As a seasoned analyst with over two decades of experience in financial markets, I have witnessed numerous bull and bear cycles, but none quite like Bitcoin’s meteoric rise. The current situation is reminiscent of the dot-com bubble, where the market was driven by speculation rather than fundamentals—yet, here we are again, watching the price action of a revolutionary asset that defies traditional finance norms.

Bitcoin‘s value has seen significant fluctuations since it reached an all-time high of $93,483 on Wednesday. Over the past few days, its price has been bouncing between this record level and a low of $85,100, suggesting that it might be entering a phase of consolidation before making its next big move. The market is eagerly watching to see if Bitcoin will settle down or keep climbing further.

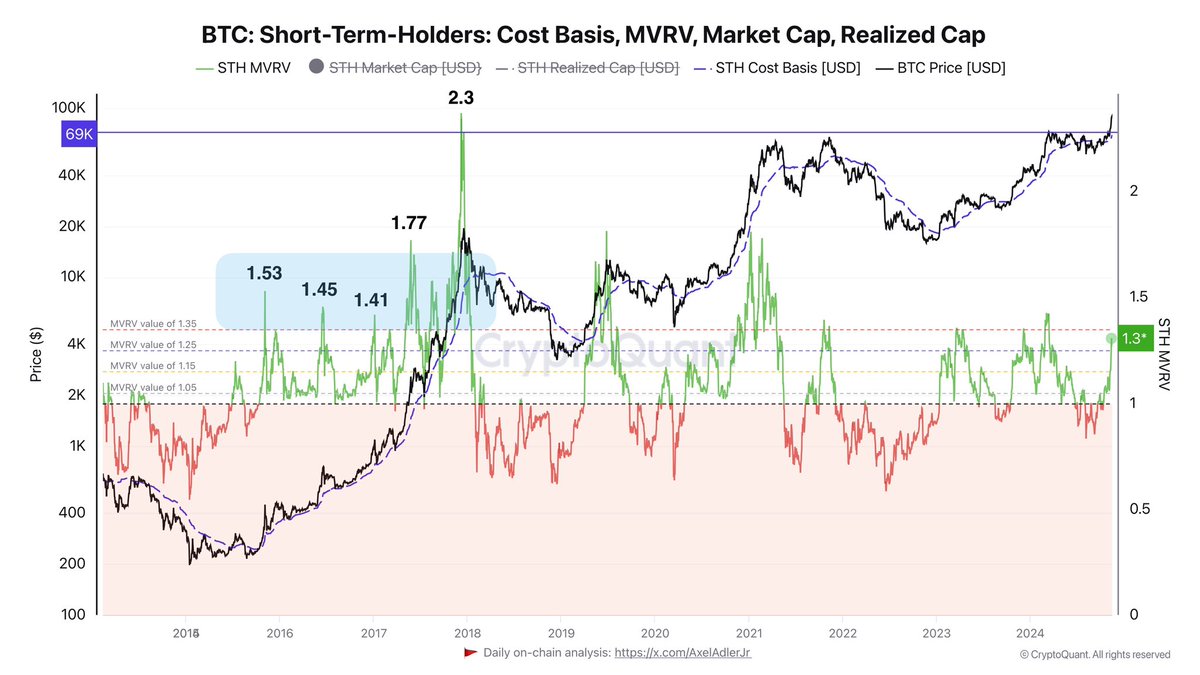

According to information from CryptoQuant, it appears that the rate at which sellers are entering the market could accelerate significantly. This trend seems to be mainly fueled by speculators aiming to cash out their gains promptly. Yet, this rise in selling pressure doesn’t automatically mean Bitcoin’s upward trend will slow down.

It’s anticipated that a large portion of the Bitcoin’s selling pressure will be counteracted by the rising interest in Bitcoin Exchange-Traded Funds (ETFs), which have become increasingly popular among institutional investors.

The equilibrium between quick Bitcoin sales and institutional buying could pave the way for Bitcoin’s next price trend. Given the anticipated volatility in the near future, investors are on high alert for any indications that may hint at Bitcoin’s price direction. Whether this period results in a more significant decline or propels Bitcoin to record highs, it’s evident that Bitcoin remains a powerful force in the financial world with its unpredictable yet impactful performance.

Bitcoin Strong Demand Supports Bullish Price Action

In simple terms, Bitcoin’s price growth during the last ten days is noteworthy, with a jump of approximately 38%. This sudden increase has piqued the interest of numerous investors, further underscoring the increasing demand for Bitcoin.

As an analyst, I’m drawing attention to some key insights from my analysis based on data from CryptoQuant. Specifically, I’ve observed that Bitcoin is currently trading at a price above its short-term holder (STH) cost basis of $69,000. This level serves as a significant support point for those who have recently purchased Bitcoin, suggesting robust demand for the cryptocurrency at prices above this threshold.

As a crypto investor, I’ve been keeping an eye on the MVRV (Market Value to Realized Value) ratio, which currently stands at 1.3. This indicates that Bitcoin is still generating profits for its holders. However, it’s important to note that if this ratio surpasses 1.35, it might lead to increased selling pressure from investors aiming to cash out their short-term gains.

Although it might lead to some fluctuations in the market, it’s crucial to understand that a large portion of these digital currencies could likely be taken up by expanding institutional interest, predominantly via Bitcoin ETFs.

As I delve into the analysis of Bitcoin’s latest performance, it seems clear that we’re witnessing a substantial change in its upward trend. Instead of being propelled by speculative future trades, the current surge appears to be primarily influenced by robust spot demand. This type of demand usually indicates a more consistent and long-term price movement compared to the volatility often associated with rallies driven by futures trading.

With Bitcoin consistently trading over crucial support points, the overall sentiment maintains a positive tilt due to a harmonious blend of speculative activities and long-term institutional investment.

BTC Technical View: Prices To Watch

Currently, Bitcoin is being exchanged at approximately $89,240, which represents a 7% decrease from its most recent record high of $93,483. After a phase marked by strong upward thrust, the price has stabilized below this level, suggesting a temporary halt in its rapid ascent and entry into uncharted territory.

During this brief lull in the market rally, it’s a chance for the market to find balance, assess crucial support points, and make an informed decision about its future direction.

As a crypto investor, I’ve noticed that the $85,000 mark has become a significant line in the sand during this consolidation phase. If Bitcoin manages to stay above this level in the near future, it could lay the groundwork for another rally, pushing against the $90,000 resistance and potentially revisiting its all-time high. Successfully recapturing the $90,000 level would suggest a resurgence of bullish sentiment, opening up possibilities for further price growth.

If we don’t manage to uphold the $85,000 level, there’s a possibility that Bitcoin could experience a more substantial drop. In such a case, it might look for support at lower levels, with $82,000 standing out as a potentially crucial point where buyers might step in.

During this crucial period, traders and investors will attentively monitor price fluctuations to decipher signs of an uptrend (breakout) or a downward correction (pullback). Each situation could influence Bitcoin’s near future trendline.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Delta Force Redeem Codes (January 2025)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Gold Rate Forecast

- Best Japanese BL Dramas to Watch

2024-11-15 19:35