Today marks the day of Donald Trump’s presidential inauguration, and there’s a buzz in the air about possible pro-cryptocurrency initiatives he might pursue. Among these, the creation of a Bitcoin Strategic Reserve (SBR) is generating much interest within the financial markets.

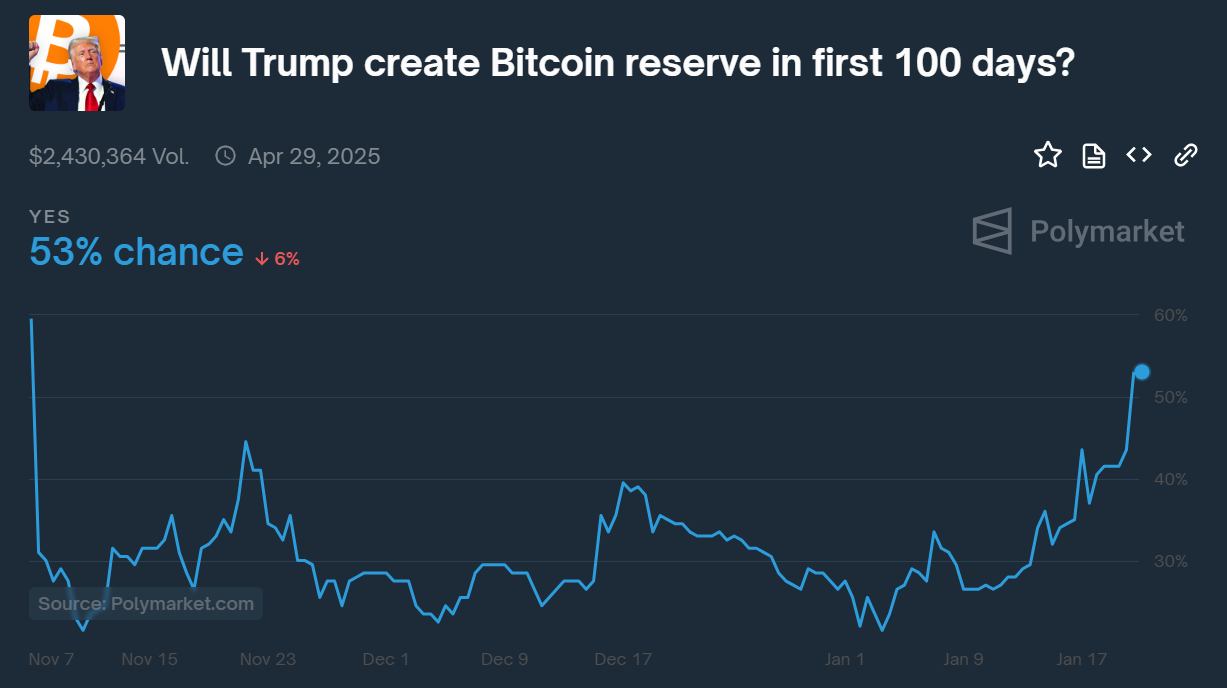

Andre Dragosch, who leads research at Bitwise Europe, stated that the market price for SBR might not be accurate, since the chances on Polymarket fell below 40%.

Initially, when the post was made, the market didn’t assign a 50/50 probability that a crypto executive would be appointed by President Trump on the first day. However, within a few hours, the market significantly revised its assessment. At the time of publication, the odds for SBR on Polymarket surpassed 50%.

As a crypto investor, I experienced an unexpected yet exciting price surge in BTC, which soared from $102K to a new high of $109.5K mere hours before the inauguration. This sudden spike hinted at a potentially bullish market trend during the event. However, it was unclear whether the State of the Union (SBR) would be included in the first-day executive orders.

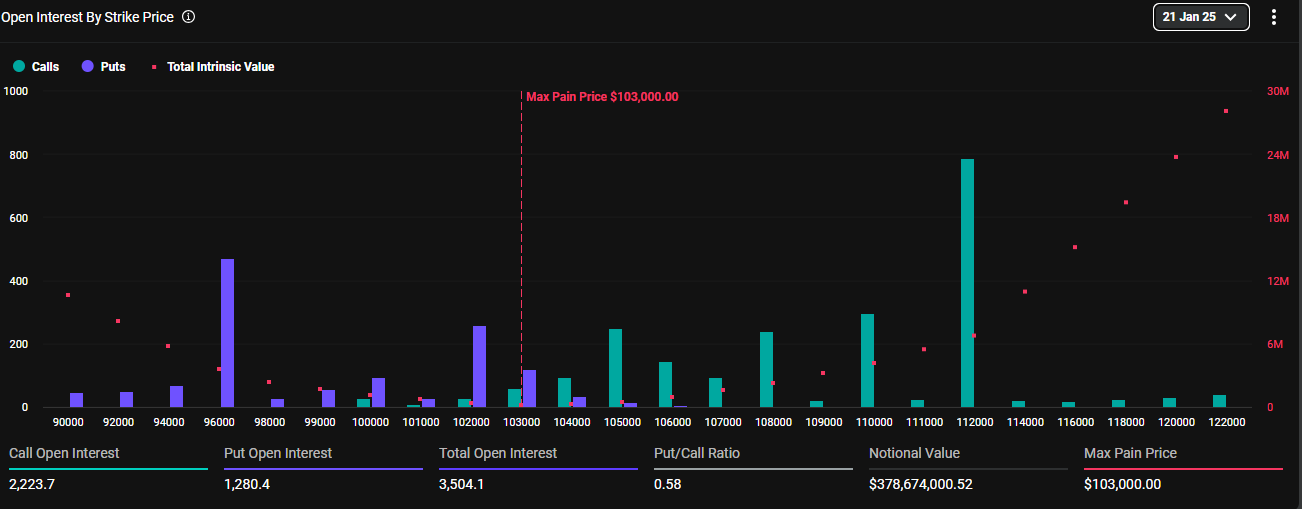

Options Traders Eyes $96K-$112K

On the Options market, traders anticipate significant price jumps within the next 48 hours. The levels where options are least valuable, or max pain, are expected to be around $102,000 and $103,000 for the January 20th and 21st expirations. Interestingly, these expirations have the highest volume of put options (indicating bearish bets) at approximately $96,000 and $97,000 respectively.

In simpler terms, for the expiration date of January 21st, call options (placing bullish bets) were predominant with a total value of approximately $85 million. This suggests that traders anticipated price fluctuations between around $96,000 and $112,000.

Furthermore, when the number of call options purchased was greater than the number of put options (with a ratio of 0.58), it indicated a higher demand for bullish (optimistic) positions in the Options market, as call options are often bought with the expectation that the underlying asset will increase in value.

Over the last 24 hours, the 25RR indicator displayed a favorable signal with a value of 12.9 volatility, indicating a significant price fluctuation could occur tomorrow. This is due to the market reacting to anticipated policy decisions and assessing their possible repercussions.

From my perspective as an analyst, the daily BTC price chart presents a comparable scenario. At the moment, BTC’s uptrend seems poised to breach the bearish resistance block and supply zone, marked red between $105K-108K. If successful, this could propel BTC above its trendline support that emerged during the November rally, potentially opening up a phase of price exploration.

If the bullish trend continues following the inauguration, it’s possible that prices could rise to $112K, $116K, or even $120K. However, there are potential areas of support if the market takes a downturn. These include the mid-range and moving average at around $96K, as well as the breakout level above $100K.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- Gold Rate Forecast

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Delta Force Redeem Codes (January 2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Overwatch 2 Season 17 start date and time

2025-01-20 12:02