As an analyst with a background in financial markets and experience in following the crypto space, I’m thrilled to witness the recent surge in investment activity surrounding Bitcoin spot ETFs. The approval of Ethereum ETFs by the SEC is just the cherry on top, fueling even more excitement within the community.

Recent developments in the world of finance have generated significant buzz: The SEC’s decision to greenlight Ethereum exchange-traded funds (ETFs) for listing has been met with much anticipation. At the same time, the Bitcoin spot ETF market has seen a revival, as indicated by two consecutive weeks of positive investment flows.

In contrast to the dismal investment scene of the past few weeks, this current string of favorable inflows signifies a significant reversal in trend. This turnaround can be attributed to the surge in investor confidence witnessed over the past fortnight.

Bitcoin Spot ETF: $252 Million In Net Inflows In One Day

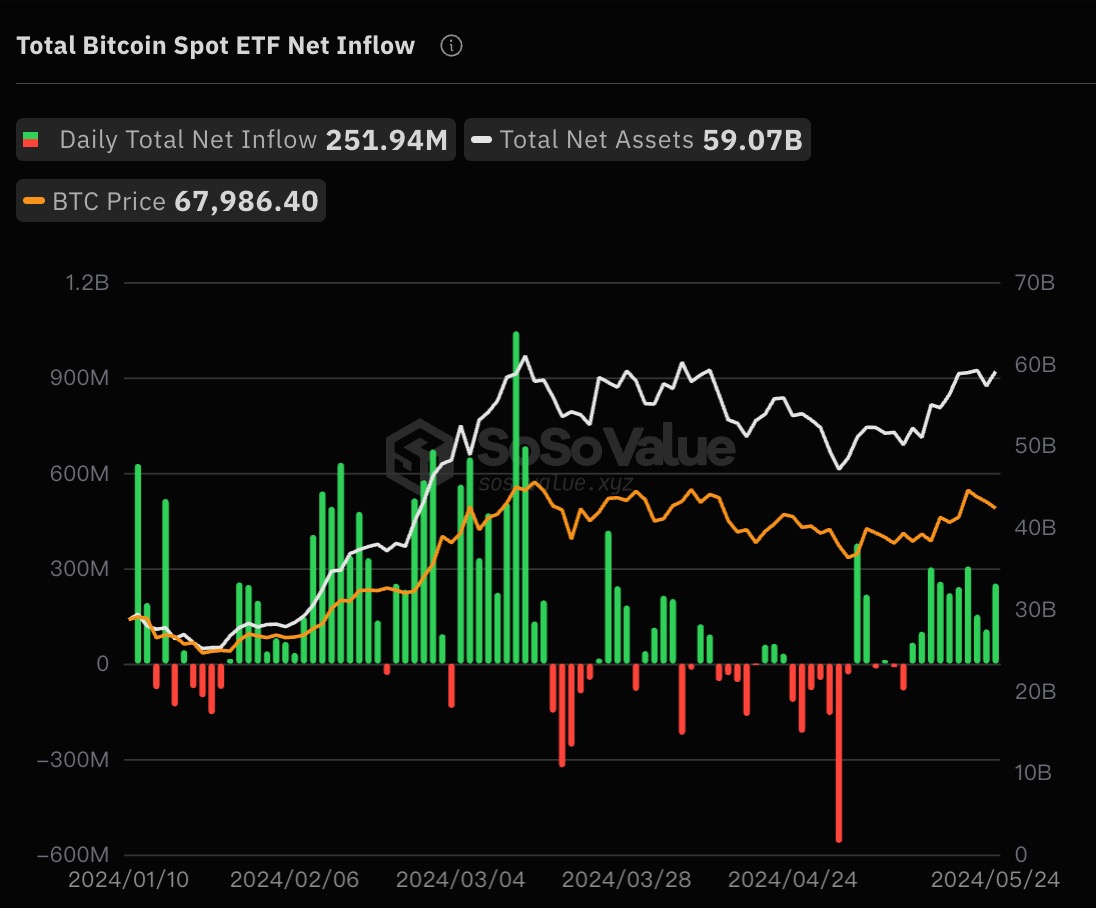

Last Friday, May 24th, marked the tenth successive day for sizeable investments in US Bitcoin spot ETFs. Data from SoSoValue indicates that the market experienced an aggregate influx of around $252 million, concluding a fruitful investment week.

Last Friday, BlackRock accumulated a significant portion of the daily investment, recording an intake of $182 million for the iShares Bitcoin ETF (IBIT). In contrast, Grayscale Bitcoin Trust (GBTC) failed to attract any capital during that day, marking the end of the week with no net inflows or outflows.

As a researcher, I’ve observed significant inflows into exchange-traded funds (ETFs) from other issuers aside from BlackRock last Friday. Fidelity, Bitwise, and ARK Investment were among the notable ones. In particular, Fidelity’s FBTC fund garnered approximately $43.7 million on that day, making it the second-largest inflow for the week.

As a crypto investor, I’m thrilled to note that the Bitcoin spot ETF market has seen substantial daily investments for the second week running. Specifically, this positive trend continued on the most recent trading day. In fact, by the close of last Friday’s session, the total net inflow for the past week reached an impressive $1.06 billion.

The persistent increase in investment toward Bitcoin ETFs indicates that investor trust in these financial instruments may have reached an unprecedented peak once more. Previously, when there was a prolonged influx of capital into Bitcoin ETFs, the value of Bitcoin hit a new record high.

As a market analyst, I’ve noticed an increasing interest in Ethereum spot Exchange-Traded Funds (ETFs) about to debut in the US markets. This trend towards crypto ETFs could potentially be the spark that reignites the crypto market, particularly Bitcoin, and completes the unfinished business of the bull cycle.

Bitcoin Price At A Glance

At present, the value of Bitcoin stands at $68,868, representing a 2.5% rise over the past 24 hours. Based on statistics from CoinGecko, this leading cryptocurrency has experienced a 3% growth on a weekly basis.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Aaron Taylor-Johnson Debuts New Look at 28 Years Later London Photocall

- How to Update PUBG Mobile on Android, iOS and PC

- Best Heavy Tanks in World of Tanks Blitz (2025)

2024-05-25 18:58