As a seasoned crypto investor who has witnessed the rollercoaster ride of Bitcoin since its inception, I can’t help but feel a sense of cautious optimism when it comes to the potential impact of the US presidential election on BTC prices. The analogy of a ‘debasement trade’ resonates deeply with my investment philosophy, especially given the unprecedented money printing we’ve seen in recent times due to the pandemic and subsequent economic stimulus packages.

As a researcher studying cryptocurrency trends, I’ve come across an interesting perspective: If the Republican US presidential candidate, Donald Trump, were to secure a victory, it might potentially accelerate the upward trajectory of Bitcoin (BTC). This is based on JPMorgan analysts’ predictions.

Retail Investors Turn To Bitcoin For ‘Debasement Trade’

According to the latest insights from JPMorgan’s team of analysts, if Donald Trump wins the election, it could potentially lead to increased value in both Bitcoin and gold. This is because more individual investors are starting to see Bitcoin as a way to counteract currency devaluation, or a ‘dollar debasement trade.’

In simpler words, a debasement trade is a financial strategy used to shield the value of assets during prolonged periods when governments print large amounts of their currency, potentially reducing its worth over time. This is often done to preserve purchasing power.

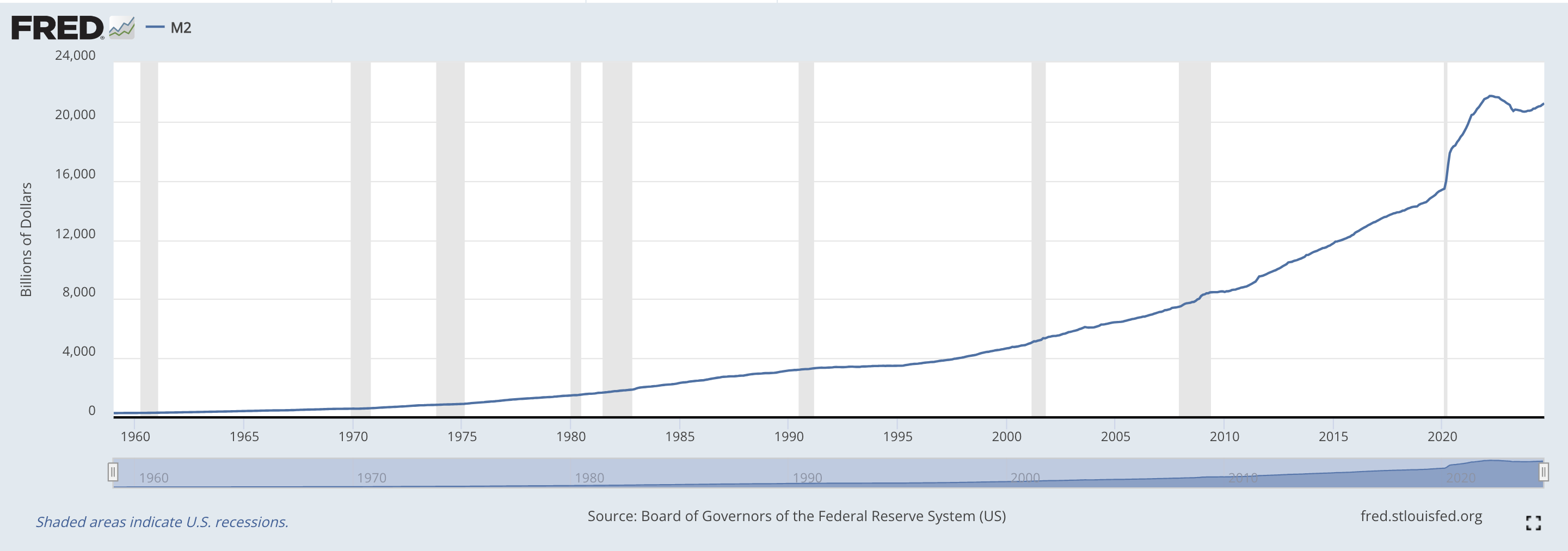

As a researcher, I observed a significant increase in the M2 money supply – the total amount of money circulating – during the coronavirus pandemic. This surge in money supply contributed to an uptick in inflation, prompting the U.S. Federal Reserve (Fed) to adjust its monetary policy by raising interest rates to curb this inflationary pressure.

Through buying Bitcoin, individual investors are seeking to preserve the worth of their funds, anticipating that Bitcoin might function as a safeguard against the decline in the value of traditional currencies, as suggested by a recent JPMorgan report.

It seems that individual investors are increasingly jumping on board with the ‘devaluation strategy’, as evidenced by their purchases of Bitcoin and Gold Exchange-Traded Funds (ETFs). Additionally, this retail trend is also noticeable in the surge of meme and AI tokens, whose market capitalization has significantly outperformed.

Over the last two days, I’ve observed an impressive surge of $1.3 billion flowing into Bitcoin exchange-traded funds (ETFs), as per the data from SoSoValue. As we stand on October 30th, the total net inflow to US-based spot BTC ETFs has reached a staggering $24.18 billion.

Inflows into Exchange Traded Funds (ETFs) related to Bitcoin reached a staggering $4.4 billion in October, making it the third-largest month for such inflows since their debut earlier in the year.

Lately, it seems institutional investors are less active in Bitcoin futures, as analysts point out that the market has reached an overbought state. This could make Bitcoin vulnerable to short-term price fluctuations.

The client note highlights that credit and prediction markets lean toward a Trump win, unlike equities, foreign exchange (FX), and rates markets. The analysts conclude:

In essence, if a Trump victory encourages retail investors to purchase high-risk assets and increase their participation in the ‘debasement trade’, it may lead to increased value for Bitcoin and Gold prices in a scenario where Trump is elected.

Where Is BTC Headed? Analysts Share Their Outlook

Currently, Bitcoin is close to hitting a fresh record high, which has sparked increased enthusiasm among cryptocurrency experts.

As a crypto analyst myself, I’ve recently proposed that Bitcoin (BTC) might soar up to $100,000 by February 2025.

It seems from the data on cryptocurrency options trading that traders are optimistic Bitcoin will reach $80,000 by the end of November 2024, regardless of the election results.

Experienced trader Peter Brandt has warned potential Bitcoin investors to exercise caution, emphasizing that a daily closing price above $76,000 is essential for validating a genuine breakout. At the current moment, Bitcoin is being traded at $71,798, representing a minor decrease of 0.1% over the past 24 hours.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Delta Force Redeem Codes (January 2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

2024-11-01 07:55