As a seasoned crypto investor with battle-tested nerves and a portfolio that has weathered more market storms than a Caribbean island, I must admit that the recent volatility of Bitcoin (BTC) is making me feel like a sailor caught in the eye of a hurricane. The price swings are as unpredictable as the stock market during an election year, but with the added excitement of a rollercoaster ride.

In light of the recent US Consumer Price Index (CPI) inflation data release, I’ve noticed a downtrend in Bitcoin (BTC) prices that dipped below $57,000 earlier today. Yet, as we speak, the price has rebounded to approximately $58,000, offering some relief for investors like myself.

The market has seen significant sell-offs due to the fluctuating BTC prices, with long and short liquidations totaling approximately $76.06 million. On a four-hour chart, a potentially supportive pattern called a death cross has been detected on the Bitcoin graph, which could help the market establish long-term stability or even set a new bottom. The observation was made that this situation might lead to the validation of a bottom for Bitcoin or potentially create a new one.

Additionally, several financial experts predict that the market could experience a significant correction down to approximately $45,000 from its current levels. This decline might bring the market to a six-month minimum and align it with an ascending trendline around the same level of $45,000.

Photo: Keith Allan

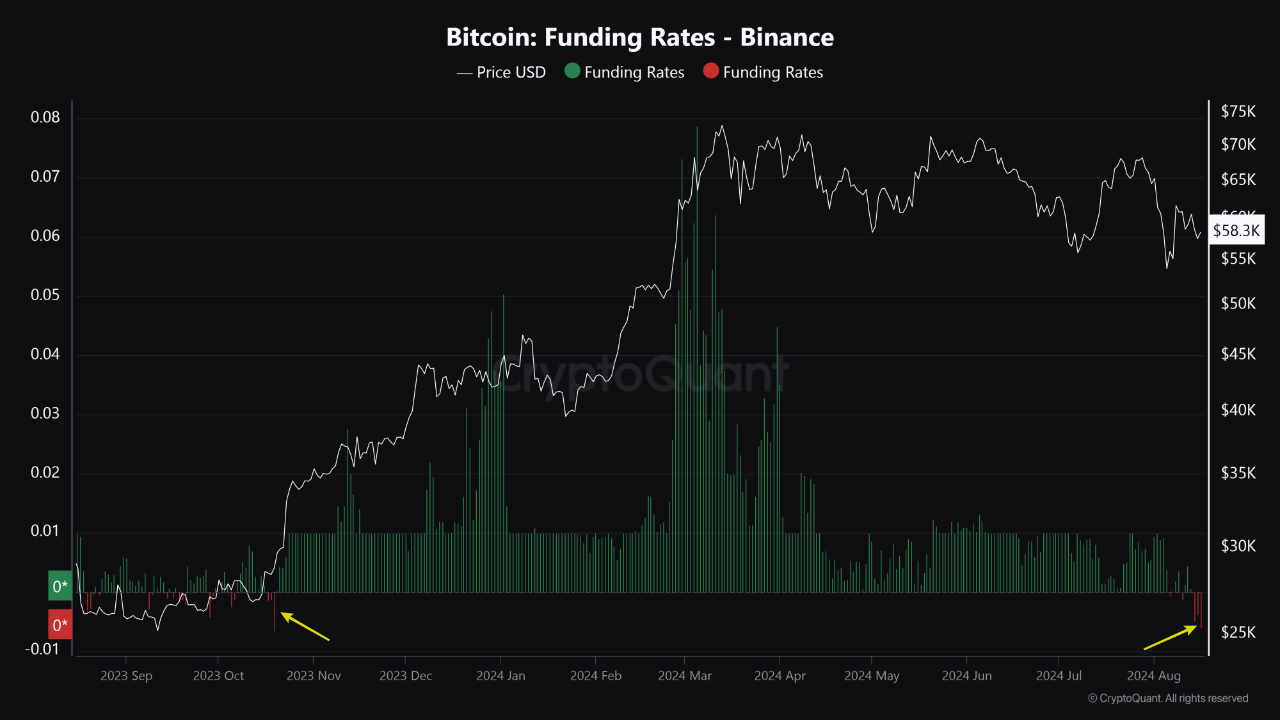

Bitcoin Funding Rate Flashes Warning Signs

A crucial on-chain metric to monitor closely is the Bitcoin Funding Rate, which has dipped into negative territory for three straight days – a level last observed in October of 2023, as highlighted by CryptoQuant in their latest update.

As a researcher studying cryptocurrency markets, I’ve noticed an interesting trend: The average Bitcoin funding rate across all exchanges has turned negative. This situation suggests that short positions are currently leading the perpetual market. Given that Binance holds a significant portion of open interest (OI), this could be a sign of bearish sentiments in the short term, indicating potential downward price movements for Bitcoin in the near future.

Photo: CryptoQuant

Coinglass’s liquidation platform indicates that the open interest for Bitcoin futures currently stands at approximately $29 billion, as of August 16. This figure has been steadily increasing throughout the week. Meanwhile, the spot price of Bitcoin has dropped by about 5% over the past two days. Open Interest represents the total number of outstanding Bitcoin futures contracts that have yet to be settled or expired.

Photo: Coinglass

A growing number of open positions suggests significant borrowing and lending is occurring in the market, which could magnify price fluctuations whether they’re up or down. As one financial institution put it, “an uptick in open interest indicates a rise in both long and short trades.”

Read More

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Delta Force Redeem Codes (January 2025)

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-08-16 17:19