As a seasoned crypto investor with a decade-long journey under my belt, I’ve learned to embrace the rollercoaster ride that is Bitcoin. The recent price fluctuations have been a stark reminder of the volatile nature of this digital gold, but they’ve also served as a testament to its resilience and potential for growth.

Bitcoin has experienced considerable price changes, with a substantial drop on August 5 that took its worth down to about $49,000. However, it quickly rebounded to around $65,000 before falling again to approximately $52,000 on the previous Friday.

Even though there are obstacles, the most significant cryptocurrency is encountering essential tests for support, similar to the trends seen in September 2023 prior to its surge to a record peak of $73,700 in March.

Bitcoin May Hit New All-Time Highs

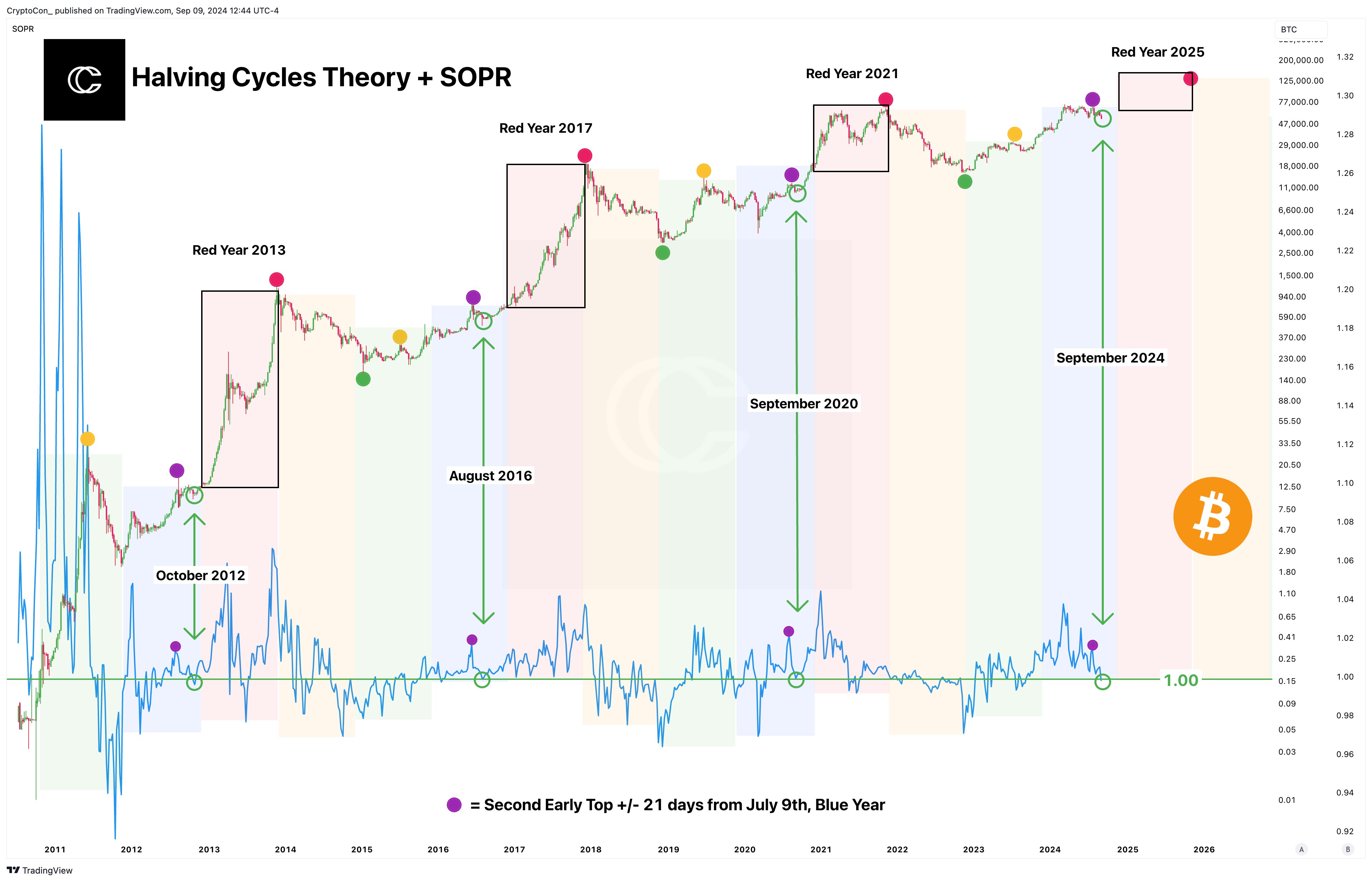

Crypto expert Crypto Con brought attention to this pattern in a social media post, focusing on Bitcoin’s Spent Output Profit Ratio (SOPR). In his analysis, peaks have historically aligned with the 1.0 line on the SOPR graph, which usually signifies where Bitcoin experiences a bottom before transitioning into a bull market period.

The pattern of recurring events has been noticeable particularly during October, August, and September, echoing the economic downturn forecasts that have surfaced lately. This resembles the situation we might find ourselves in September 2023 and at a turning point in November 2022 after the collapse of crypto exchange FTX.

Based on the current trends, it appears that Bitcoin could be about to experience a substantial price increase, possibly even exceeding its old record highs. The optimistic outlook is supported by past patterns where Bitcoin has been known to surpass previous peak values, as illustrated in the graph provided.

Is September A ‘Fake-Breakdown Month’?

According to Rekt Capital’s detailed examination of immediate price fluctuations, it’s vital for Bitcoin to finish the week above $53,250 to keep the price support within the $52,000 to $55,000 range where investors are actively buying at a discount.

Under the identified downward-sloping channel on Bitcoin’s weekly chart (at approximately $56,500), an analyst noted a developing range below. According to Rekt, it’s crucial for Bitcoin to regain the $55,881 level as support in order to gain momentum and potentially make a comeback within this channel.

To add to the discussion, Rekt proposed an intriguing theory suggesting that September might function as a “deceptive breakdown month.” Historically, it’s been observed that September usually records an average monthly return of approximately -5%, whereas October has an average return of 22.90%.

The current pattern indicates that any apparent drop in Bitcoin’s price over the past month might rapidly be regained, considering it is currently valued around $56,600. If October follows its usual trend, a potential 22.90% growth could place Bitcoin just shy of its record high, estimated to be about $68,780.

Currently, as I’m typing this, the most prominent cryptocurrency on the market is experiencing a 4% rise within the past 24 hours, propelling its price back up to around $56,600. Yet, over the last month, Bitcoin has seen losses exceeding 7%.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Gold Rate Forecast

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Overwatch 2 Season 17 start date and time

2024-09-10 01:16