The Bitcoin Fear & Greed Index, as reflected by current data, has moved towards a balanced state. Let’s explore what this potential shift might mean for the cryptocurrency’s market value.

Bitcoin Fear & Greed Index Is Now Pointing At ‘Neutral’

The “Fear & Greed Index” is a tool devised by analysts at Alternative, providing insights into the general mood or sentiment among Bitcoin and broader crypto market traders.

As a researcher, I employ a unique methodology that takes into account five key components to determine its measurement: volatility, trading volume, public sentiment on social media, market dominance, and the trends in Google searches.

As a researcher, when I observe an indicator value exceeding 53, I can infer that collectively, investors are expressing a sentiment of greed. Conversely, if the value falls below 47, it indicates a prevailing market fear. Values falling within this range suggest a balanced or neutral mentality among investors.

Apart from the primary feelings of optimism, pessimism, and neutrality, we find two intense emotions referred to as excessive fear and excessive excitement or euphoria. Excessive fear kicks in when the level reaches 75 or more, while excessive excitement occurs at or below 25.

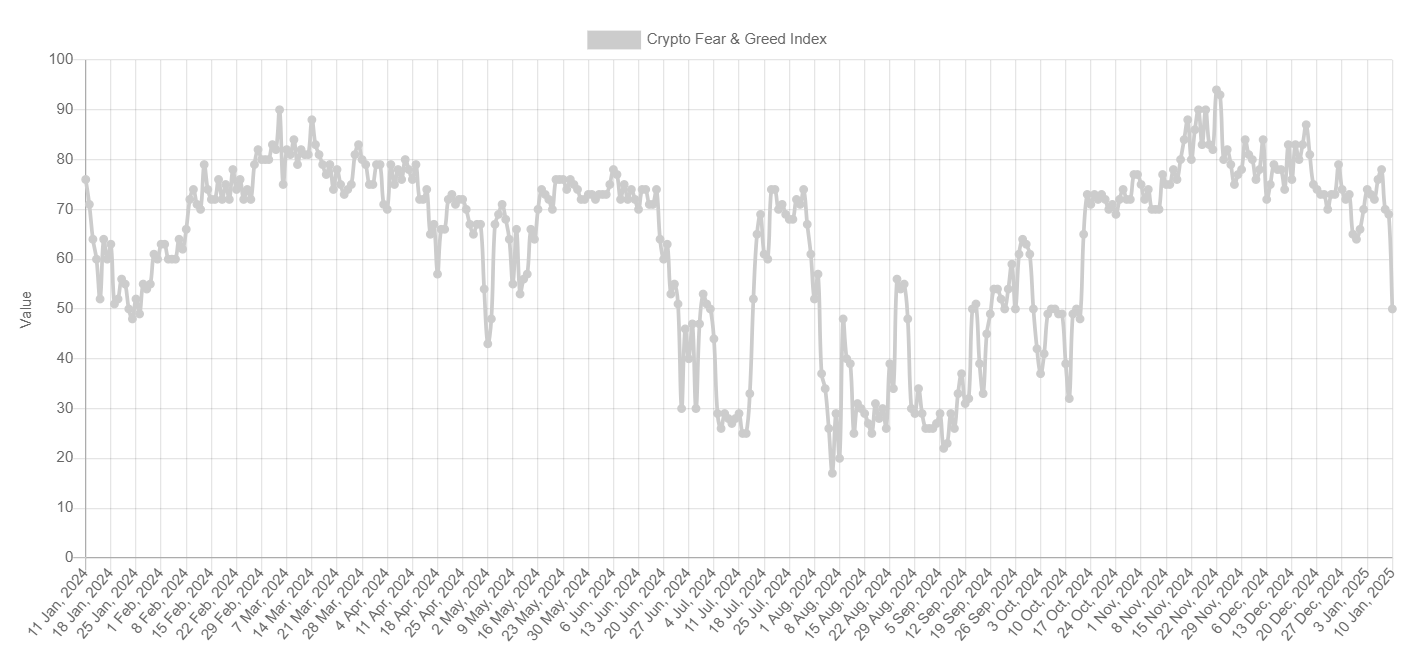

Now, here is how the Bitcoin Fear & Greed Index is looking at the moment:

The chart shows that the indicator currently stands at 50, suggesting the market’s general sentiment is perfectly balanced. This is quite different from yesterday’s reading of 69, indicating a more positive outlook then.

This chart demonstrates the fluctuations in the Fear & Greed Index during the last twelve months.

A few days back, the indicator’s value stood at 78, indicating a predominant feeling of excessive greed among investors. However, since then, there has been a significant shift in investor sentiment due to the Bitcoin recovery rally losing steam and transforming into a steep price decline.

For the first time since mid-October, the index has fallen into a neutral zone. During this period, the market has been characterized by optimism, with the asset’s price generally trending upward.

After this restart, it seems that investors have become uncertain about the future of cryptocurrency. However, if past events serve as an indicator, this uncertainty might not necessarily be a negative development.

Digital currencies like Bitcoin often behave in a manner that contrasts popular beliefs. Significant peaks have typically been reached during periods of intense optimism or ‘exuberance’, while troughs have usually formed when there’s widespread ‘extreme fear’. For instance, last year’s peak and bottoms were such instances.

Although the market isn’t showing signs of fear just yet, the absence of excessive enthusiasm might pave the way for a price turnaround. We’ll have to watch closely over the next few days to see how Bitcoin and the overall market sentiment unfold.

BTC Price

At the time of writing, Bitcoin is floating around $94,200, down almost 4% in the last seven days.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Like RRR, Animal and more, is Prabhas’ The Raja Saab also getting 3-hour runtime?

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

2025-01-11 12:42