The price of Bitcoin has persistently dropped, with recent data indicating a significant decrease in the amount flowing into the cryptocurrency market.

Cryptocurrency Capital Inflows Have Seen A Notable Drop Recently

According to a recent post by analyst Ali Martinez on X, there’s been a decrease in capital flowing into the cryptocurrency market during the last month. Most of this money enters or leaves the digital asset market through three primary categories: Bitcoin (BTC), Ethereum (ETH), and stablecoins. It isn’t until these inflows reach these coins that they subsequently move into other, alternative cryptocurrencies (altcoins).

In essence, the transactions linked with these digital assets might serve as indicators for the overall net transfers within the cryptocurrency market. To calculate these flows, one could employ the Realized Capitalization metric when analyzing Bitcoin and Ethereum transactions.

The Realized Cap is a model used on the blockchain to calculate the overall worth of any particular asset. This is done by supposing that the true value of each circulating token is equivalent to the price at which its latest transaction occurred within the network.

In simpler terms, each coin’s final transaction represents where it was last traded, and the price at that moment serves as its current cost basis. By totaling up these values for all coins in circulation, we arrive at the Realized Capitalization, which essentially shows the collective investment capital put into the asset by all investors.

The movements of capital in Bitcoin and Ethereum can be likened to shifts in these indicators. On the other hand, since the prices of stablecoins are consistently pegged near the $1 value, changes in their collective market capitalization provide an adequate means for tracking capital flow.

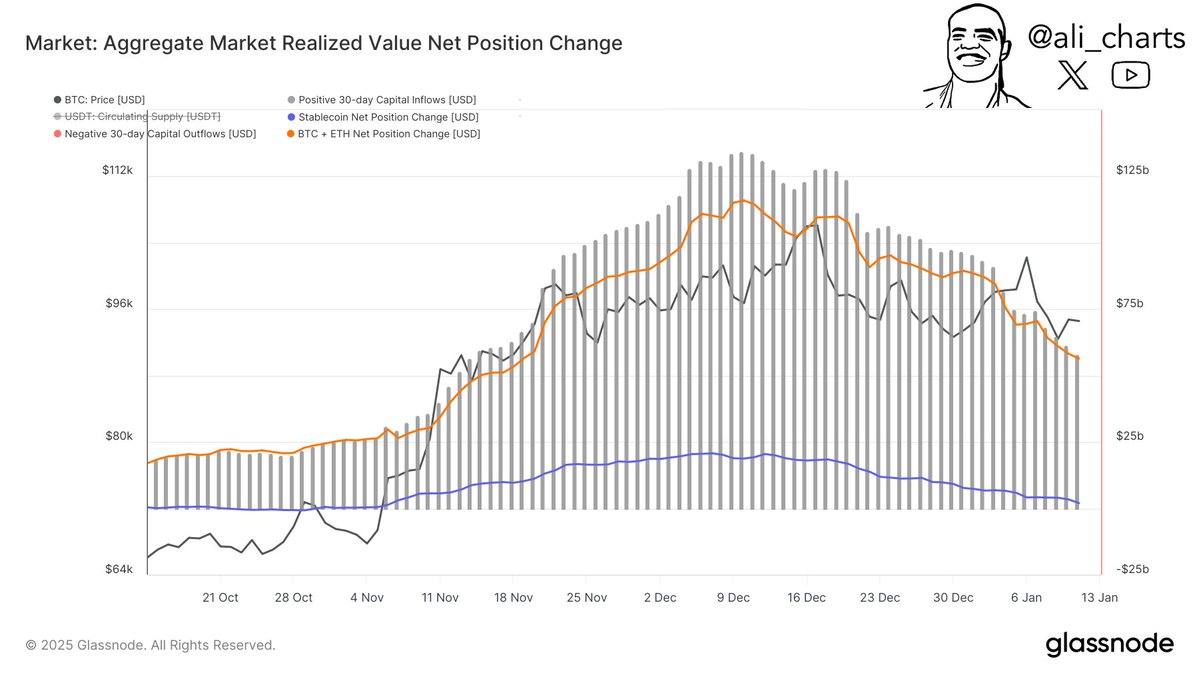

Here’s a chart provided by the analyst illustrating the trend of 30-day inflows for the past several months across the three investment categories:

Over the past couple of months, as shown in the provided graph, there’s been a steady influx of capital into the cryptocurrency market, with more money flowing in than out, which is indicated by positive netflows.

It seems that the inflow rate for the past 30 days reached its highest point last month, and since then it’s been on a steady decline. Over this time period, the value of this metric has dropped from $134 billion to $58 billion, which represents a significant decrease of over 56%.

According to Martinez, this indicates a substantial decrease in investment actions, which might explain why Bitcoin and other assets have been moving towards a downward trend lately due to the slowing of financial inputs.

BTC Price

Earlier today, Bitcoin dipped below $91,000, but it seems to have recovered and is currently being traded at approximately $91,800.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Like RRR, Animal and more, is Prabhas’ The Raja Saab also getting 3-hour runtime?

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

2025-01-14 11:10