As a seasoned crypto investor with a decade of experience under my belt, I must say that the current state of Bitcoin‘s Fear & Greed Index has me slightly concerned but not alarmed. Having witnessed numerous market cycles, I have come to understand that sentiment indicators like these can be useful guides, but they are not infallible prophets.

The data indicates that the Bitcoin market’s general feeling remains quite intense, leaning towards excessive optimism. This could suggest that a further decrease in prices might occur before we reach a turning point.

Bitcoin Fear & Greed Index Still Has A High Greed Value

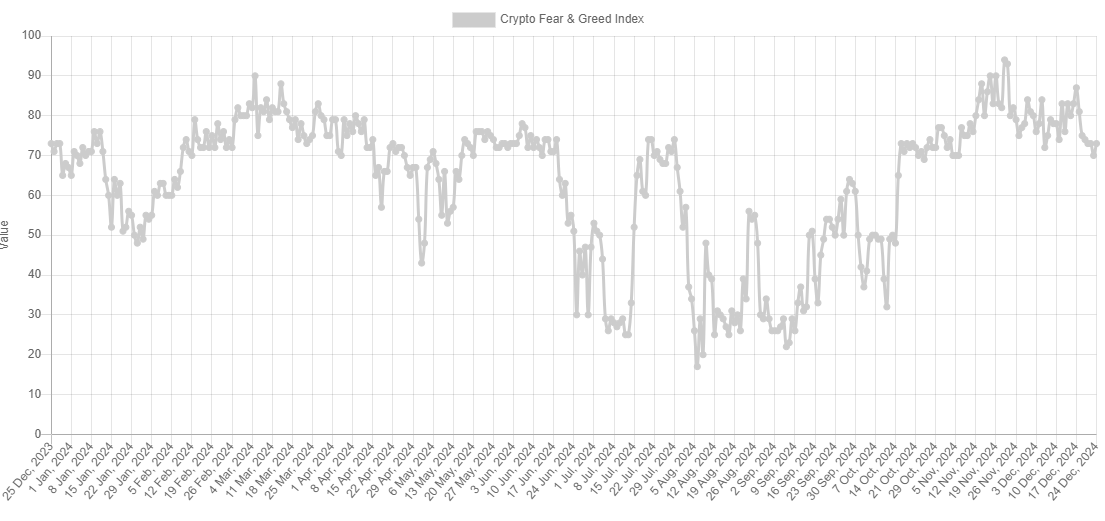

The “Fear & Greed Index,” developed by a certain entity known as Alternative, serves as a tool to gauge the overall emotional state or sentiment of investors in the Bitcoin and broader cryptocurrency market.

As a crypto investor, I find it intriguing to note that an index we’re following employs a scale from zero to a hundred to express the overall sentiment. When this value exceeds 53, it suggests that investors are predominantly feeling greedy, while figures below 47 indicate a prevailing sense of fear in the market. Values landing within these thresholds reflect a balanced or neutral mood among investors.

Presently, let me share with you what the prevailing emotion within the cryptocurrency market appears to be as indicated by the Bitcoin Fear & Greed Scale.

Looking at the data right now, I see that the indicator reading stands at 73, indicating that on average, traders are feeling quite greedy – and this isn’t just a little bit of greed, but a strong, nearly overwhelming sense of it. This level is actually close to what we call the “extreme greed” region, suggesting there might be some significant potential for market correction.

In simpler terms, ‘extreme greed’ sets in when the index exceeds 75, while ‘extreme fear’ can be found on the other side, below 25, on the fear scale.

Historically, strong opinions, whether positive or negative, have played a significant role in the price movements of Bitcoin and other cryptocurrencies. Prices often peak or trough when the market is within these opinionated zones.

Typically, the connection between price and sentiment tends to work in reverse, implying that intense optimism often results in peaks and intense pessimism triggers valleys. The recent peak in Bitcoin’s price happened when the sentiment index stood at 87.

As a researcher examining the current market scenario, I’m pondering if the recent cooling down in sentiment is substantial enough. Typically, significant market phases demand a plunge into apprehension or even extreme fear to reach their bottoms. However, bull markets tend to experience shallower pullbacks. The challenge lies in determining whether this cooling off aligns with a typical bull market recovery or if it’s a precursor to a more substantial correction.

Frequently, just entering the common zone of ambition or a balanced state can be enough to revitalize the price movement. However, given the current mood, which is almost at an extreme level of greed, a significant shift might be required before we witness a genuine reversal.

