As an analyst with over two decades of market experience under my belt, I’ve seen countless cycles of fear and greed play out across various asset classes. The current state of extreme greed in the Bitcoin market, as indicated by the Fear & Greed Index, is reminiscent of similar situations in the past that have often preceded significant price corrections.

The data indicates that Bitcoin investors’ optimism has reached an unusually high level, as the price of Bitcoin has hit a record peak.

Bitcoin Fear & Greed Index Is Now Pointing At ‘Extreme Greed’

The “Fear & Greed Index” is an indicator created by Alternative that tells us about the average sentiment among the traders in the Bitcoin and the wider cryptocurrency sectors.

This index measures sentiment on a scale from 0 to 100. It does this by considering information from the following five elements: volatility, trading activity, market influence, public opinion via social media, and Google search trends.

If the indicator’s value exceeds 53, this suggests that investors are feeling greedy at present. Conversely, when the value is less than 47, it indicates that fear prevails in the market. Values falling within the range between these two numbers suggest a balanced or neutral mindset among investors.

In addition to the three primary emotions, there are two unique areas: excessive optimism (or extreme greed) and intense anxiety (or extreme fear). Excessive optimism surfaces when values exceed 75, whereas intense anxiety appears when values fall below 25.

Now, here is what the Bitcoin Fear & Greed Index is like right now:

From what you see, the indicator stands at 77, indicating that the traders in this sector are currently experiencing an extremely greedy sentiment. This represents a shift from yesterday’s market state, where the sentiment was still within the typical greed range.

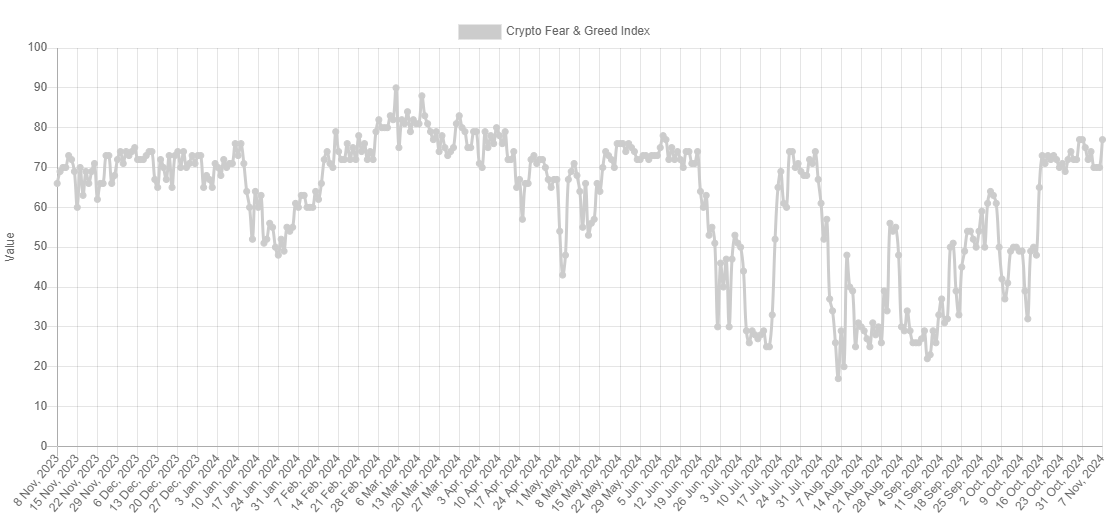

Here is a chart that shows how the index’s value has changed over the past year:

Historically, Bitcoin’s price has often peaked or dipped significantly when it’s within these extreme sentiment zones.

Indeed, the connection between sentiment and price seems to follow a reverse pattern. In other words, when emotions reach an excessive peak of optimism (greed), it often signals market highs, whereas intense anxiety or fear (at market lows) tends to set the stage for recovery.

It’s clear from the graph that the Fear & Greed Index reached extremely high levels, indicating a state of excessive optimism or ‘greed,’ coinciding with the peak of Bitcoin prices in the initial quarter of this year.

As a seasoned crypto investor, I can’t help but notice the renewed excitement surrounding digital currencies following the recent breaking of all-time highs. It’s not unreasonable to speculate that this enthusiasm might lead to another peak for Bitcoin.

Typically, significant peaks happen when the index reaches exceptionally high values. For example, the peak we just saw happened at a value of 88. So, there might be more optimism to build up, before the upward trend encounters a significant hurdle.

BTC Price

At the time of writing, Bitcoin is floating around $75,900, up 8% over the last seven days.

Read More

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

- Brody Jenner Denies Getting Money From Kardashian Family

- Move Over Sydney Sweeney: Ozzy Osbourne’s DNA Is in Limited-Edition Iced Tea Cans

- Nobuo Uematsu says Fantasian Neo Dimension is his last gaming project as a music composer

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- Anna Camp Defends Her & GF Jade Whipkey’s 18-Year-Old Age Difference

- How Taylor Swift’s Bodyguard Reacted to Travis Kelce’s Sweet Gesture

- The Entire Cast Of Pretty Little Liars Hopes For A Reunion Movie

- Anupama Parameswaran breaks silence on 4-year hiatus from Malayalam cinema: ‘People have trolled me saying that I can’t act’

- KPop Demon Hunters 2: Co-Director on if Sequel Could Happen

2024-11-08 11:48