As a seasoned analyst with over two decades of experience in financial markets, I have witnessed numerous market cycles and trends that have shaped my perspective on investments. The current surge in Bitcoin (BTC) is particularly intriguing, given its historical performance during September. However, this year’s trend seems to defy tradition, with BTC poised to record its best September in a decade.

It appears that Bitcoin (BTC) is shaping up for one of its strongest Septembers in over ten years, exceeding the $65,000 mark. The unusual increase in value may be due to a variety of significant factors.

Reasons Behind Bitcoin’s Impressive September Gains

Historically, Bitcoin (BTC) has typically experienced poor price performance in September. But this year, BTC could be poised for its best September in over a decade due to various significant economic factors influencing the market.

For the first time in four years, the U.S. Federal Reserve (Fed) started reducing interest rates on September 18. They lowered rates by 0.5% (or 50 basis points), as a reaction to decreasing inflation and increasing joblessness.

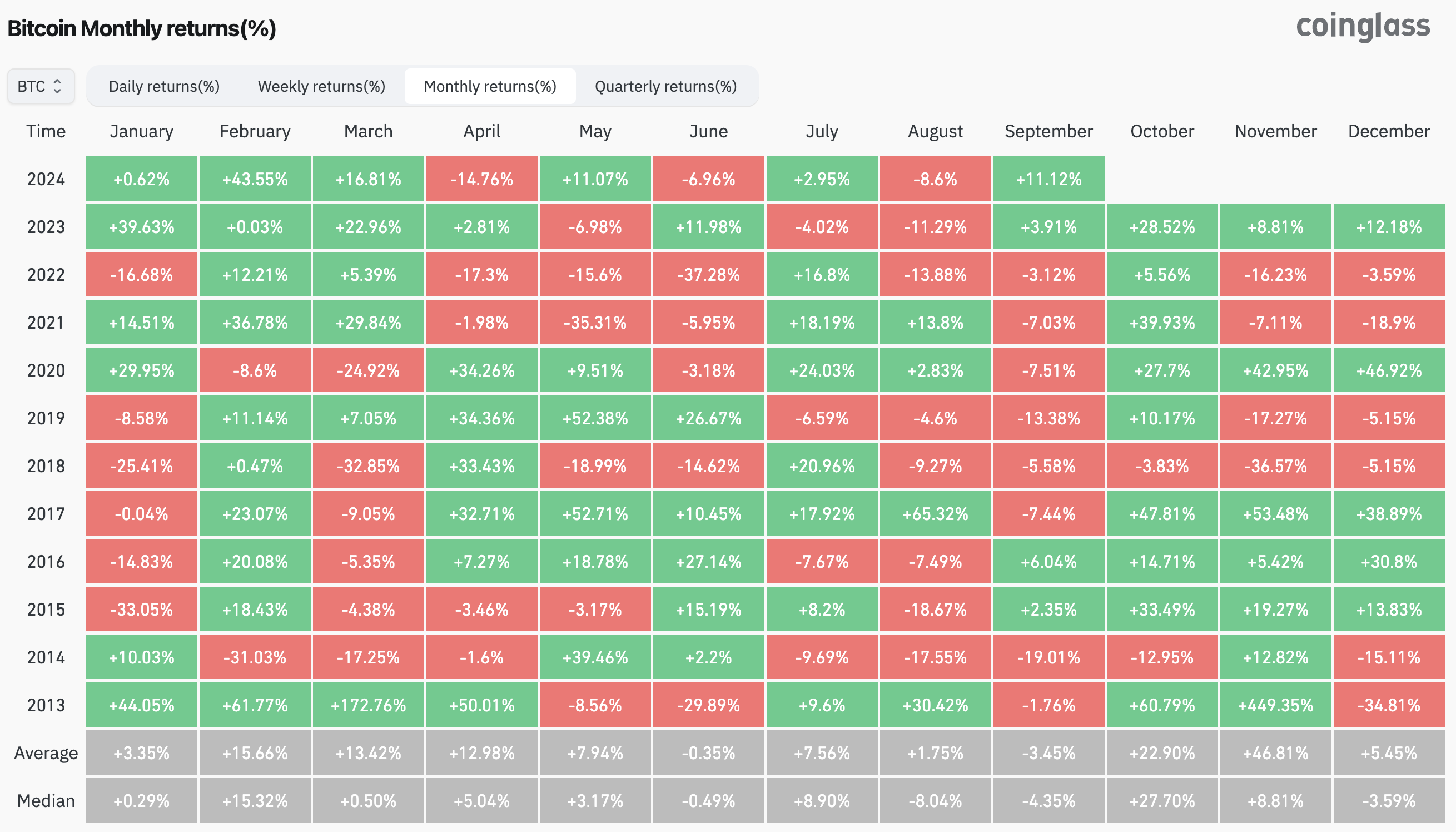

Following the immediate rate reduction, there was a noticeable boost in riskier assets such as BTC, which has seen a surge of more than 10% since then. In contrast, Bitcoin’s typical price drop during September, based on past decade data from CoinGlass, averages at 3.45%.

Based on the Federal Reserve’s decision, both the European Central Bank (ECB) and the People’s Bank of China (PBoC) reduced lending rates in an effort to boost their economies. This action served to push the price of Bitcoin closer to its prior peaks.

The Bitcoin halving, which took place in April this year and reduced miner’s block confirmation rewards from 6.25 BTC to 3.125 BTC, is now believed to be influencing the digital currency’s price fluctuations.

Historical trends suggest that Bitcoin’s halving often serves as a catalyst for increased prices because it reduces the supply in circulation. For example, following the halving in May 2020, the value of Bitcoin skyrocketed from around $8,900 to over $64,000 by April 2021 – a staggering eightfold increase within just under a year.

