As a seasoned researcher with a penchant for deciphering the cryptic world of blockchain and digital currencies, I find myself captivated by the recent analysis from CryptoQuant. The parallels drawn between Bitcoin’s short-term holder behavior in 2019 and the current market structure are intriguing, to say the least.

A recent Quicktake analysis on the on-chain analytics platform CryptoQuant highlighted how Bitcoin’s short-term holders’ (STH) behaviour is similar to that of 2019. This analysis comes as Bitcoin remains below $60,000, continuing the bearish September trend.

Peak In Bitcoin’s Short-Term Holders Similar To 2019 Structure

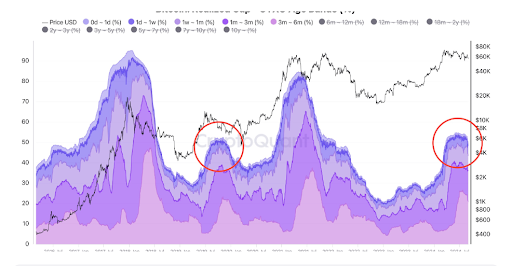

As a crypto investor, I recently noticed an intriguing pattern in Unspent Transaction Outputs (UXTOs) under six months. This minor peak seems strikingly similar to one we saw back in 2019. Upon closer examination, it turns out that these UXTOs represent newcomers or short-term investors who joined the market around March of this year when Bitcoin reached its latest all-time high (ATH)

The analyst’s interpretation is that the decreasing number of UXTOs implies that some investors may have withdrawn from the market because of Bitcoin’s volatile pricing trends since March, or they might have kept their investments and transformed into long-term holders (those who have had UTXOs for six months or more)

The chart provided illustrates that a comparable pattern emerged close to the halving event in 2019, during which Bitcoin also achieved a local peak. Following this peak, Bitcoin’s price experienced a dip and required approximately 490 days to reach another all-time high (ATH), although Avocado_onchain pointed out that the COVID-19 pandemic also played a role in this period of stagnation

This progression offers clear indications about the potential future trajectory of Bitcoin for long-term investors, despite its short-term price fluctuations. Avocado_onchain expressed optimism regarding Bitcoin’s long-term growth trend, but he advises investors to curb their enthusiasm and keep a close eye on market movements in the immediate future

Simultaneously, while the analyst acknowledged there’s no specific event causing a Bitcoin surge, he pointed out that an influx of funds from new investors has often played a crucial role in driving up Bitcoin prices. Notably, Bitcoin reached a record high in March due to the introduction of Spot Bitcoin ETFs, which brought fresh capital into the Bitcoin market

Bitcoin Looks To Continue Bearish September Trend

This year, it appears that Bitcoin might carry on its downward trend in September, a traditionally challenging month for the cryptocurrency. Since the start of the month, Bitcoin has dropped by more than 4%. In fact, based on statistics from Coinglass, Bitcoin has experienced a monthly loss in six out of the last seven Septembers, starting from 2017

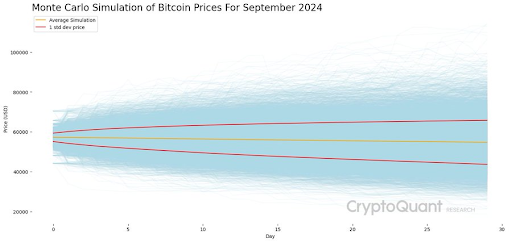

According to CryptoQuant’s Head of Research, Julio Moreno, who recently simulated Bitcoin’s price for this month, he predicts an average closing price of $55,000 by the end of the month. Earlier, Moreno warned that if Bitcoin falls below $56,000, it could be at risk for a more significant price correction and potentially enter a prolonged phase of bearish trend

Currently, the cryptocurrency community anticipates that the US Federal Reserve might decrease interest rates during its upcoming FOMC meeting on September 17-18. Such a rate reduction is thought to potentially spur Bitcoin’s value and facilitate a surge past $60,000

Currently, as I’m typing this, Bitcoin is being traded approximately at $56,400. Over the past day, it has experienced a decrease of more than 4%. These figures are based on information provided by CoinMarketCap

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- The First Descendant fans can now sign up to play Season 3 before everyone else

- Like RRR, Animal and more, is Prabhas’ The Raja Saab also getting 3-hour runtime?

2024-09-04 23:11