As a seasoned analyst with over two decades of experience in the financial markets, I’ve witnessed countless market fluctuations and trends. The meteoric rise of Bitcoin above $97,000 is an extraordinary event that rivals some of the most significant milestones in the history of finance.

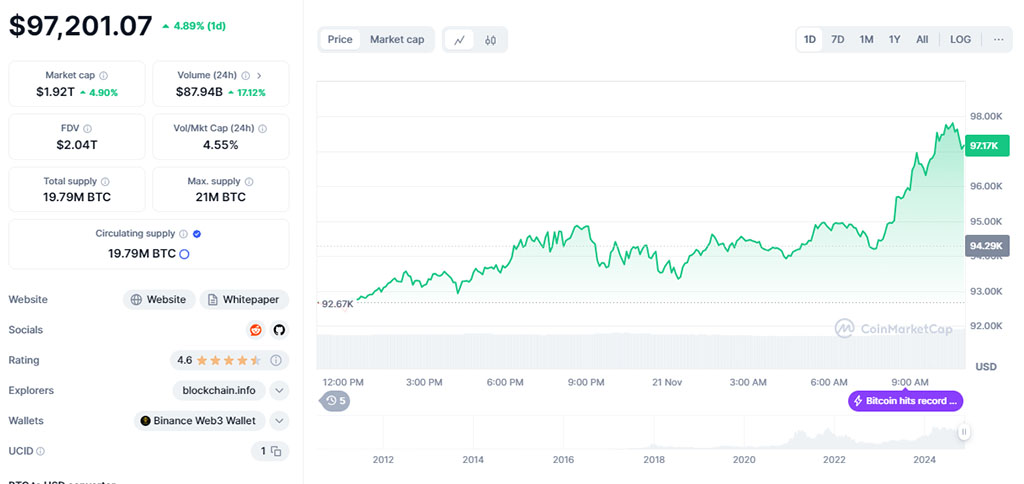

On Thursdays Asian session, Bitcoin surpassed $97,200 for the first time, fueled by investor optimism over potential regulatory reforms under President-elect Donald Trump. This significant leap brings Bitcoin close to the $100,000 mark, signifying increasing faith in its potential under the new administration. The 24-hour volatility stands at 4.2%, while the market cap is estimated at a whopping $1.92 trillion and the 24-hour trading volume reached $103.96 billion.

Source: CoinMarketCap

Over the last twelve months, Bitcoin’s worth has significantly surpassed itself by more than twofold. This surge was particularly noticeable within a fortnight post Trump’s election, with an impressive 40% rise. The influx of crypto-friendly legislators into Congress has further fueled this growth trend, indicating potential support for the cryptocurrency industry from legal frameworks. As a result, investors are growing optimistic about regulations that could boost the development of digital assets.

According to analyst Tony Sycamore from IG Markets, Bitcoin has moved into an overbought area but is being pulled towards $100,000. This indicates that the technical and market factors driving Bitcoin’s growth are strong, with traders continuing to hold a positive view on its future price trend.

Trump Pledges to Make US Crypto Hub

During his election bid, Trump expressed strong support for digital currencies and declared that he aimed to make America the leading global hub for cryptocurrencies. To achieve this goal, he suggested creating a national reserve specifically for Bitcoin, which was seen as a clear indication of his desire to integrate cryptocurrencies into the nation’s financial structure. This proposal garnered considerable interest from investors who directed substantial resources towards US-based Bitcoin exchange-traded funds (ETFs).

After the recent election, a staggering $4 billion has been invested in Exchange-Traded Funds (ETFs), demonstrating increased institutional interest. A significant event transpired this week with the introduction of options for BlackRock’s iShares Bitcoin Trust (IBIT). The number of call options, which represent wagers on price increases, has surpassed put options, suggesting a positive outlook towards Bitcoin’s price trend.

Stocks tied to Bitcoin have mirrored the digital currency’s rising pattern. For instance, MARA Holdings, a well-known Bitcoin miner, experienced a 14% increase in share prices overnight. Furthermore, MicroStrategy, a software company with substantial Bitcoin investments, witnessed a 10% rise in its stock, boosting its market worth beyond $100 billion. This indicates a growing faith in Bitcoin’s continued growth path.

Will US Crypto Policies Gain Clarity Soon?

According to Peck, who leads digital assets at WisdomTree, there’s increasing interest in whether the present government will bring long-overdue regulatory clarity for the crypto industry. He conveyed a blend of hopefulness and wariness, suggesting potential advancements in regulation while underlining the challenges of realizing tangible progress.

With the green light given to Bitcoin ETF options, it’s not just about the evolution of the crypto ETF sector – we’re witnessing Bitcoin establishing itself as an accepted asset class for mainstream institutional investment, standing side by side with stocks, bonds, and commodities.” (Nathan McCauley, CEO and Co-Founder of Anchorage Digital)

The price hike in Bitcoin can be traced back to November 5, when Trump was elected president instead of Vice President Kamala Harris. Speculations suggest that the White House may soon create a specific role for crypto policy, marking the first time such a position has existed in the White House. This could indicate a more organized and favorable stance towards regulating cryptocurrencies.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Gold Rate Forecast

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Overwatch 2 Season 17 start date and time

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

2024-11-21 12:06