As a researcher with experience in cryptocurrency market analysis, I find the recent downturn in Bitcoin’s price concerning. The failure of the $69,000 support level and the rejection of the 21-day moving average are bearish signals that cannot be ignored. The lack of strong buying pressure, or bid liquidity, as highlighted by market analyst Keith Alan, exacerbates this downtrend.

The price of Bitcoin (BTC) is experiencing renewed downward pressure and dipped below the $68,000 mark during the June 11th Asian trading session. Analysts are issuing warnings of possible further declines, with some expressing concern about a potential slide towards $60,000.

Photo: TradingView

The bearish outlook arises from Bitcoin’s 3.88% drop over the past day, causing it to reach lows around $66,800, as indicated by TradingView. The crucial support level at $69,000 was unable to prevent this decline, and the thin order book added to the selling pressure.

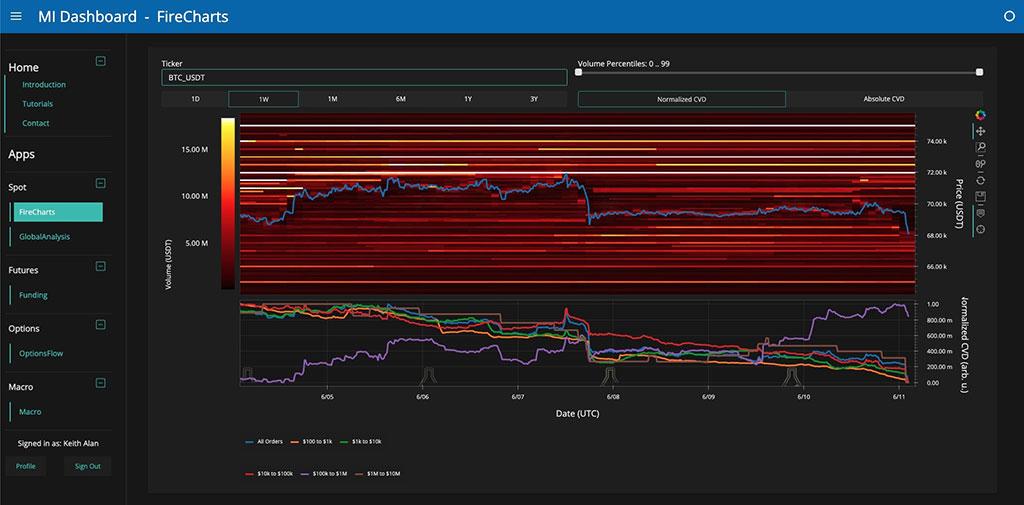

Market analysts express concern over the absence of robust buying demand, commonly referred to as “bid depth” or “strong bids.” Keith Alan, co-founder of Material Indicators, recently brought attention to this issue in his YouTube update.

“We do have some bid support at various levels in this market, but it’s not excessively concentrated there. In fact, there’s only moderate bid support even as low as $60,000.”

$69K Support Fails amid Bearish Signals

As a crypto investor, based on my analysis using Material Indicators, I see a bearish forecast for Bitcoin. The recent price decline has caused Bitcoin to reject both the significant support level at $69,000 and the 21-day moving average, which is an essential indicator of short-term trends.

Photo: Material Indicators

“The 21-day moving average and the RSI flip at $69,000 have lost their significance in the analysis. The price action is far from finished. I anticipate the ‘killer whale’ patterns to persist until Jerome Powell’s comments on Wednesday and the economic reports due on Thursday.”

This week, Bitcoin and the wider crypto market could see volatility due to imminent US economic data releases. Keep an eye on the following significant events: The Consumer Price Index (CPI) and Producer Price Index (PPI) reports, the Federal Reserve’s interest rate decision, and Jerome Powell’s subsequent press conference.

Expert’s take: Renowned trader Skew expressed his perspective on the relationship between recent events. He pointed out that Consumer Price Index (CPI) and Producer Price Index (PPI) have been hovering near their upper limits, whereas the Federal Open Market Committee (FOMC) meetings have resulted in temporary dips. The upcoming period, according to Skew, promises intrigue.

Will Bulls Defend $65,000?

Although a drop to $60,000 is a possibility, some analysts express cautious optimism due to the potential influence of large-volume traders. Credible Crypto, a notable industry figure, suggests that these traders’ actions might hinder a more significant decline. He highlights “spot absorption” on dips as evidence of buying interest even at lower price points.

He additionally pointed out the quick cancellation of sell orders (or resistance) at $72,000 when the price began to reverse. This implies that certain whales could be orchestrating market manipulation strategies.

As an analyst at Credible Crypto, I believe it’s plausible that we could reach lows around the $62,000 to $65,000 mark. However, it’s important to note that this is not a certainty. The upcoming price action within the next 24 hours should provide us with valuable insights into the potential direction of the market.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-06-11 16:21