expressing gratitude for their involvement in this important process.

Senator Lummis’ self-proposed legislation, popularly known as the “Bitcoin Bill,” aims to acquire one million Bitcoins. Similarly, Michael Saylor, Chair of MicroStrategy, participated in discussions with members of the Trump administration’s cabinet. He posted a picture on X featuring himself along with Robert F. Kennedy Jr. and Jared Kushner, with the caption: “The Future Belongs to Bitcoin.

During this time, Eric Trump shared a photo alongside Saylor and “Crypto Leader” David Sacks, writing: “Let’s soar higher! #Bitcoin @WorldLibertyFi @saylor @DavidSacks

At a recent event hosted by the Vice President, it was notable that the Chairman and CEO of MARA Holdings (NASDAQ:MARA), one of America’s biggest Bitcoin mining companies, was seen in the company of the incoming US Secretary of Defense, suggesting a potential favorable stance towards Bitcoin from the White House.

MacroScope (@MacroScope17), a well-known market analyst, pointed out on X: “Remember that the articles and images depicting Trump and his new administration interacting with Bitcoin supporters (such as Scott Bessent at the crypto ball) are merely the beginning. Prepare for numerous news headlines to surface in the coming days, weeks, and months. This is an unprecedented situation in financial market history.

David Bailey, CEO of BTC Inc, who previously supported Trump’s pro-Bitcoin platform during his candidacy, expressed today that Trump’s recent venture into a personal memecoin TRUMP isn’t something he personally finds appealing. However, he reiterated his appreciation for Trump’s continued pro-Bitcoin stance.

I’ll persist in assisting the President in any way I can as he promotes Bitcoin and offers guidance when needed. My vision is for America to become a leading force in Bitcoin and Cryptocurrency, and this victory is just the beginning. Regarding your questions about major crypto-friendly actions like releasing Ross Ulbricht, declaring a national stockpile by executive order, and co-sponsoring Sen. Lummis’ SBR bill, I can assure you that all these steps will be taken and even more.

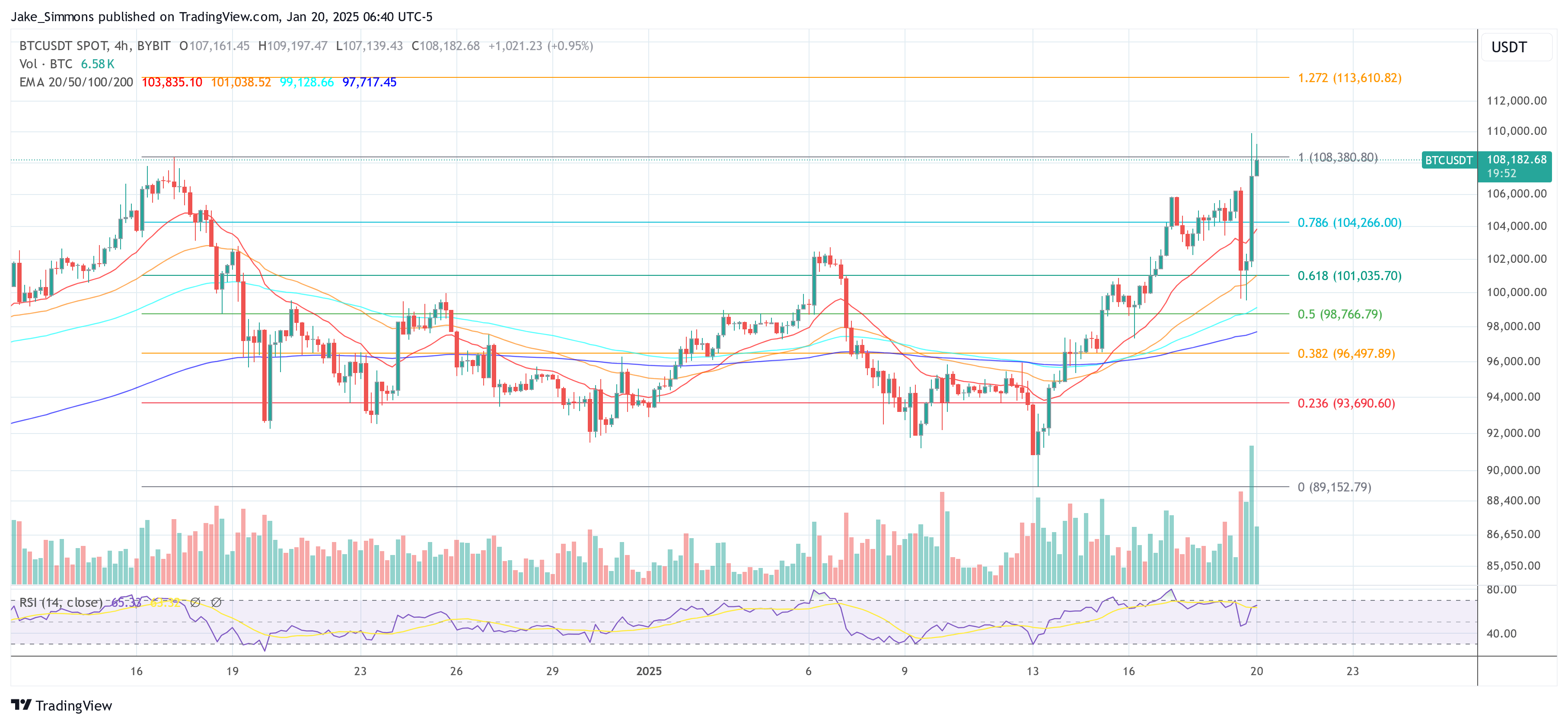

Charles Edwards, head of Capriole Investments, noticed that Bitcoin’s sudden drop followed by an immediate surge to fresh highs might suggest even greater increases. Edwards advised, “Faith in the subsequent shift,” underscoring the idea that “when markets make a dramatic shift in one direction and then swiftly reverse it, the second shift has a higher likelihood of being the genuine move that establishes the new trend.

He mentioned that following a traditional “squeeze,” investors discovered an “overwhelming optimism” surrounding the rumored advancements, which included increased chances of a BSR and the integration of the MAGA community into cryptocurrency. However, Edwards cautioned that “anything can occur” in such a volatile market scenario.

He shared his thoughts stating that after a standard market squeeze, investors found an extreme level of optimism regarding the whispers of upcoming developments, including a higher probability of BSR and the incorporation of the MAGA group into cryptocurrencies. Nevertheless, Edwards warned that anything can take place in such a volatile market setting.)

At press time, BTC traded at $108,182.

Read More

- Connections Help, Hints & Clues for Today, March 1

- Shiba Inu Sees Bullish Reversal In On-Chain Metrics, Can SHIB Price Recover?

- Shruti Haasan is off from Instagram for THIS reason; drops a comeback message on Twitter

- Sitara Ghattamaneni: The 12-Year-Old Fashionista Taking the Spotlight by Storm!

- BUZZ: Rajinikanth starrer Jailer 2 directed by Nelson Dilipkumar likely to go on floors from March 2025

- The games you need to play to prepare for Elden Ring: Nightreign

- When To Expect Blue Lock Chapter 287 Spoilers & Manga Leaks

- Chiranjeevi joins Prime Minister Narendra Modi for Pongal celebrations in Delhi; see PICS

- What Is Dunkin Donuts Halloween Munchkins Bucket?

- Pepe Battles Price Decline, But Analysts Signal A Potential Rally Ahead

2025-01-20 16:35