As a seasoned researcher with a background in financial markets and a keen interest in cryptocurrencies, I find the analysis by Julio Moreno of CryptoQuant particularly insightful. The Bull-Bear Market Cycle Indicator, based on the P&L Index, offers a unique perspective on Bitcoin’s market trends.

The Head of Research at the on-chain analytics firm CryptoQuant has explained why Bitcoin may be at risk of seeing a further drawdown.

Bitcoin Is Still On Verge Of Bear Market In This Indicator

In his recent update on X, CryptoQuant’s Chief Researcher Julio Moreno delved into the current pattern in the Bitcoin Profit-Loss (P&L) Market Cycle Signal. The “Profit-Loss Market Cycle Signal” from CryptoQuant is a tool derived from the P&L Index.

The P&L Index combines a few popular BTC metrics related to profit and loss, so it sums up the market balance in one value. This indicator can ascertain whether the asset is going through a bullish or bearish period by comparing it against its 365-day moving average (MA).

If a cryptocurrency surpasses its moving average (MA) calculated over 365 days, it’s often taken as a sign that the market is in an uptrend (bull market). Conversely, when the value of the cryptocurrency falls below its 365-day MA, it might suggest a shift towards a downtrend (bear market).

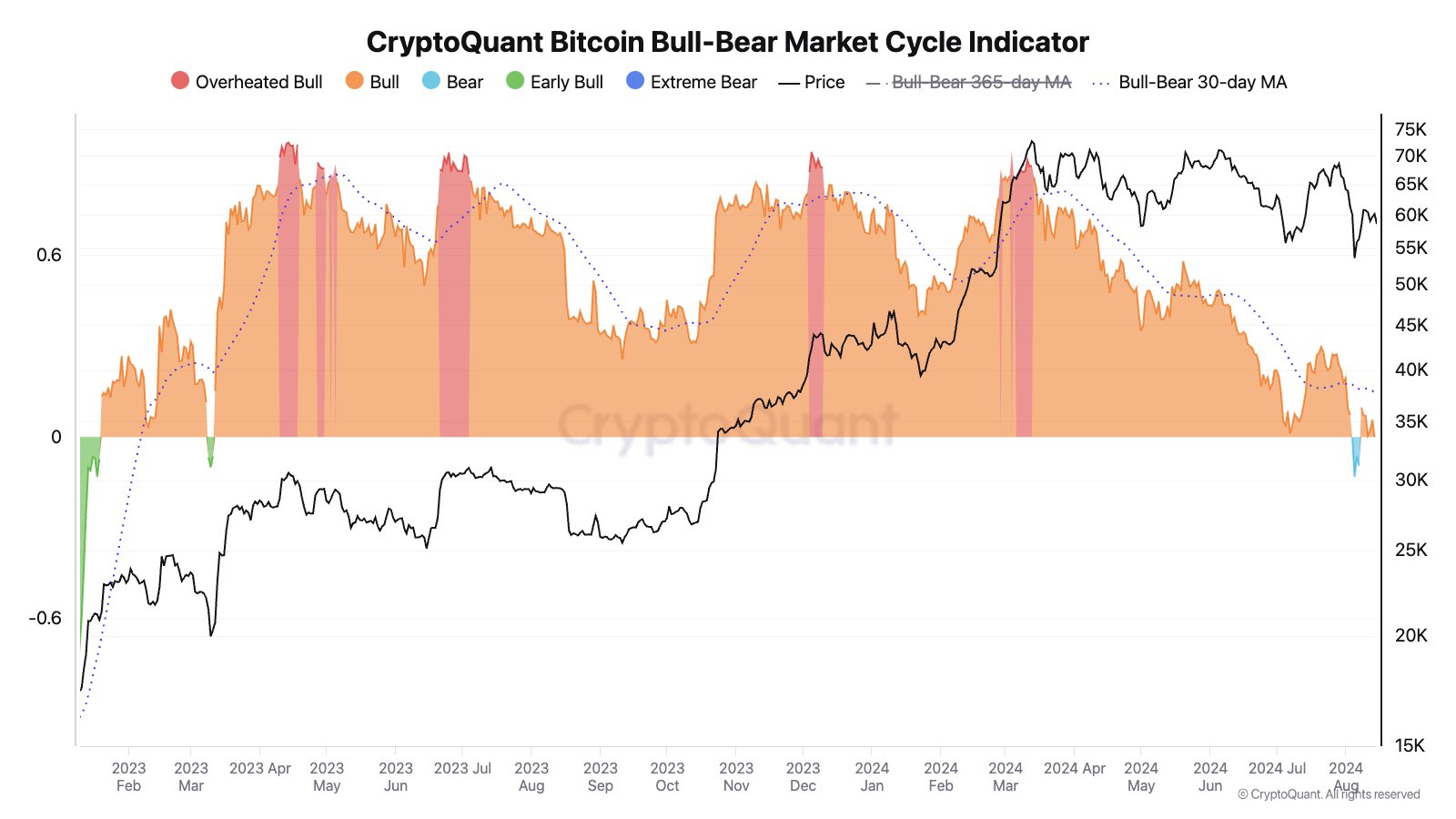

The Bull-Bear Market Cycle Indicator, the actual metric of focus here, exists to make this pattern easier to follow; it keeps track of the distance between the P&L Index and its 365-day MA.

Currently, I’d like to share a graph illustrating the evolution of the Bitcoin Bull-Bear Market Cycle Indicator over the last few years:

According to the graph, the Bitcoin Bull-Bear Market Cycle indicator peaked at unusually high levels when Bitcoin hit its record price earlier this year, as denoted by the red color.

At these current levels, the P&L Index is significantly larger than its 365-day moving average, suggesting that the cryptocurrency’s bullish trend may be overextended. The graph indicates that this signal has been given on several other occasions in the last two years, and every time it did, the asset’s price peaked.

Despite earlier setbacks, the market was able to withstand long-term pressure since the Bull-Bear Market Cycle Indicator remained within the bull phase (orange-shaded area), with the P&L Index consistently above its 365-day moving average.

As a researcher, I’ve noticed an intriguing shift in market dynamics recently. The bullish momentum, which had been driving prices upward, seems to be slowing down. In fact, during the latest market downturn, the indicator momentarily dipped into what we call ‘bear territory’ – a term used when the market experiences prolonged falls, represented by the light blue section on our charts.

Although Bitcoin’s price surge has pushed its metric back into the bull market territory, it remains quite near the neutral point, suggesting it might easily slide back into the bearish phase soon. According to Moreno’s analysis, there is a possibility that Bitcoin may experience additional corrections based on this trend.

BTC Price

As a researcher, I’ve noticed that the recent recovery of Bitcoin seems to have hit a plateau, with its current trading price hovering around $58,500.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- How to Update PUBG Mobile on Android, iOS and PC

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

2024-08-16 22:20