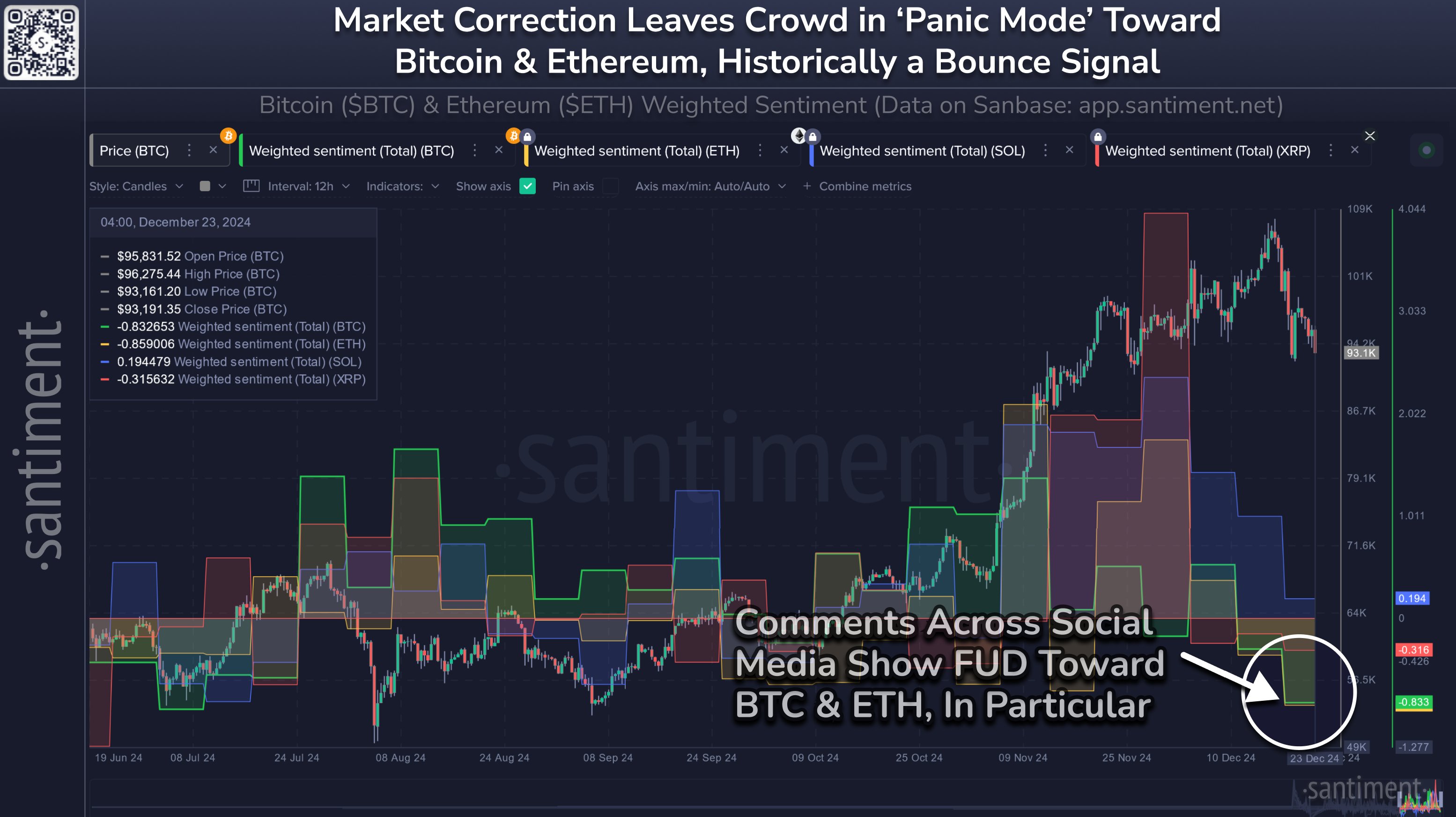

The Fear & Greed Index determines its score based on several elements, including public sentiment on social media. Although the general mood remains optimistic, there’s a growing sense of apprehension among social media users, according to a recent post by analytics company Santiment.

BTC Price

Over the past 24 hours, I’ve noticed a significant 6% surge in the value of Bitcoin. This could be a sign that the recent plunge into ‘greed’ sentiment might have been just what was needed to kick-start another rally.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Delta Force Redeem Codes (January 2025)

- Gold Rate Forecast

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Overwatch 2 Season 17 start date and time

2024-12-25 06:40