As a seasoned crypto investor with battle-scarred fingers from navigating through the rollercoaster rides of the cryptocurrency market, I must admit that the current state of affairs is both intriguing and slightly puzzling. The fact that derivatives exchange users continue to short Bitcoin even after its recovery beyond the $57,000 mark is a testament to the age-old adage: “You can’t teach an old dog new tricks.

It appears that individuals using derivative exchanges continue to place bets against Bitcoin even as it surpasses the $57,000 milestone and recovers.

Bitcoin Funding Rate Is Still Negative On Major Exchanges

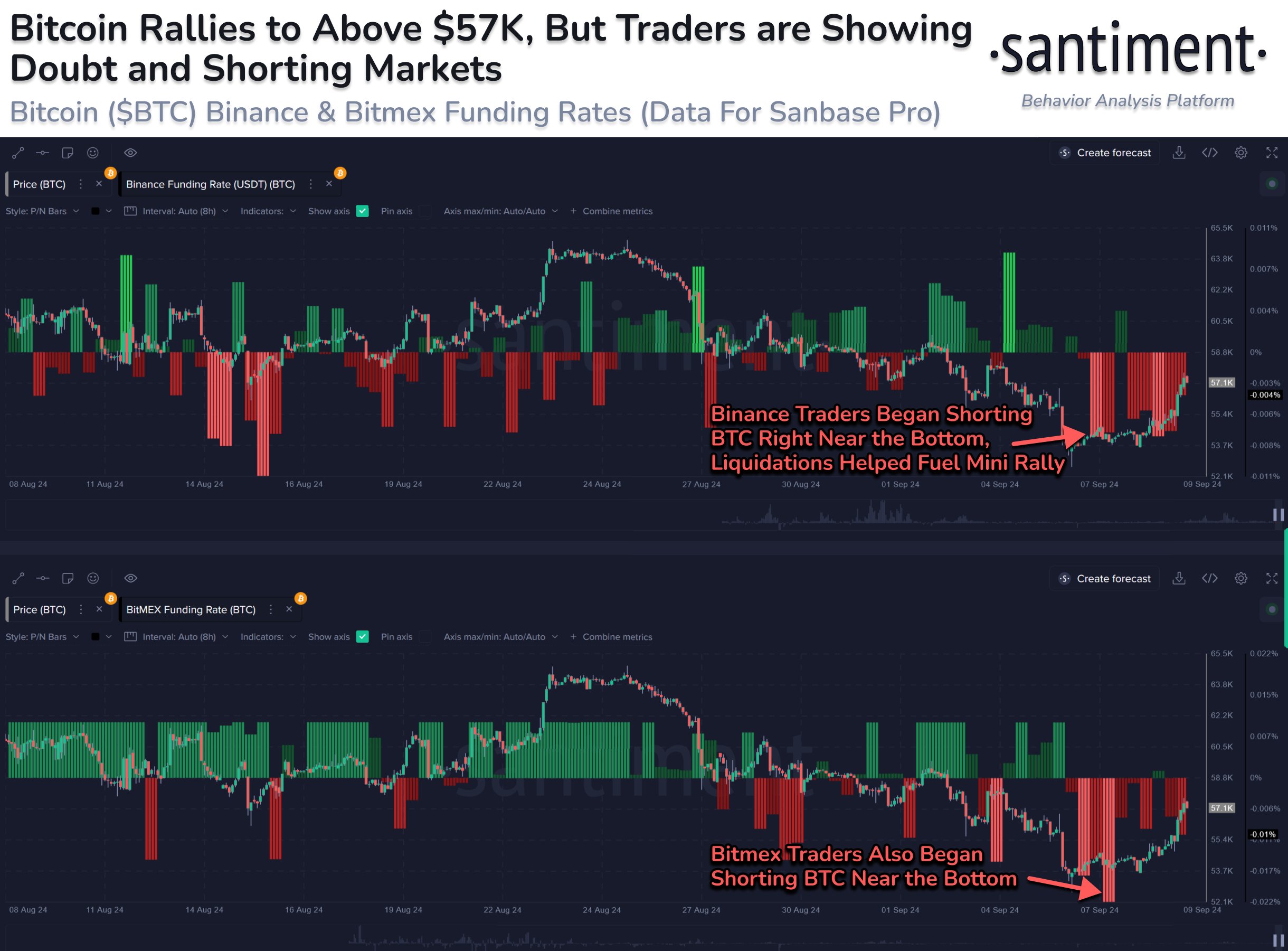

Based on information from analytics company Santiment, it appears that some investors have been selling Bitcoin (BTC) using a future contract over the past few days. The metric being focused on here is the “Funding Rate,” which reflects the ongoing fee these derivatives traders on a specific exchange are currently paying to each other.

When the value of this metric is more than zero, it signifies that long-term investors are compensating short-term investors with a higher price for maintaining their investment positions. This pattern suggests that there’s a widespread optimistic outlook among investors, as they anticipate market prices to rise (bullish sentiment).

In contrast, a negative indicator implies that there are more short positions than long ones. This suggests a predominant bearish sentiment within the market.

Presently, let me share a graph illustrating the evolution of the Bitcoin Funding Rate on two exchanges, Binance and BitMEX, during the last 30 days.

It’s clear from the graph that the Bitcoin Funding Rate for both platforms reached substantial low points just before the recent price trough.

This implies that those using derivatives anticipated a continued drop in the cryptocurrency’s value. However, the strategy of Binance and BitMEX traders didn’t pan out as the coin has been on an upward trend since then. In reality, the liquidation of these investors might have played a significant role in kick-starting the recovery from the bottom.

