As a seasoned crypto investor with a keen interest in technical analysis, I’ve learned to keep an eye on various indicators that can help me gauge the market trends and make informed decisions. The recent TD Sequential sell signal for Bitcoin, as highlighted by the analysis from Ali Martinez, is one such indicator that has caught my attention.

As a market analyst, I’ve been closely monitoring the price action of Bitcoin using the Tom Demark (TD) Sequential indicator. Yesterday, this powerful technical tool gave a sell signal after Bitcoin surpassed the $71,000 mark.

Bitcoin TD Sequential Is Giving A Sell Signal Right Now

According to analyst Ali Martinez’s latest post on X, a TD Sequential signal has emerged in Bitcoin’s 1-hour price chart. This “TD Sequential” indicator is a popular technical analysis tool used to identify potential turning points in the price trend of a commodity.

In the TD Sequential strategy, there are two distinct stages: setup and countdown. During the initial stage, an identical pattern of candles, be they red or green, is tallied up to the number nine. Once this threshold of nine candles has been reached, it’s typically indicative that the asset has undergone a price reversal.

As a crypto investor, I’ve come to rely on the TD Sequential indicator to help me make informed buying decisions. If the candlesticks just before the setup are red, this trusted tool will signal it’s time for me to consider purchasing the asset. Conversely, if those preceding candles are green, I might want to exercise caution and prepare for a potential price reversal in the opposite direction.

Following the conclusion of the initial setup, the subsequent phase involves a countdown of thirteen candles instead of nine. This stage mirrors the first, yet signifies a potential second opportunity for price reversal upon its termination.

The 1-hour Bitcoin price chart, as shown in Ali’s share, indicates that a TD Sequential pattern of this kind has recently concluded.

As a financial analyst observing the graph, I can see that TD Sequential has completed its setup stage, indicated by the appearance of green candles, for Bitcoin. This significant development occurs as the coin breaks through the $71,000 resistance level for the first time since mid-May.

Based on this TD setup, it’s possible that the current rally in the market has reached its peak, and a potential reversal back down could be imminent.

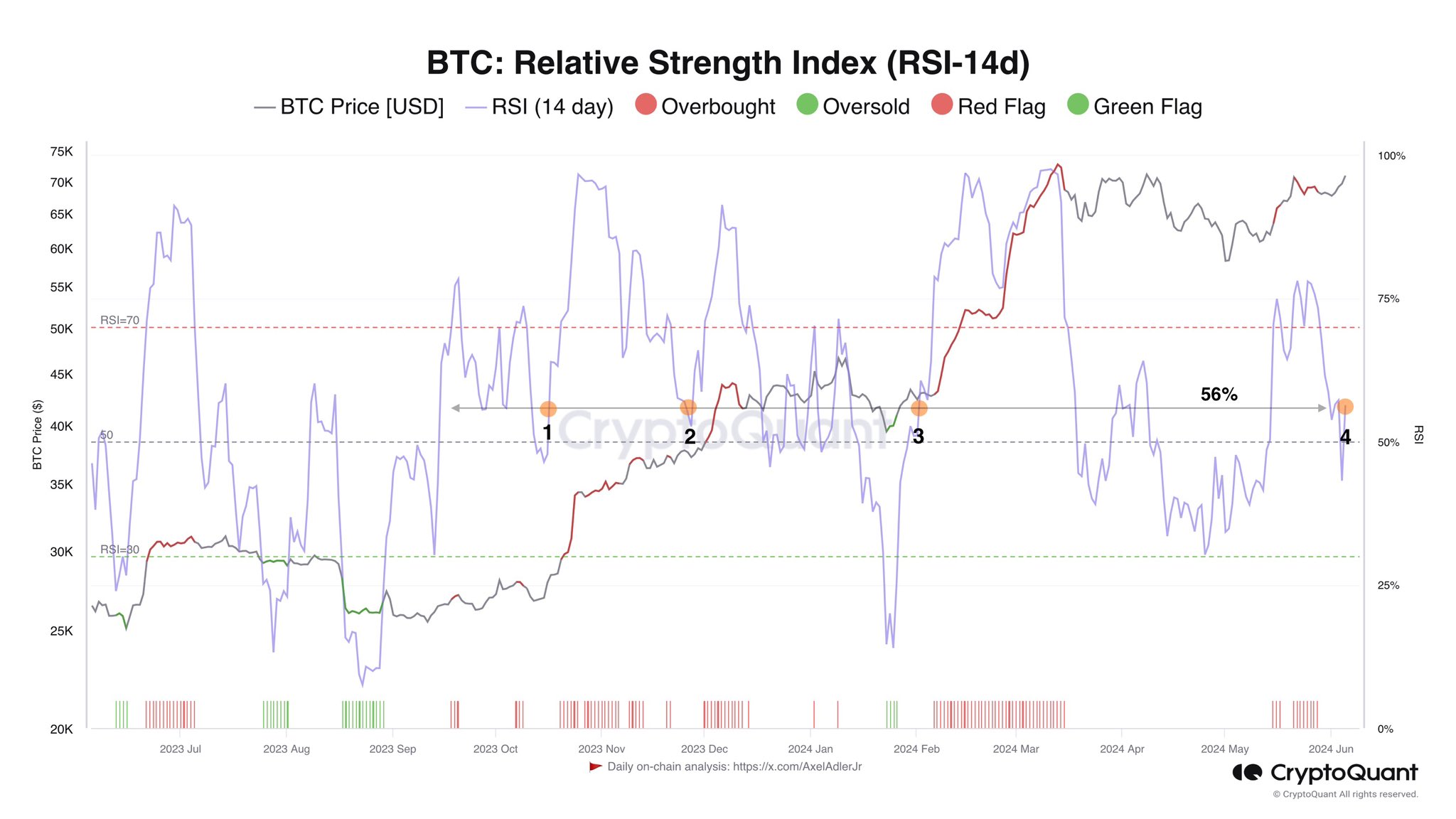

Although the TD Sequential indicator may raise concerns about a potential short-term downturn for Bitcoin, another technical analysis tool, the Bitcoin Relative Strength Index (RSI), could suggest a bullish outlook instead. As Axel Adler Jr, author of CryptoQuant, noted in a recent post, the RSI is currently at a level that has historically preceded price increases for Bitcoin.

The Relative Strength Index (RSI) measures the size of recent price fluctuations for an asset. According to the graph, the 14-day RSI for Bitcoin presently stands at 56%.

Normally, the price is believed to be underpriced when this indicator falls below the 30% threshold. Interestingly, the previous three significant upward trends in Bitcoin occurred when the Relative Strength Index (RSI) stood at 56%. It’s possible that this is just a coincidence, but if it’s a pattern, Bitcoin could experience a substantial price increase soon.

BTC Price

As an analyst, I’ve noticed that despite the TD Sequential signal suggesting a potential reversal, Bitcoin continues to defy expectations and has surged past $71,600.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Delta Force Redeem Codes (January 2025)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Gold Rate Forecast

- Best Japanese BL Dramas to Watch

2024-06-06 06:04