As a seasoned analyst with over two decades of experience in financial markets, I have learned to navigate through turbulent times and seize opportunities when they present themselves. The recent downtrend in Bitcoin is concerning, but not unforeseen or unexpected. Based on historical data, it seems that September has traditionally been a challenging month for the premier cryptocurrency. However, as we all know, past performance is not always indicative of future results.

Based on statistics from CoinMarketCap, Bitcoin had a rocky finish to August, shedding roughly 7.75% of its market value during the last week. This drop in price highlights Bitcoin’s overall poor performance as the crypto market leader over the past month, with a monthly decrease of 10.64%. It’s worth noting that, despite this downward trend, Bitcoin’s historical price data suggests that the bears might maintain control in the upcoming weeks.

September Popular For Negative Returns, Analyst Says

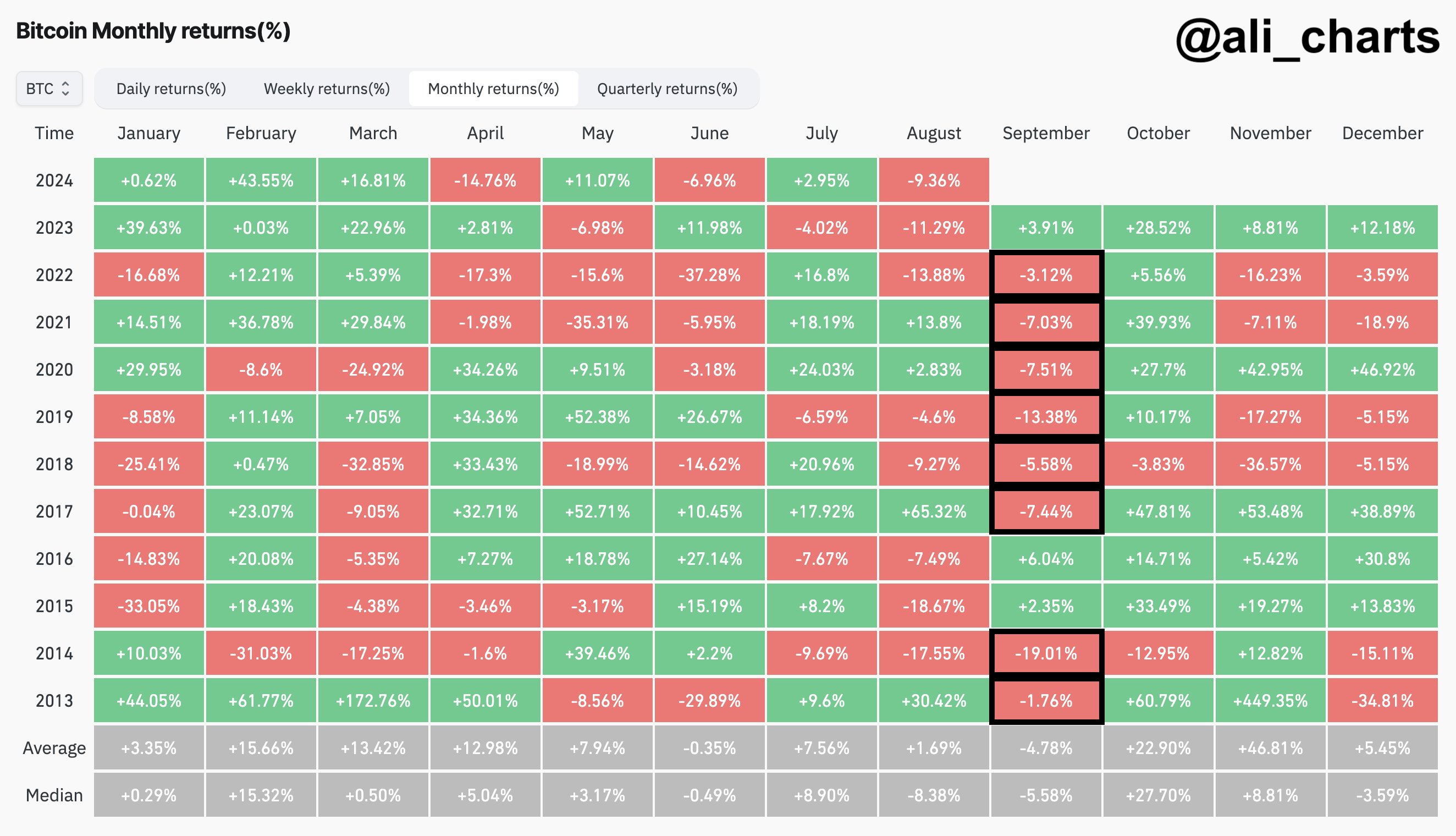

On Friday, well-known cryptocurrency analyst Ali Martinez cautioned Bitcoin investors to prepare for a potentially challenging month in September. According to his analysis using historical price data, Bitcoin tends to experience a total decline in value during September, as it has done in eight out of the last 11 years.

During the last month, Bitcoin has seen an average decrease of 4.78% and a median drop of 5.58%. This suggests that the value of Bitcoin might fall to around $55,618 to $56,105 over the next four weeks, according to this trend. Investors should be prepared for these potential price levels.

As a crypto investor, I find this phase of possible price decline intriguing because it might present an excellent opportunity for substantial Bitcoin accumulation. Historically speaking, Bitcoin, being the market leader, has demonstrated remarkable price surges during Q4. In fact, October has shown a positive cumulative return in 9 out of the last 11 years.

In the case of investors, November seems to hold a special appeal as it has seen impressive returns in recent bull markets – 42.95% in 2020 and 53.48% in 2017. On average, this month has shown promising potential for substantial price increases, with an average gain of around 46.81% since 2013.

Investors might want to approach December with careful consideration. Though Bitcoin has historically experienced impressive gains of up to 46.92% in December (as seen in 2020), it’s important to remember that there have also been substantial losses, such as the 34.81% drop observed in 2013. It’s worth noting that Bitcoin’s performance at year-end can be unpredictable, often showing both strong gains (an average price increase of 5.45%) and losses (a median price decrease of 3.59%).

Bitcoin Price Outlook

Currently, as I write this, Bitcoin is being traded at approximately $59,218, marking a 0.84% decrease in the past day. Simultaneously, the trading volume of this asset has experienced a growth of 3.05%, reaching a value of around $33.38 billion.

Based on Bitcoin’s daily chart analysis, it appears the dominant cryptocurrency is experiencing a period of price stabilization. A break beyond this stage might propel its value towards the $65,400 region. On the other hand, information from the Relative Strength Index suggests that Bitcoin is currently not overextended, which could potentially lead to additional declines. If this happens, investors may want to brace for a possible drop approaching $53,800.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-08-31 09:58