As a seasoned crypto investor with years of experience navigating volatile markets, I’ve learned to appreciate the ebb and flow of Bitcoin prices. The current range-bound action between $99,000 and $102,000 is reminiscent of a cat playing with a mouse – it keeps us on our toes but refuses to commit to a decisive move.

Bitcoin has been trading within a narrow band of $99,000 to $102,000 since surpassing the symbolic $100,000 barrier. The initial breakout stirred enthusiasm among investors, but recent price fluctuations suggest market uncertainty, as there’s no definitive trend in sight for the near future. Fears of a possible correction linger as the market looks for more robust signs to confirm the direction of the next phase.

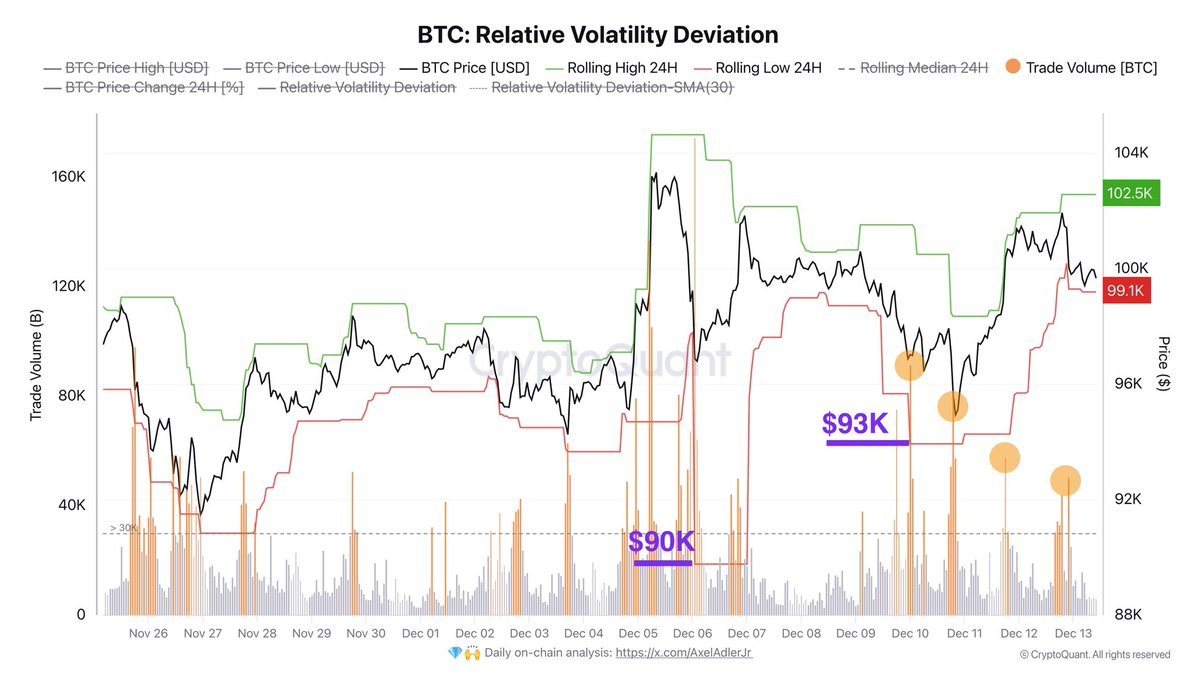

Top analyst Axel Adler recently provided analysis on X, backed by data from CryptoQuant, identifying significant support levels at approximately $90,000 and $93,000. These levels are key areas of demand, indicating that the market base has risen higher, suggesting strength even in uncertain times. According to Adler, these supports could potentially act as protective barriers, soaking up selling pressure if Bitcoin struggles to maintain its advance beyond $100,000.

Even though there’s still some uncertainty, investors are finding hope in Bitcoin consistently staying above $100,000 for multiple days. It’s unclear whether the market will surge beyond its current limits to keep up the bullish trend or if a downturn might occur instead. At this point, everyone is closely watching Bitcoin’s price fluctuations close to these crucial thresholds as they search for indicators that could predict the direction of the market throughout the rest of the year.

Bitcoin Technical Details Explained

Lately, Bitcoin’s price fluctuations have been erratic, causing a sense of suspense among traders and investors who are eagerly awaiting the next significant shift – be it an increase or a decrease. Given this uncertainty, they are keeping a close eye on crucial technical indicators and economic factors. The market has been stuck within a range of $99,000 to $102,000 as people wait for a clear breakthrough, indicating the direction the price might take next.

As a researcher delving into the intricacies of the digital currency landscape, I’ve recently come across an insightful macro analysis by top analyst Axel Adler regarding Bitcoin. In essence, Mr. Adler suggests that the market has established two pivotal support levels at $90,000 and $93,000. This indicates a notable upward shift in the overall market floor, offering a promising outlook for Bitcoin’s current position.

These stages might function as robust safeguards should Bitcoin encounter a temporary dip. Adler highlighted that these barriers indicate increasing faith in Bitcoin’s future prospects, even amidst present uncertainty.

A significant trend worth noting is the decrease in trading activity at high points, which implies a cautious approach from traders. This hesitance suggests they are choosing to defer entering substantial positions until they receive more definitive market indicators. Additionally, this drop in trading volume may signal a lower possibility of abrupt price fluctuations in the near future.

In its present price range, the market is quite responsive to outside influences. A notable piece of news or incident could promptly cause a surge or collapse, thereby preparing the groundwork for Bitcoin’s next significant shift.

BTC Price Action

Currently, Bitcoin is being traded at around $100,100. Despite attempts to surpass its previous record high of $103,600, it has not been successful so far. This temporary pause indicates uncertainty among traders, as they weigh their options while Bitcoin’s price remains above significant demand zones. The fact that Bitcoin is holding steady above the $100,000 mark implies that positive buying pressure may persist, with investors keeping an eye out for chances to drive the price even higher.

Over the coming days, it’s crucial to watch Bitcoin closely. If it can’t sustain above the significant psychological threshold of $100,000 and struggles to gather enough strength to surpass $103,600, a correction might be imminent. Analysts caution that if Bitcoin falls below $100,000, this could ignite a surge in selling activity, potentially driving the price towards less resilient support levels.

Keep an eye on the $93,000 area during a downturn, as it’s a significant point to consider. If this important support is breached, it increases the chances of bearish outcomes, since it denotes a vital area of market demand. A breakdown at this level might lead to a more pronounced correction, possibly undermining Bitcoin’s bullish trend.

The fact that Bitcoin’s value remains above $100,000 gives a slightly hopeful feeling. If bulls can sustain their efforts and push it beyond its previous record high, Bitcoin might embark on a new phase of price exploration. Yet, the importance of each move either surpassing or falling short of these levels makes them crucial for determining the immediate trend direction.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Delta Force Redeem Codes (January 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- Best Japanese BL Dramas to Watch

- Overwatch 2 Season 17 start date and time

- Gold Rate Forecast

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

2024-12-14 00:05