Currently, there’s a growing enthusiasm among both individual and institutional investors towards US Bitcoin exchange-traded funds (ETFs). On September 26 alone, these ETFs attracted a record-breaking daily net inflow of $365.57 million, the largest since late July. Since their introduction, the total cumulative net inflow for Bitcoin ETFs now stands at a substantial $18.31 billion.

Cautious Optimism Key To Riding The BTC Wave

It’s noteworthy that Bitcoin seems to have escaped the usual September downturn. However, it’s crucial to remember that for Bitcoin to reach a fresh all-time high, it must first surpass some significant price thresholds.

Previously mentioned, Bitcoin’s Relative Strength Index (RSI) has dropped beneath 80 in its monthly graph, suggesting that the digital currency’s prolonged surge in value could potentially slow down following a vigorous purchasing period.

Furthermore, a recent analysis by cryptocurrency exchange Bitfinex indicates that while Bitcoin has seen an upward trend, it needs to convincingly surpass a significant resistance point of around $65,200 to sustain its positive trajectory. Encouragingly for Bitcoin bulls, the cryptocurrency is currently maintaining its position at approximately $65,674, representing a 2% increase over the past day.

Read More

- Connections Help, Hints & Clues for Today, March 1

- The games you need to play to prepare for Elden Ring: Nightreign

- Shiba Inu Sees Bullish Reversal In On-Chain Metrics, Can SHIB Price Recover?

- Shruti Haasan is off from Instagram for THIS reason; drops a comeback message on Twitter

- When To Expect Blue Lock Chapter 287 Spoilers & Manga Leaks

- What Is Dunkin Donuts Halloween Munchkins Bucket?

- Chiranjeevi joins Prime Minister Narendra Modi for Pongal celebrations in Delhi; see PICS

- Sitara Ghattamaneni: The 12-Year-Old Fashionista Taking the Spotlight by Storm!

- Pepe Battles Price Decline, But Analysts Signal A Potential Rally Ahead

- Bitcoin’s Record ATH Surge: Key Factors Behind the Rise and Future Predictions

2024-09-28 09:40