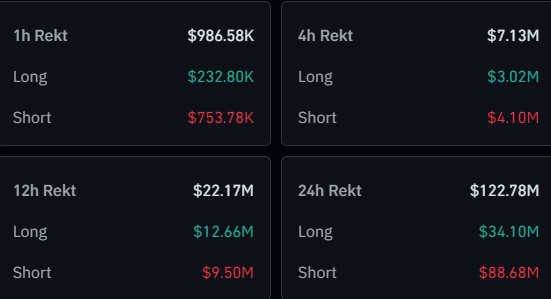

Over the last 24 hours, Bitcoin has experienced a significant rise, surpassing the $57,000 mark. As per information from CoinGlass, this Bitcoin surge and market-wide growth have resulted in approximately $123 million worth of liquidations across the sector.

Approximately $88 million from the total liquidations have been attributed to short investors, with bitcoin shorts accounting for about $34 million. Despite this substantial loss, as shown in the Funding Rate chart, the metric remains negative on these platforms, implying that aggressive bearish speculators haven’t ceased their activities following this heavy blow.

However, just like past instances during this market spike, these investment positions might face liquidation. This could intensify the price increase even more. The question is whether Bitcoin will buck the trend predicted by most derivative investors and continue its defiance or not.

BTC Price

Currently, as I type this, Bitcoin’s value stands approximately at $57,000, marking a rise of over 3% in the past 24 hours.

Read More

- Connections Help, Hints & Clues for Today, March 1

- The games you need to play to prepare for Elden Ring: Nightreign

- Sitara Ghattamaneni: The 12-Year-Old Fashionista Taking the Spotlight by Storm!

- Shruti Haasan is off from Instagram for THIS reason; drops a comeback message on Twitter

- Shiba Inu Sees Bullish Reversal In On-Chain Metrics, Can SHIB Price Recover?

- When To Expect Blue Lock Chapter 287 Spoilers & Manga Leaks

- What Is Dunkin Donuts Halloween Munchkins Bucket?

- BUZZ: Rajinikanth starrer Jailer 2 directed by Nelson Dilipkumar likely to go on floors from March 2025

- Pepe Battles Price Decline, But Analysts Signal A Potential Rally Ahead

- Chiranjeevi joins Prime Minister Narendra Modi for Pongal celebrations in Delhi; see PICS

2024-09-11 04:34