As a seasoned analyst with over two decades of experience in the tech and finance industries, I’ve witnessed countless transformations and trends. The upcoming Microsoft shareholder meeting, with its focus on Bitcoin as a potential investment, is yet another intriguing development that demands close attention.

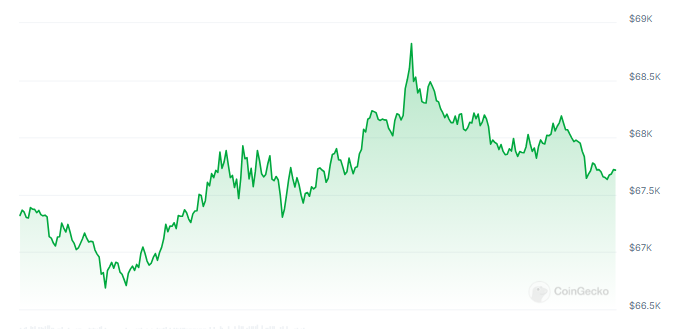

Microsoft is gearing up for a significant shareholders’ gathering scheduled for December 10th, where the possible incorporation of Bitcoin as an investment option might be a contentious issue. Currently, Bitcoin is valued at around $68,115, which equates to a roughly 1.22% rise in value.

The rise in interest aligns with constant debates around the cryptocurrency as an inflation hedge, which some Microsoft investors find appealing.

Microsoft’s Position On Bitcoin

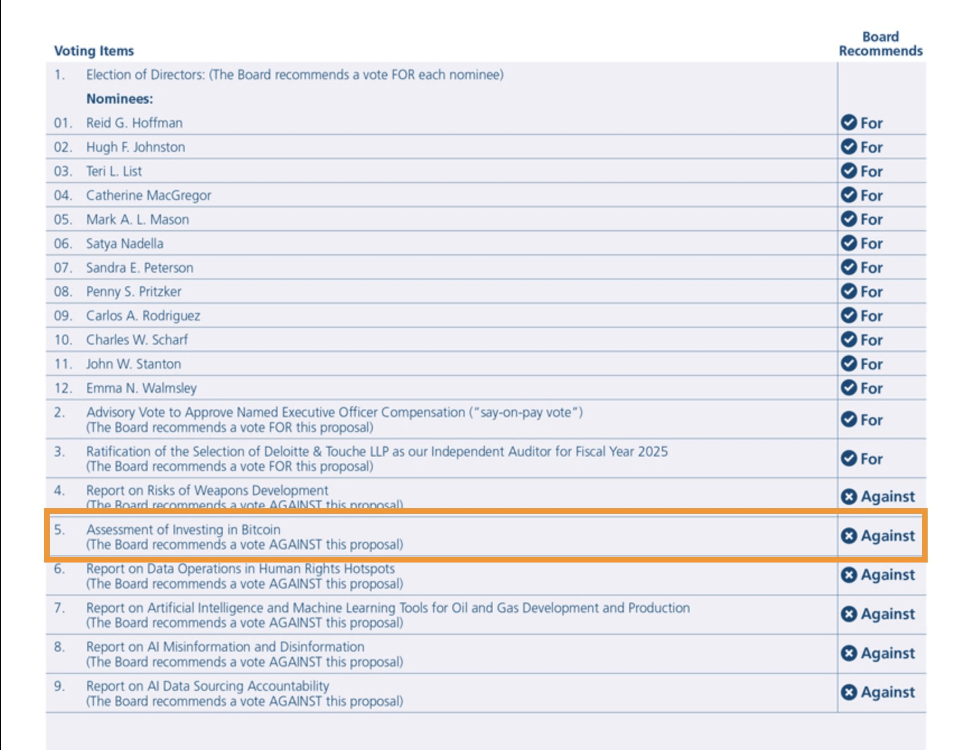

In simpler terms, Microsoft has mentioned in a recent filing with the U.S. Securities and Exchange Commission that they plan to discuss the possibility of investing in Bitcoin at an upcoming conference.

According to the National Center for Public Policy Research (NCPPR), Bitcoin has outperformed conventional investments and may serve as an effective method for safeguarding wealth during periods of inflation.

According to a recent Securities and Exchange Commission (SEC) disclosure, Microsoft is considering a possible board decision regarding the potential investment in Bitcoin.

The board is recommending that shareholders vote AGAINST the proposal.

— TFTC (@TFTC21) October 24, 2024

In contrast to this proposal, Microsoft’s board advises shareholders to reject it since the firm has previously examined numerous potential investments, among which are digital currencies like cryptocurrencies.

According to a spokesperson for the company:

“Volatility is one of the important aspects for all the investments in cryptocurrencies for corporate treasury”

Microsoft’s approach to managing its corporate treasury is meticulously strategic, also aiming to bolster shareholder value over the long term.

The board believes that the proposed public evaluation isn’t required since they are already keeping track of market trends and advancements within the cryptocurrency industry on their own.

Big-Wig Stockholders

A significant portion of Microsoft’s stocks is owned by several prominent investment firms like Vanguard, BlackRock, and State Street. As substantial stakeholders, they possess substantial influence over the company’s strategic decisions.

As a crypto investor, I understand that while some fellow investors are urging Bitcoin investments, I find myself resonating more with the board’s prudent approach. After all, it’s important to tread carefully when dealing with such volatile markets.

It’s worth mentioning that BlackRock has been steadily augmenting its Bitcoin assets via its exchange-traded funds (ETFs). Specifically, BlackRock’s iShares Bitcoin Trust ETF has seen substantial investments, totaling more than $317 million within a single day, as per recent updates.

This pattern suggests a growing number of institutions are showing more curiosity towards Bitcoin, even though Microsoft has yet to take similar steps.

The Road Ahead

With the approaching December conference, the discussion surrounding Bitcoin’s role in Microsoft’s investment strategy is growing increasingly heated.

The NCPPR proposes that companies ought to allocate a minimum of 1% of their total resources towards Bitcoin, with the aim of mitigating potential inflation threats. However, Microsoft maintains that their current strategies for distributing corporate funds are already adequate.

In just one year, Bitcoin’s value has nearly doubled, and it’s increased a stunning 414% over the past five years. While Microsoft might not be ready to dive into cryptocurrency investments yet, the growing attention from big-time investors like BlackRock indicates that Bitcoin’s conversation is far from finished.

The upcoming Microsoft shareholders’ gathering is generating a lot of interest, as there’s uncertainty about whether the tech powerhouse might change its stance on digital currencies or continue to prioritize financial stability in its investment approach.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Gold Rate Forecast

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Overwatch 2 Season 17 start date and time

2024-10-25 16:17