As an analyst with over two decades of experience in the financial markets, I’ve seen my fair share of bull and bear runs, bubbles, and crashes. However, when it comes to Bitcoin, I must admit that its unique fundamentals and the Stock-to-Flow model have piqued my interest like no other asset has before.

As I delve into my analysis this Monday morning, October 28, I find myself intrigued by Bitcoin‘s potential return to the $69,000 mark. If the bullish sentiment holds and we see a significant breach above this level, it could pave the way for an extended upward trend in the forthcoming months.

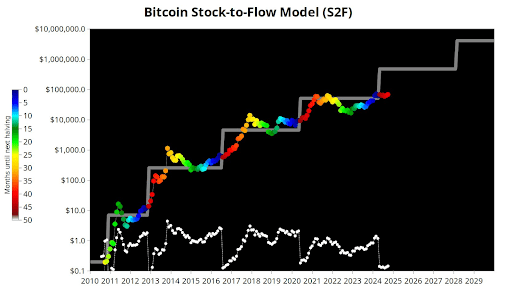

Discussing a prolonged price surge, it’s worth noting that the Bitcoin Stock-to-Flow model indicates an intriguing pattern in Bitcoin’s long-term forecast. Specifically, crypto analyst Plan B used this model to hint at Bitcoin entering its next significant evolutionary stage.

BTC Is Ready For Next Phase Transition

The Bitcoin Stock-to-Flow (S2F) framework is garnering interest because it suggests that Bitcoin could be preparing for a significant shift, potentially pushing its value beyond $100,000. Originally designed for commodities like gold and silver, the S2F model evaluates an asset’s current supply relative to the pace of new units being introduced into the market. For Bitcoin, this model estimates scarcity by factoring in its fixed 21 million coin supply and the periodic halvings that decrease the issuance every four years.

With each halving, the production rate diminishes, leading to a progressive shortage that the model links to increased pricing. As demonstrated by the S2F chart presented by Plan B, these halvings have historically been followed by price surges in the subsequent months, and the S2F model has shown an impressive ability to predict Bitcoin’s movement into higher price tiers.

In April 2024, Bitcoin underwent its latest halving, reducing the block reward from 6.25 Bitcoins to 3.125 Bitcoins. Historically, as shown on the S2F chart, such halvings have marked the beginning of a shift into a new price phase for Bitcoin. For instance, the halving in 2020 initiated a transition that eventually led BTC to surpass $10,000 and reach an all-time high of approximately $66,000.

Since we’ve passed the six-month mark since the April 2024 Bitcoin halving, the impact of this event is now being incorporated into the market dynamics of supply and demand. This could potentially set Bitcoin up for a significant shift or transition, with prices potentially surpassing $100,000.

What Does This Mean For Bitcoin Price?

Previous phase transitions have shown that once Bitcoin’s price crosses and stabilizes above $100,000, it is likely to hold at this level. With this point now acting as a strong foundation, Bitcoin’s price can be expected to continue growing in the following months.

In previous instances, a transition phase has consistently resulted in Bitcoin reaching a new high before another halving event. It’s estimated that this phase’s peak might be around $1,000,000 if historical patterns continue. If past trends persist, the Bitcoin price may hit this significant mark before the next halving, scheduled for 2028.

At the time of writing, Bitcoin is trading at $68,340.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Delta Force Redeem Codes (January 2025)

- Gold Rate Forecast

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Overwatch 2 Season 17 start date and time

2024-10-28 12:04