As a researcher with a background in financial markets and a keen interest in cryptocurrencies, I’ve been closely following the recent developments in Bitcoin’s price action. The past day has seen a significant drop in the asset’s value, pushing it below the $67,000 mark.

Over the last 24 hours, Bitcoin has experienced a significant drop in value, causing its price to dip below the $67,000 mark. The following historical price level may serve as potential support for the asset.

Bitcoin Is Now Not Far From The Short-Term Holder Realized Price

I, as a researcher, have observed an uptrend in the Realized Price of Bitcoin held by short-term investors. At present, this price hovers around the $64,000 mark.

The term “Realized Price” in this context signifies an on-chain measurement that monitors the average investor’s cost basis within the Bitcoin market. This metric derives from the “Realized Capitalization” approach for cryptocurrencies.

If the current market price of an asset exceeds its realized price, this indicates that investors have accrued some unrealized gains at present. Conversely, when an asset’s value falls short of its realized price, it implies that investors have experienced more losses than profits in the market according to this metric.

When discussing the present subject, it’s essential to consider the Realized Price for a particular market segment – specifically, Short-Term Holders (STHs). These STHs are defined as investors who acquired their assets within the previous 155 days.

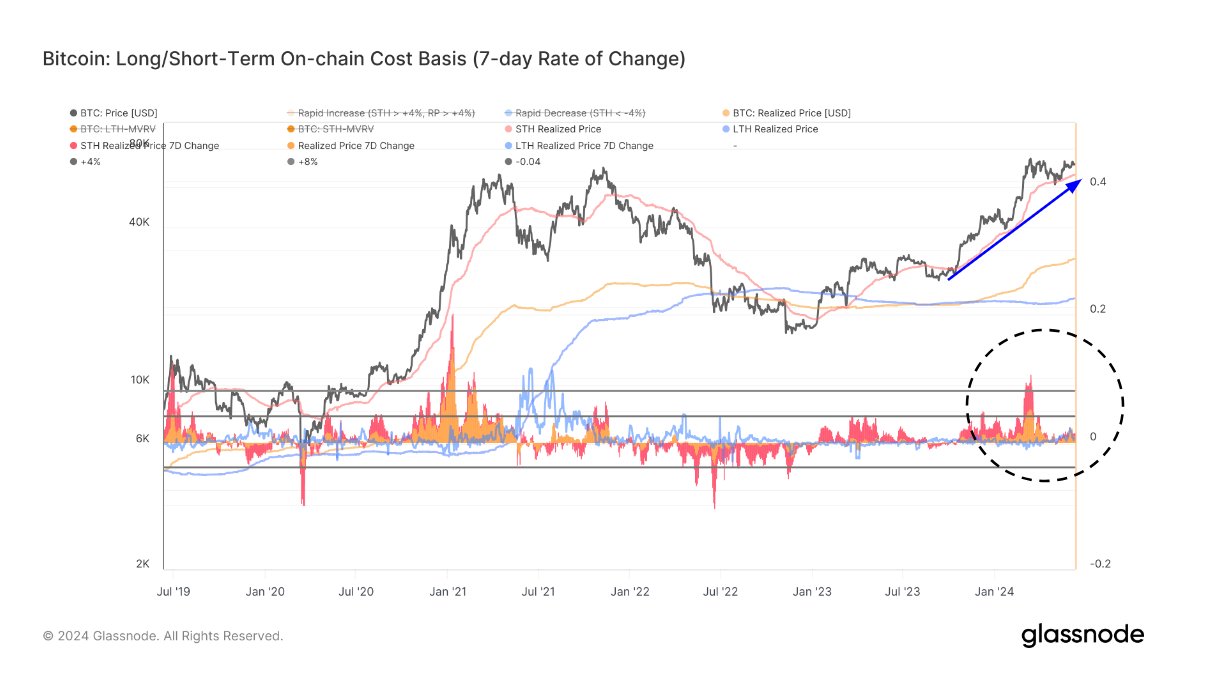

Over the past few years, this chart illustrates the development in the actual selling price of Bitcoins through the Stack-and-Trade (STH) method.

In the graph above, we observe that the Bitcoin STH (Short-Term Holder) Realized Price surged significantly during the market rally leading up to the asset’s all-time high price (ATH). This development can be explained logically because new investors, represented by the STH cohort, had to buy at progressively higher prices as Bitcoin rose, consequently boosting their average purchase price.

Following Bitcoin’s price consolidation after reaching an all-time high in March, the upward trend of this indicator has become less swift, yet it continues to rise, now hovering around $64,000 after the latest increase.

As a researcher studying the behavior of Shibaswap (STH) tokens in the cryptocurrency market, I’ve noticed that the Realized Price plays a pivotal role in determining both support and resistance levels. Historically speaking, this critical indicator has shown a propensity to switch between providing essential foundation for price recovery and acting as an insurmountable barrier for further growth.

In bullish markets, this metric can help identify potential bottom formations for cryptocurrencies, thereby maintaining their value above the given level. Conversely, during bearish trends, the metric often functions as a resistance level, preventing the coin from rising above it. Crossing above this threshold has historically signaled a reversal in trend direction for the cryptocurrency.

I. The consistent trend may persist due to the STHs’ tendency to be highly reactive, given their relatively limited experience. II. For investors in this group, the cost basis holds significant importance. III. However, they might be more prone to anxiety when their cost basis is tested.

During a bullish market, self-directed investors (STHs) might choose to purchase additional assets when prices decrease to their average purchase price, viewing the decline as just a “temporary dip” in the market. Conversely, during bearish phases, they could react to similar price tests by selling in a state of panic instead.

The graph indicates that Bitcoin rebounded from this level during the late April/early May market downturn, which could signify that bullish sentiments have persisted.

It’s intriguing to observe Bitcoin (BTC) dipping below the $67,000 mark recently and approaching the realistic selling price of $64,000 for holders (STH). The upcoming potential retest could yield fascinating results.

BTC Price

At the time of writing, Bitcoin is trading at around $66,800, down over 3% in the past week.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-06-11 23:13