As a seasoned crypto investor with battle-scarred fingers from countless dips and rallies, I find myself both intrigued and cautious by the recent spike in positive sentiment around Bitcoin. The last time we saw such optimism was during the 2017 bull run, which ended in a brutal correction that left many investors licking their wounds.

It appears that a surge in favorable opinions about Bitcoin is being noticed on social platforms following its price rise above $58,000, which might suggest that investors could be experiencing fear of missing out (FOMO).

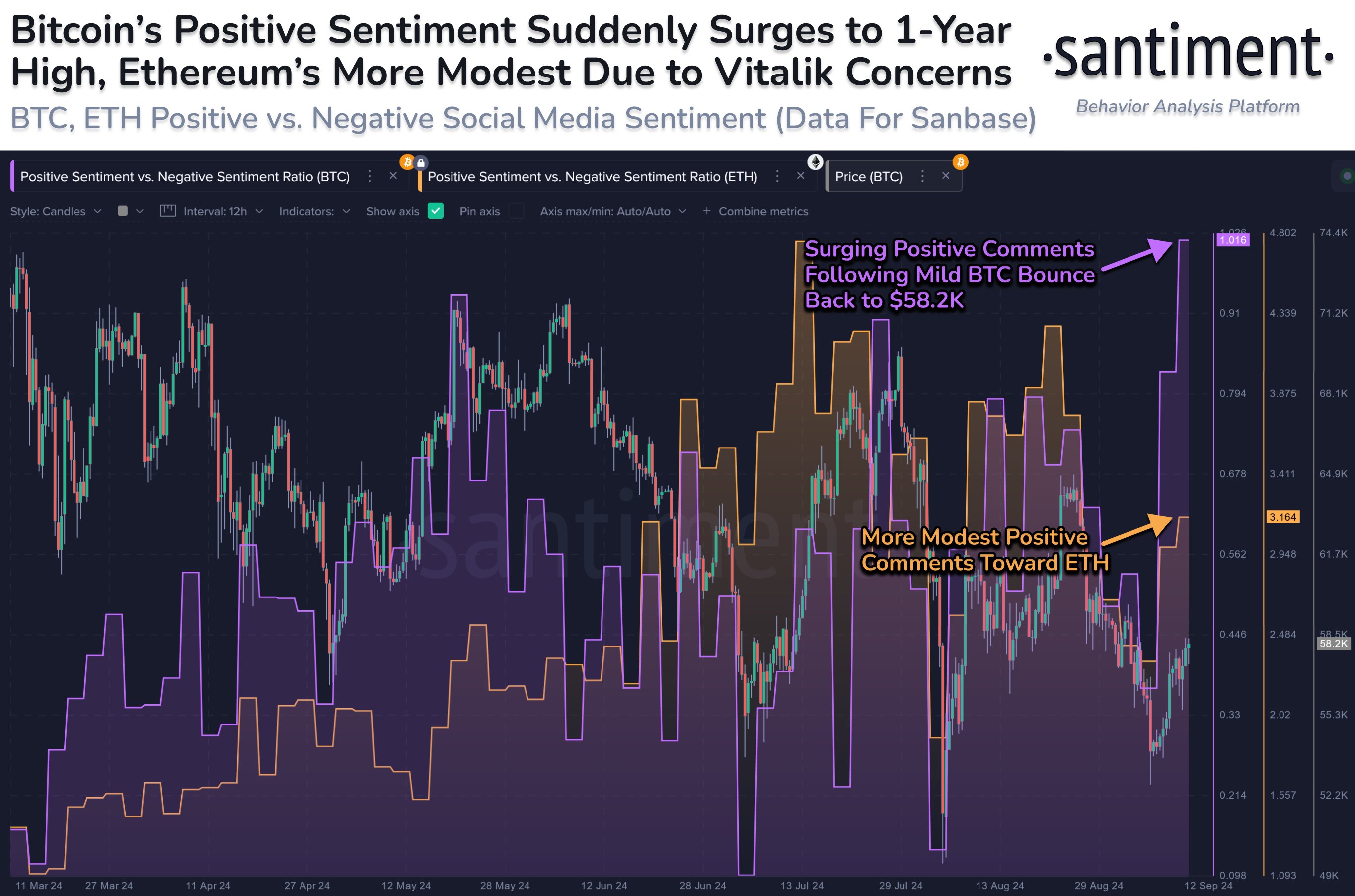

Bitcoin Positive Vs. Negative Sentiment Ratio Has Spiked Recently

Based on information from analytics company Santiment, there’s been a recent surge in optimistic sentiment among the public concerning Bitcoin. The metric used to gauge this is the “Positive Sentiment to Negative Sentiment Ratio,” which, as its name implies, calculates the proportion of positive and negative comments about a specific cryptocurrency on social media platforms.

One approach to rephrase the given sentence in a natural and easy-to-read manner could be: The analytics company collects discussions from social media platforms such as Twitter, Reddit, Telegram, and 4Chan. They use machine learning techniques to classify these discussions as either positive or negative with their model.

If the indicator exceeds 1, it implies that there are more positive comments compared to negative ones in the analysis. Conversely, when it’s below the set threshold, it generally means that a majority of social media users express a negative sentiment.

Currently, let me share a graph illustrating the changing balance between Positivity and Negativity as expressed in the sentiment of the top digital currencies, Bitcoin and Ethereum, during the recent months:

According to the graph shown earlier, there was a significant increase in favorable opinions towards Bitcoin compared to unfavorable ones following the recent rebound of cryptocurrencies.

As an analyst, I’ve noticed a significant shift in the balance of posts on major social media platforms. For the first time, the number of positive posts has nearly doubled the count of negative ones, reaching an unprecedented peak. This is an interesting development to observe.

Although it appears that investors are confident in this asset, their enthusiasm might warrant some caution. This is due to Bitcoin’s past tendency to contradict popular opinions, as the likelihood of an opposite trend increases when the crowd becomes increasingly certain about a specific direction.

Due to a significant surge in optimistic feelings following a minor increase in price, it seems fear of missing out (FOMO) might be influencing the market prematurely. This could potentially mark a peak for Bitcoin. Regarding when Bitcoin’s market might regain its bullish trend, the analytics firm suggests:

As a crypto investor, I’m keeping an eye out for traders who might be overly enthusiastic and need to cool down a bit. Once their fears start to surface again, that’s when we’ll see Bitcoin really pushing towards retesting its March all-time high market values.

It’s worth noting that while Bitcoin-related fear of missing out (FOMO) dominates social media discussions, users exhibit a more subdued level of optimism regarding Ethereum. This situation might inadvertently contribute to an upward trend in ETH prices.

BTC Price

Bitcoin’s attempts to consistently surpass $58,000 have faced obstacles, as it was rejected again today at around $57,800.

Read More

- Move Over Sydney Sweeney: Ozzy Osbourne’s DNA Is in Limited-Edition Iced Tea Cans

- Steven Spielberg UFO Movie Gets Exciting Update as Filming Wraps

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

- Anna Camp Defends Her & GF Jade Whipkey’s 18-Year-Old Age Difference

- Aaron Taylor-Johnson Debuts New Look at 28 Years Later London Photocall

- Best Items to Spend Sovereign Sigils on in Elden Ring Nightreign

- The Entire Cast Of Pretty Little Liars Hopes For A Reunion Movie

- Brody Jenner Denies Getting Money From Kardashian Family

- How Taylor Swift’s Bodyguard Reacted to Travis Kelce’s Sweet Gesture

2024-09-14 05:46