As a seasoned researcher with a decade-long career in the cryptocurrency market, I can’t help but find the Bitcoin Fear & Greed Index intriguing. The current reading of 75, teetering on the edge of extreme greed, is certainly a sight we’ve seen before. Historically, such high readings have often signaled significant price reversals. However, the market dynamics during bull runs can be unpredictable, and even a return to the neutral or normal greed zone might be enough to sustain the rally.

As an analyst, I’ve noticed a noteworthy shift in the Bitcoin Fear & Greed Index; it has moderated from extreme greed, potentially indicating a more favorable trajectory for Bitcoin’s price.

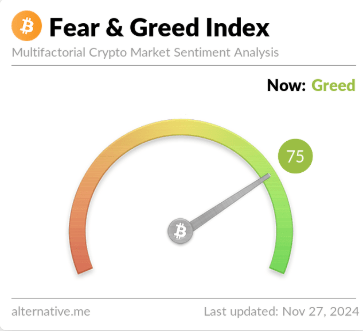

Bitcoin Fear & Greed Index Is Pointing At ‘Greed’ Again

The “Fear & Greed Index” is a term for a tool developed by analysts at Alternative, which provides insights into the general mood or sentiment among Bitcoin and broader cryptocurrency market investors.

In simpler terms, this measurement system ranges from zero to one hundred. Values above 53 indicate that traders are displaying signs of greed, whereas values below 47 signal fear within the market. Values falling between these two thresholds suggest a balanced or neutral mindset among traders in the given region.

In addition to the primary feelings it conveys, this indicator may also display two unusual sentiments: intense anxiety (when the value falls below 25) and excessive optimism (when the value exceeds 75).

Now, here is what the Bitcoin Fear & Greed Index is saying regarding the current market sentiment:

From what’s shown here, it can be seen that the index stands at 75, indicating that current investor sentiment leans towards excessive optimism or greed. Furthermore, this feeling is quite intense, as the index reading falls squarely within the extreme greed region on the scale.

Historically, strong or extreme views have played a notable role in Bitcoin and other digital currencies, as they often signal price reversals at crucial points. This means that during such periods, the prices are more likely to reach significant turning points.

Conversely, the connection between them is reversed: market bottoms tend to appear during periods of extreme fear, whereas market tops are more common when there’s widespread greed.

Adherents of a trading strategy known as contrarian investing take advantage of this principle to execute their trades; they purchase assets during intense panic and sell them in periods of excessive enthusiasm. Warren Buffet’s well-known quote encapsulates this notion perfectly: “Act with fear when others are greedy, and act with greed when others are fearful.

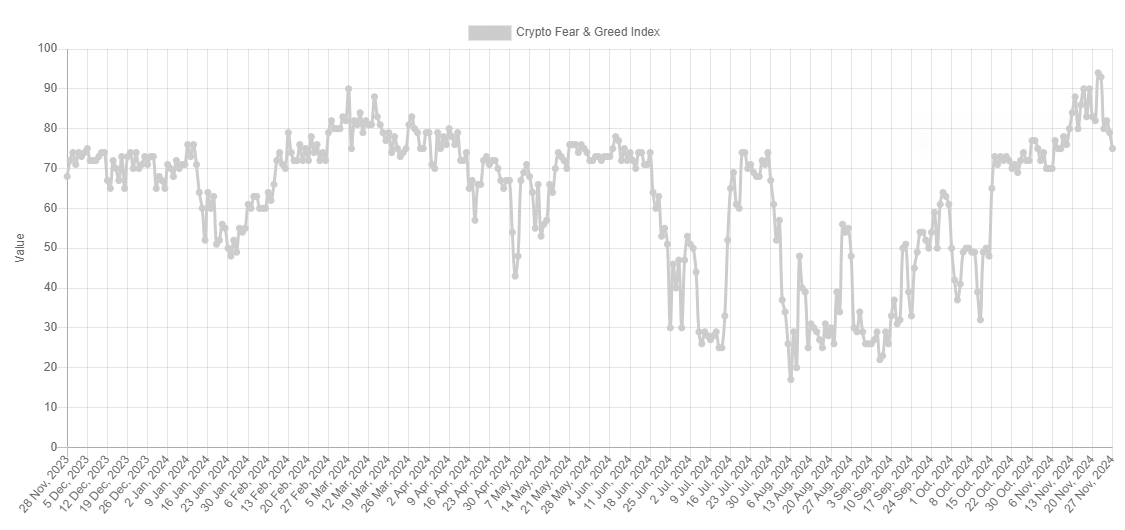

Currently, the index’s value is quite substantial, but it has been even greater over the past few days, as the following graph illustrates.

During the bullish run of Bitcoin, the Fear & Greed Index remained deep within the “extreme greed” zone. The maximum reading of 94 was reached concurrently with Bitcoin surpassing its peak value of $99,000.

It seems that Bitcoin’s behavior is opposite of what was expected, as its price has experienced a significant drop following the peak of widespread greed.

In an ideal scenario, the feelings should calm down and shift towards fear as a prelude to a reversal in the asset’s value. However, during bull markets when demand is unusually high, simply returning to the normal level of greed or neutral sentiment can be enough to reinvigorate the rally.

It’s unclear if Bitcoin can bounce back since the Fear & Greed Index is still indicating ‘greed’.

BTC Price

When writing, Bitcoin is trading at around $93,800, up over 1% in the last 24 hours.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-11-28 05:47