As a seasoned crypto analyst with a decade of experience in this dynamic digital market, I find the recent analysis by Rekt Capital and others quite intriguing. The exhaustion of sellers seems to be at an all-time high, indicating that the bearish trend may soon reverse, possibly paving the way for another bull run.

According to cryptocurrency expert Rekt Capital, there’s reason for Bitcoin investors to be hopeful as the intense selling activity on the leading digital currency seems to be easing up. This positive outlook arises during a period when Bitcoin’s influence within the market has noticeably increased.

Bitcoin Seller Exhaustion Is At Its Peak

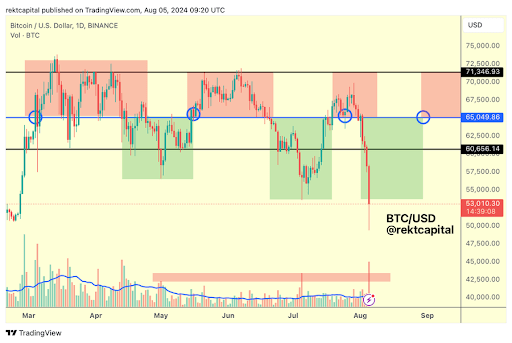

In a recent post on X (previously Twitter), Rekt Capital noted that the amount of sellers has surpassed and even significantly exceeded the Seller Exhaustion levels observed during past price increases. The analyst further explained that Bitcoin hasn’t experienced such intense selling pressure from the sell side since the Halving event in April this year.

It’s clear that this situation represents a positive trend for the primary cryptocurrency, as Bitcoin appears to be on the verge of a significant turnaround, with selling pressure noticeably subsiding. This shift is already underway, as Bitcoin has bounced back in the last 24 hours after falling below $50,000 for the first time since January.

Rekt Capital predicted a potential short-term surge in Bitcoin’s price, reaching up to $62,550. This prediction is based on Bitcoin filling the CME gap, which currently spans between $59,400 and $62,550. He emphasized that the chances are high for this occurrence because Bitcoin has consistently filled all the CME Gaps it’s created in recent months.

crypto expert Skew also observed a significant amount of sell orders for Bitcoin, which he attributed to Bitcoin’s failure to sustain its price above $70,000 after its July price surge. He further noted that while there has been a downward price adjustment, there is currently no sign of widespread market turmoil, implying that investors should not be unduly concerned about the recent price fluctuation.

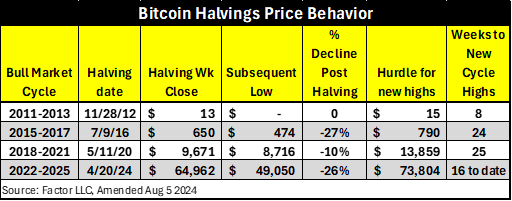

After reaching its maximum sell-off point, there’s a possibility that Bitcoin may have hit rock bottom and this could mark the last major correction before the market surge resumes strongly. As per seasoned trader and analyst Peter Brandt, Bitcoin’s price fall since the halving event mirrors the decline experienced during the Bitcoin bull market cycle between 2015 and 2017.

BTC’s Dominance Hits 3-Year High

In times of market chaos, data from Coinglass indicates that Bitcoin’s influence has reached its peak since April 2021. This surge can largely be attributed to Spot Bitcoin ETFs, which have led to an influx of fresh funds into the Bitcoin sector. While altcoins are struggling, retail investors are spreading their investments across various cryptocurrencies, reducing the capital available for altcoins.

Crypto experts such as Roman anticipate that Bitcoin’s influence over the market is likely to increase in the near future, with the leading cryptocurrency absorbing most of the available liquidity up until the end of the year. He foresees Ethereum and other alternative coins remaining relatively stable during this timeframe.

Currently, as I’m typing this, Bitcoin is being exchanged for approximately $56,000, marking an increase of more than 10% within the past day, based on information from CoinMarketCap.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Delta Force Redeem Codes (January 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- Gold Rate Forecast

- Best Japanese BL Dramas to Watch

- Overwatch 2 Season 17 start date and time

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

2024-08-06 23:10