Based on CryptoQuant’s recent weekly analysis, it’s predicted that the value of Bitcoin (BTC) could potentially reach between $145,000 and $249,000 by 2025. This projection is supported by increasing investments from institutions and positive crypto regulations, which are seen as major factors contributing to Bitcoin’s potential price growth.

Bitcoin To Benefit From Increasing Institutional Flows

After experiencing a sudden drop to $89,256 earlier this week, Bitcoin is making an effort to regain the $100,000 mark. A recent analysis by CryptoQuant suggests that BTC might reach a high of $249,000 in the current year, buoyed by several positive factors such as a supportive stance towards cryptocurrencies from the Trump administration in the U.S.

The report forecasts a significant rise in Bitcoin’s price, reaching around $145,000 by 2025, primarily driven by increased investments, and estimates that over half a trillion dollars could enter the Bitcoin market this year based on historical investment patterns.

Given a favorable regulatory landscape, easy-going monetary policies, and recurring trends, it seems likely that investments will persistently move towards Bitcoin in the year 2025.

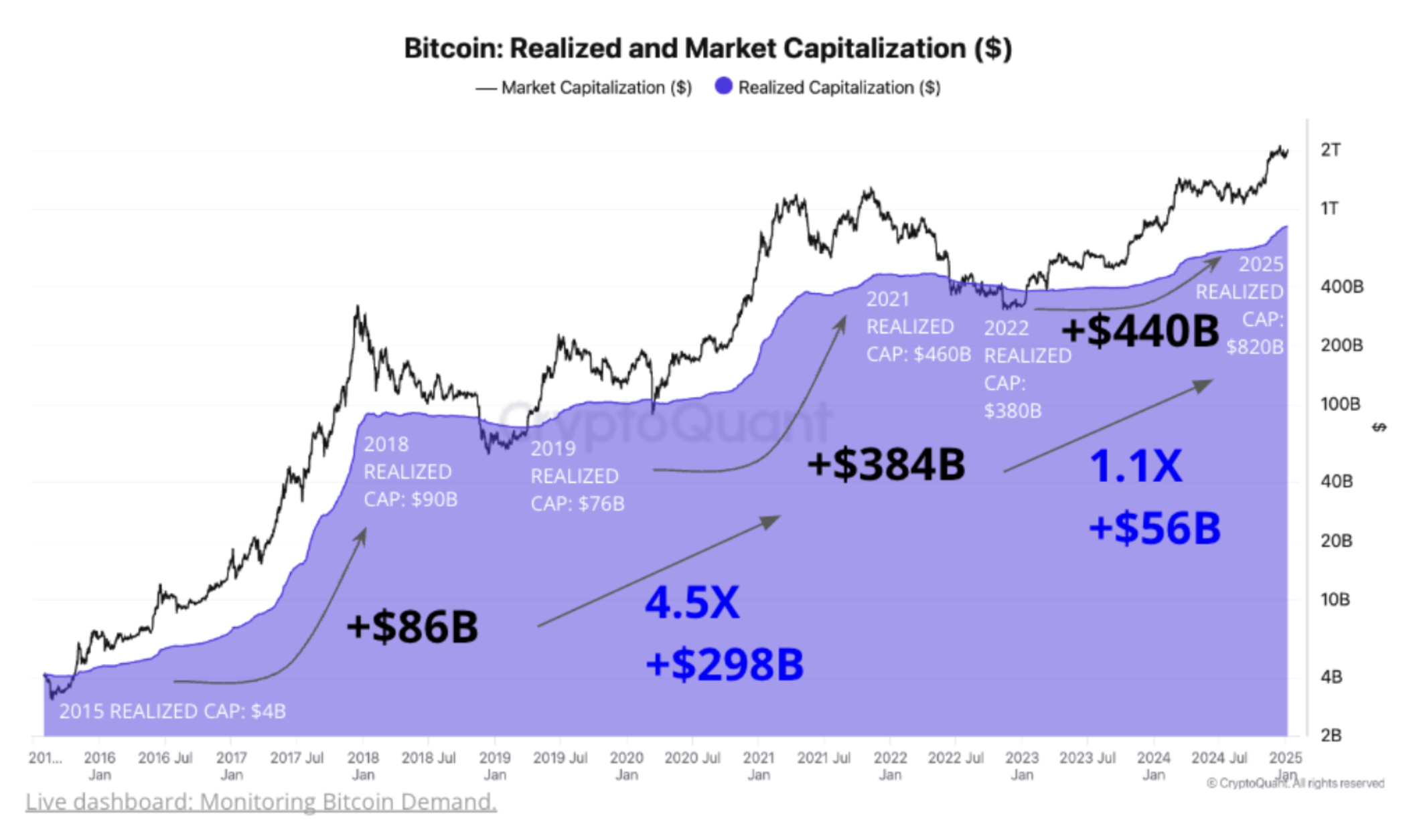

This graph shows the total worth of Bitcoins in U.S. dollars since 2015, calculated by adding up the value of each Bitcoin whenever it was last transferred between wallets (also known as ‘on-chain’).

Based on past market trends, it’s possible that the predicted inflow of $520 billion into Bitcoin could materialize. This additional funding might propel the Bitcoin price to ranges between $145,000 and $249,000. The increase in Bitcoin’s realized capitalization tends to have a disproportionately large impact on its market value and price.

The analysis emphasizes that major institutional investors, specifically those with bitcoin holdings ranging from 100 to 1,000, are leading the way in market investment. Most of these investors are associated with high-level custodial services and Bitcoin Exchange-Traded Funds (ETFs).

Significantly, major institutions boosted their Bitcoin investments by a substantial $127 billion in 2024, demonstrating strong faith in the cryptocurrency’s long-term prospects. Furthermore, it’s worth noting that the last year of Bitcoin’s four-year cycle is typically characterized by significant price increases for this digital asset.

All Eyes On US Federal Reserve

Although several Bitcoin analysts and market observers remain hopeful about its future in 2025, others voice concern over the possible effects of the U.S. Federal Reserve’s (Fed) postponed interest rate reductions due to inflation worries and reduced retail investment activity.

For example, a recent study by 10x Research suggests that if the Fed delays raising interest rates, it could slow down Bitcoin’s price increase trend. Moreover, information from CME FedWatch shows that there is a 97.3% likelihood that the Federal Reserve will choose not to adjust rates during their upcoming meeting this month.

In summary, Sygnum, a well-known asset manager, believes that Bitcoin could experience fluctuations in demand due to increasing acceptance among institutional investors. Currently, the value of one Bitcoin stands at approximately $99,309, representing an increase of 2.9% within the past day.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Delta Force Redeem Codes (January 2025)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Criminal Justice Season 4 Episode 8 Release Date, Time, Where to Watch

- Gold Rate Forecast

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

2025-01-16 19:01